Global Penny Stocks Spotlight: Liaoning SG Automotive Group And 2 Other Top Contenders

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's recent interest rate cuts, small-cap stocks have shown notable resilience, with indices like the Russell 2000 experiencing a significant rally. In such an economic landscape, identifying promising investment opportunities requires a keen eye for companies that combine financial strength with growth potential. Penny stocks, though sometimes overlooked and considered outdated by some investors, still present intriguing possibilities when they demonstrate robust balance sheets and strategic positioning in their sectors.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.57 | HK$964.89M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$422.76M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.685 | MYR348.31M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.45 | HK$2.03B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.37 | MYR550.13M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.32 | SGD13.07B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.15 | £183.08M | ✅ 4 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.02 | €279.21M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,738 stocks from our Global Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Liaoning SG Automotive Group (SHSE:600303)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Liaoning SG Automotive Group Co., Ltd. is a Chinese company that manufactures and sells automobiles, axles, and other auto parts, with a market cap of CN¥2.40 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥2.4B

Liaoning SG Automotive Group, with a market cap of CN¥2.40 billion, has seen its earnings decline by 31.6% annually over the past five years and remains unprofitable, with a negative return on equity of -29.02%. Despite this, it maintains a satisfactory net debt to equity ratio of 37.7% and boasts sufficient cash runway for more than three years due to positive free cash flow growth. Recent earnings show increased sales and revenue compared to the previous year but also an increased net loss of CN¥145.24 million. The company was recently added to the Shanghai Stock Exchange Composite Index in July 2025.

- Navigate through the intricacies of Liaoning SG Automotive Group with our comprehensive balance sheet health report here.

- Explore historical data to track Liaoning SG Automotive Group's performance over time in our past results report.

ZJBC Information Technology (SZSE:000889)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ZJBC Information Technology Co., Ltd, with a market cap of CN¥3.17 billion, primarily offers information intelligent transmission services in China through its subsidiaries.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥3.17B

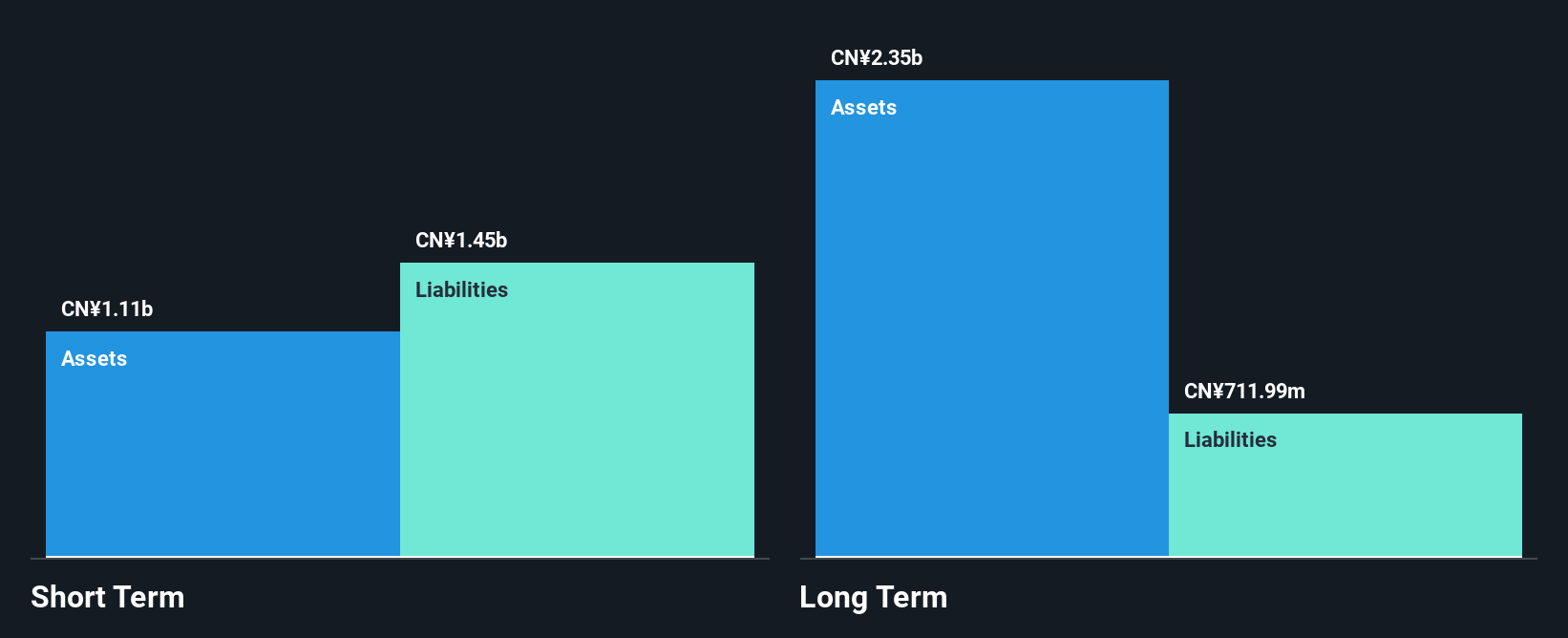

ZJBC Information Technology Co., Ltd, with a market cap of CN¥3.17 billion, reported revenue growth for the first half of 2025 to CN¥775.76 million from CN¥702.31 million the previous year; however, it remains unprofitable with a net loss increasing to CN¥21.44 million from CN¥14.49 million year-on-year. Despite this, ZJBC maintains a satisfactory net debt to equity ratio of 6% and has not significantly diluted shareholders recently. Its short-term assets exceed its long-term liabilities but fall short in covering short-term liabilities entirely, while its cash runway is sufficient for over three years under stable conditions.

- Click to explore a detailed breakdown of our findings in ZJBC Information Technology's financial health report.

- Learn about ZJBC Information Technology's historical performance here.

Shenzhen Jinjia GroupLtd (SZSE:002191)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Jinjia Group Co., Ltd. specializes in the research, development, production, and sale of packaging products and related materials in China, with a market cap of CN¥6.49 billion.

Operations: The company's revenue is primarily derived from the Packaging Segment, which accounts for CN¥1.94 billion, followed by contributions from the New Tobacco Industry at CN¥382.38 million and Other Industries at CN¥342.14 million.

Market Cap: CN¥6.49B

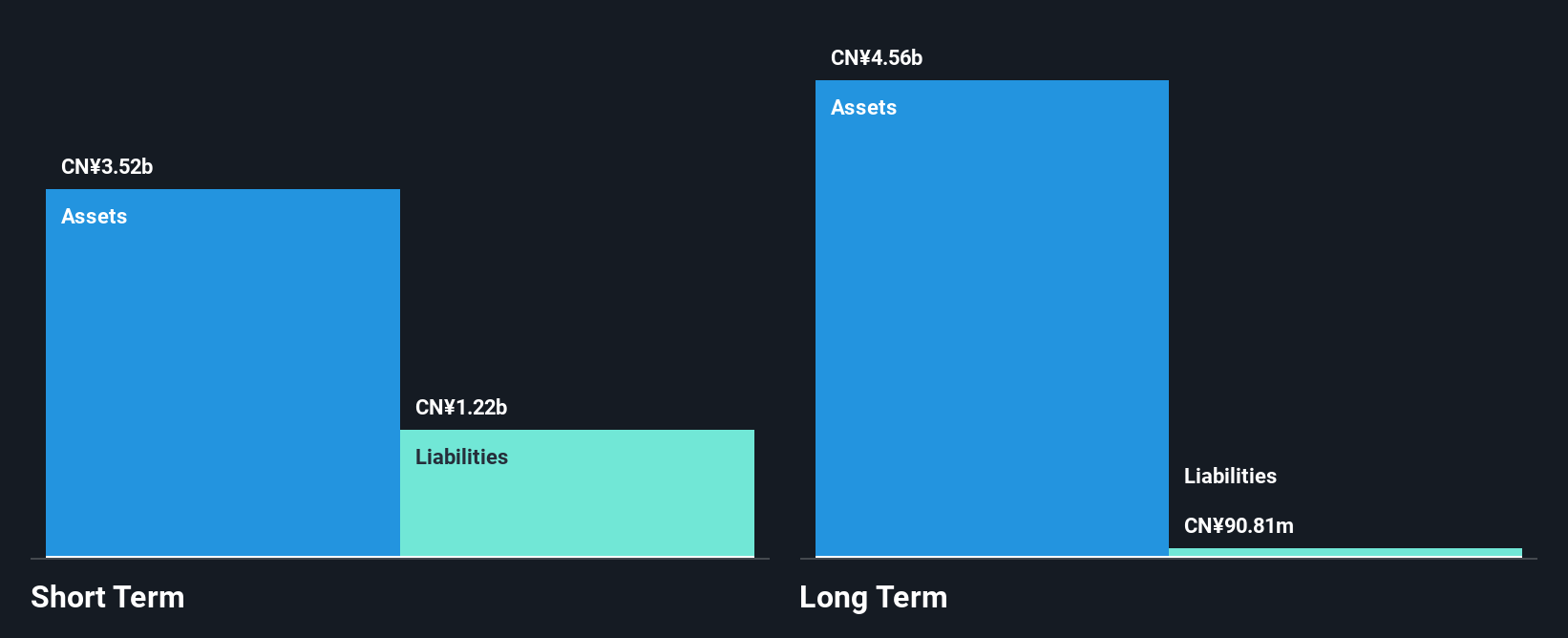

Shenzhen Jinjia Group Co., Ltd. has a market cap of CN¥6.49 billion, with its primary revenue from the Packaging Segment at CN¥1.94 billion. Despite stable weekly volatility over the past year, earnings have significantly declined by 52.8% annually over five years, and recent results show reduced revenue and net income compared to the previous year. The board is experienced with an average tenure of 10 years, and while debt levels are manageable with cash exceeding total debt, profitability remains a concern as return on equity is low at 0.2%. Short-term assets cover both short- and long-term liabilities comfortably.

- Get an in-depth perspective on Shenzhen Jinjia GroupLtd's performance by reading our balance sheet health report here.

- Understand Shenzhen Jinjia GroupLtd's track record by examining our performance history report.

Summing It All Up

- Access the full spectrum of 3,738 Global Penny Stocks by clicking on this link.

- Seeking Other Investments? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002191

Shenzhen Jinjia GroupLtd

Engages in the research and development, production, and sale of packaging products and related materials in China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives