- Australia

- /

- Specialty Stores

- /

- ASX:BBN

Getting In Cheap On Baby Bunting Group Limited (ASX:BBN) Might Be Difficult

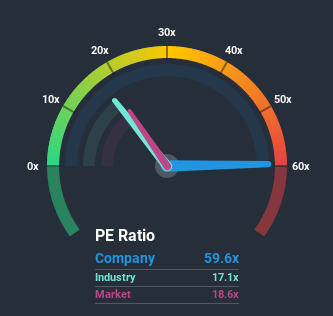

When close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 18x, you may consider Baby Bunting Group Limited (ASX:BBN) as a stock to avoid entirely with its 59.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Baby Bunting Group has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

View our latest analysis for Baby Bunting Group

Is There Enough Growth For Baby Bunting Group?

The only time you'd be truly comfortable seeing a P/E as steep as Baby Bunting Group's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 19% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 46% per year over the next three years. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

With this information, we can see why Baby Bunting Group is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Baby Bunting Group maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Baby Bunting Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Baby Bunting Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Baby Bunting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:BBN

Baby Bunting Group

Engages in the retail of maternity and baby goods in Australia and New Zealand.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives