- United States

- /

- Trade Distributors

- /

- NYSE:FERG

Ferguson Enterprises (NYSE:FERG) Declares US$1 Dividend With Payment Set For August

Reviewed by Simply Wall St

On May 29, 2025, Ferguson Enterprises (NYSE:FERG) enhanced its shareholder value by declaring a $0.83 per share dividend. Over the past month, the stock price increased by 7.82%, which aligns with broader market trends, including the S&P and Nasdaq indices' strong performances, up 6% and 10% respectively. This indicates that the company’s financial strategies, such as the regularized dividend announcement, may have bolstered investor confidence amidst positive market sentiment, despite geopolitical uncertainties like renewed U.S.-China trade tensions. While the market was gaining overall, Ferguson's performance slightly outpaced the Dow's 4% rise.

Every company has risks, and we've spotted 2 risks for Ferguson Enterprises you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

Ferguson Enterprises' recent dividend announcement is expected to further enhance its long-term shareholder value, aligning with its strategic growth initiatives in HVAC and Waterworks segments. This decision may reinforce investor confidence, as indicated by the company's 7.82% share price increase over the past month. Over the longer term, Ferguson’s shares have achieved a total return of 153.45% over the past five years, underscoring its robust growth compared to its 1-year negative earnings growth of 6.9% in a challenging industry backdrop.

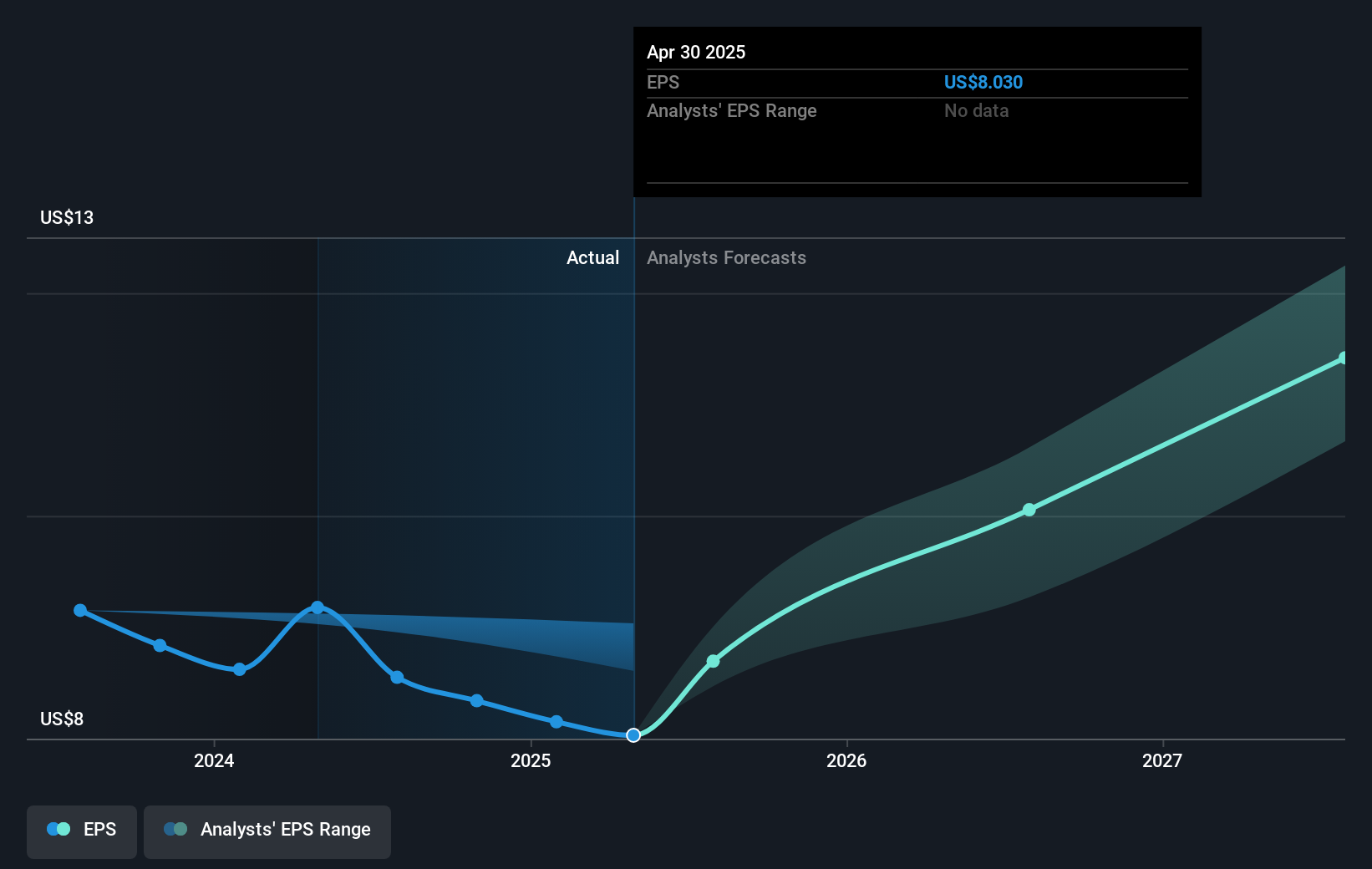

Relative to its peers, Ferguson’s 1-year performance exceeded the US Trade Distributors industry, which delivered a negative return of 14.7%. However, it underperformed compared to the overall US market’s 11.5% gain. Analysts’ fiscal forecasts remain positive, despite current challenges. The anticipated revenue growth of 5.6% annually reflects strategic efforts, though below the broader market expectation of 8.6%. Earnings are projected to grow 10.3% per year, but the company faces risks such as deflation and competitive pressures that could impact margins.

The latest dividend may reinforce the company's revenue and earnings forecasts by solidifying investor confidence and supporting analysts’ price target of approximately US$194.21. Currently, Ferguson's stock trades near US$168.66, which presents a roughly 12.9% discount to this target, suggesting potential upside should the company effectively deliver on its aggressive growth strategies while mitigating execution risks. Overall, the anticipated share repurchase program further reflects management’s optimism about enhancing EPS and achieving sustained shareholder value.

Assess Ferguson Enterprises' future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FERG

Ferguson Enterprises

Distributes plumbing and heating products in the United States and Canada.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives