- Japan

- /

- Auto Components

- /

- TSE:7283

Global Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by inflation data and interest rate cut speculation, U.S. stocks have climbed to record highs, fueled by optimism over potential Federal Reserve actions. In this environment of economic shifts and mixed signals, dividend stocks stand out as a compelling option for investors seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.09% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.62% | ★★★★★★ |

| NCD (TSE:4783) | 4.62% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.96% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Daicel (TSE:4202) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

Click here to see the full list of 1381 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

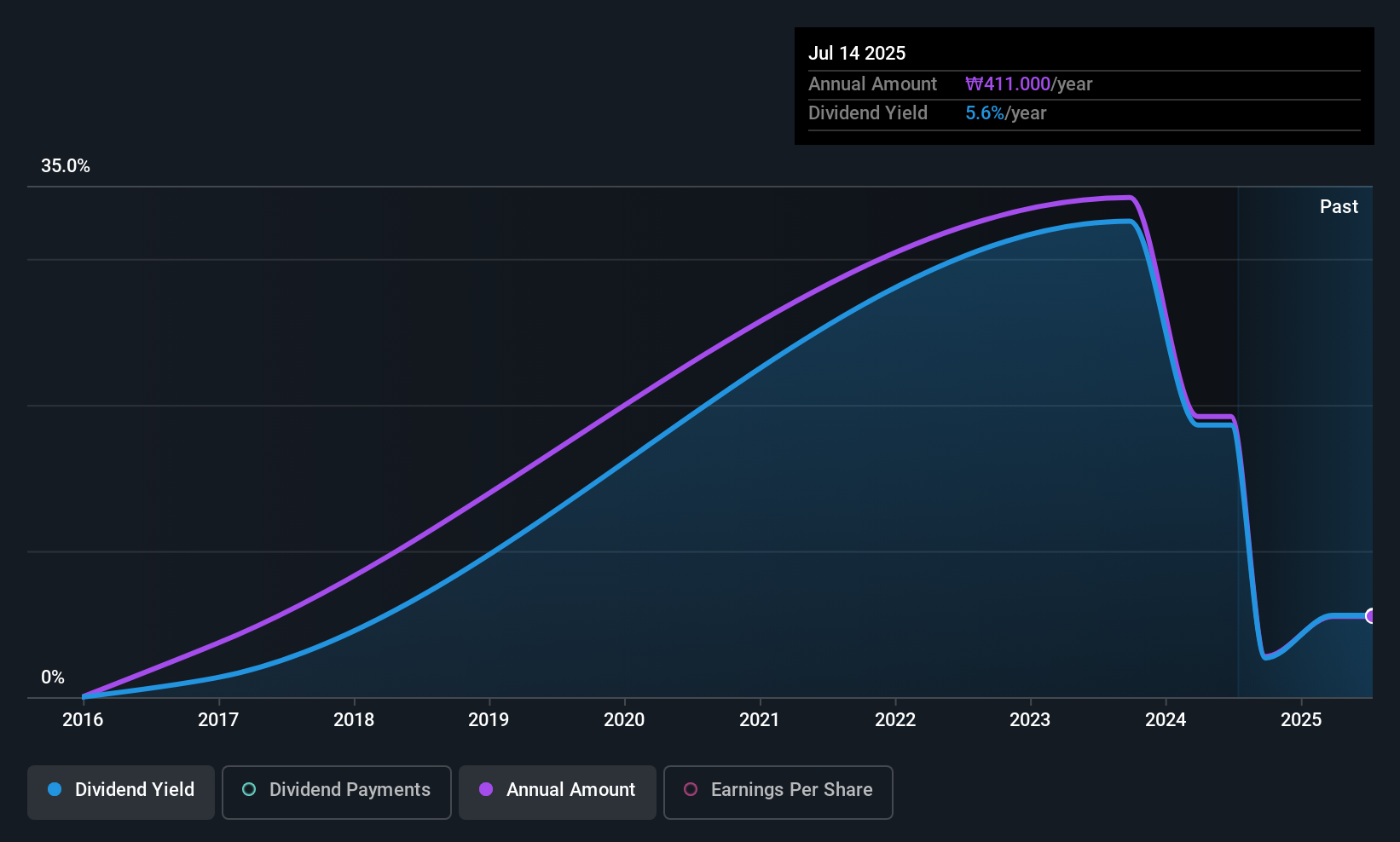

Able C&C (KOSE:A078520)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Able C&C Co., Ltd. and its subsidiaries manufacture, distribute, retail, and sell cosmetics and household goods across various regions including South Korea, China, Japan, the rest of Asia, Europe, and North and Central America with a market cap of ₩290.17 billion.

Operations: Able C&C Co., Ltd.'s revenue primarily comes from the manufacturing and sales of cosmetics, totaling ₩257.44 billion.

Dividend Yield: 3.6%

Able C&C's dividends are covered by earnings and cash flows, with payout ratios of 71% and 60.9%, respectively. The dividend yield is competitive in the Korean market, but its payments have been volatile over nine years, indicating an unstable track record. Recent earnings reports show growth, with net income rising to KRW 3.94 billion for Q2 2025 from KRW 3.61 billion a year ago. Additionally, the company completed a share buyback worth KRW 1.85 billion in June 2025.

- Unlock comprehensive insights into our analysis of Able C&C stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Able C&C is priced higher than what may be justified by its financials.

Carpenter Tan Holdings (SEHK:837)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carpenter Tan Holdings Limited is an investment holding company that designs, manufactures, and distributes wooden handicrafts and accessories under the Carpenter Tan brand, with a market cap of HK$1.59 billion.

Operations: The company's revenue primarily comes from its Manufacture and Sales of Wooden Handicrafts and Accessories segment, amounting to CN¥505.44 million.

Dividend Yield: 5.8%

Carpenter Tan Holdings' dividends are supported by earnings and cash flows, with payout ratios of 50% and 75.6%, respectively. Although the dividend yield is below the top tier in Hong Kong, payments have grown over a decade despite volatility. Recent news from May 2025 indicates a decrease in declared dividends to HK$0.37 per share for FY2024, reflecting an unstable dividend history but maintaining coverage by both profits and free cash flow.

- Click here to discover the nuances of Carpenter Tan Holdings with our detailed analytical dividend report.

- Our valuation report unveils the possibility Carpenter Tan Holdings' shares may be trading at a premium.

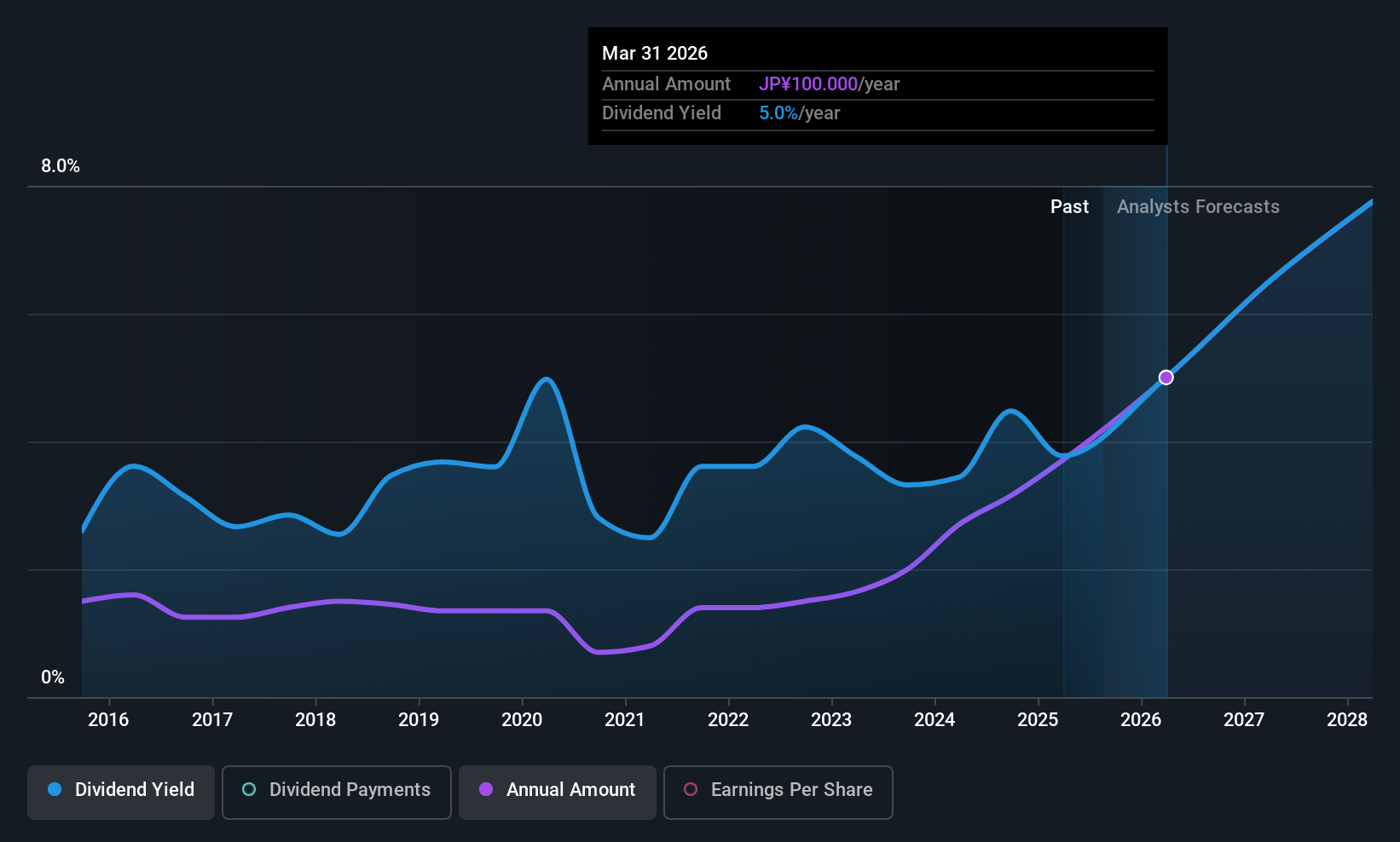

Aisan Industry (TSE:7283)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aisan Industry Co., Ltd. manufactures and sells automotive parts both in Japan and internationally, with a market cap of ¥113.11 billion.

Operations: Aisan Industry Co., Ltd.'s revenue is derived from several regions, with ¥142.60 billion from Asia, ¥135.19 billion from Japan, ¥15.48 billion from Europe, and ¥75.95 billion from the Americas.

Dividend Yield: 3.7%

Aisan Industry's dividend payments are supported by a low payout ratio of 36.6% and a cash payout ratio of 54.3%, ensuring coverage by earnings and cash flows. Although dividends have grown over the past decade, they remain volatile with an unreliable track record, reflected in their below top-tier yield of 3.71%. Recent guidance anticipates ¥310 billion in net sales for FY2026, while plans to acquire treasury shares could impact future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Aisan Industry.

- Upon reviewing our latest valuation report, Aisan Industry's share price might be too pessimistic.

Make It Happen

- Dive into all 1381 of the Top Global Dividend Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7283

Aisan Industry

Engages in the manufacture and sale of automotive parts in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives