- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

European Stocks That May Be Priced Below Their Estimated Intrinsic Values

Reviewed by Simply Wall St

As European markets experience a slight uptick, with the pan-European STOXX Europe 600 Index rising by 0.65% amid trade negotiations and slowing inflation, investors are keenly observing potential shifts in monetary policy from the European Central Bank. In this environment, identifying stocks that may be priced below their estimated intrinsic values can offer opportunities for those looking to capitalize on market inefficiencies and economic developments.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.90 | €104.47 | 48.4% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.90 | €3.70 | 48.6% |

| CTT Systems (OM:CTT) | SEK213.50 | SEK416.33 | 48.7% |

| Séché Environnement (ENXTPA:SCHP) | €99.00 | €197.26 | 49.8% |

| Clemondo Group (OM:CLEM) | SEK10.80 | SEK21.25 | 49.2% |

| Lectra (ENXTPA:LSS) | €24.05 | €47.11 | 49% |

| Absolent Air Care Group (OM:ABSO) | SEK214.00 | SEK416.45 | 48.6% |

| Trøndelag Sparebank (OB:TRSB) | NOK114.50 | NOK226.55 | 49.5% |

| Nexstim (HLSE:NXTMH) | €7.98 | €15.71 | 49.2% |

| VIGO Photonics (WSE:VGO) | PLN522.00 | PLN1042.74 | 49.9% |

Let's dive into some prime choices out of the screener.

Maire (BIT:MAIRE)

Overview: Maire S.p.A. specializes in developing and implementing solutions for the energy transition, with a market cap of €3.76 billion.

Operations: The company's revenue segments consist of Integrated E&C Solutions, generating €5.97 billion, and Sustainable Technology Solutions, contributing €376.94 million.

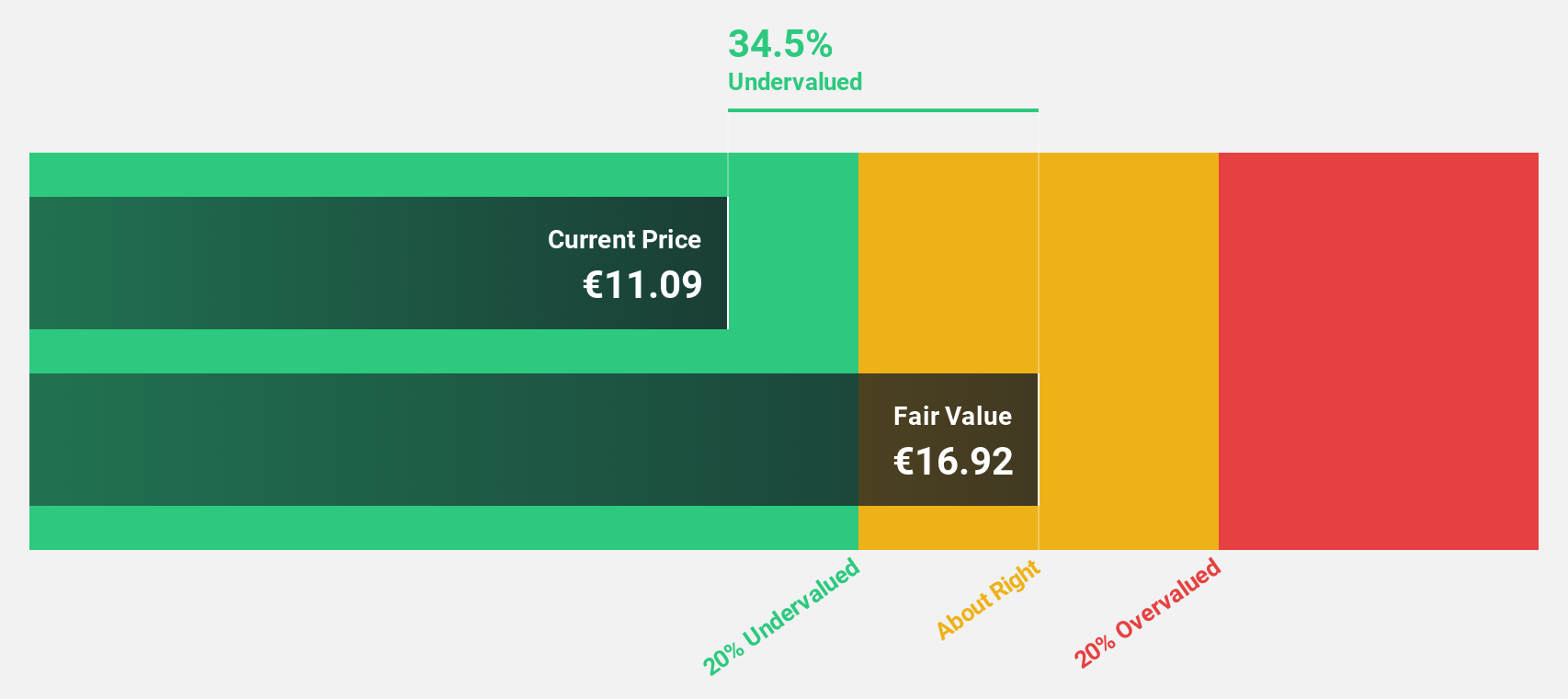

Estimated Discount To Fair Value: 35.8%

Maire S.p.A. appears undervalued, trading 35.8% below its estimated fair value of €17.83, with a current price of €11.45. Recent earnings growth and a forecasted annual profit increase of 12.4% outpace the Italian market's average growth rate, despite revenue projections being modest at 5.9%. The company's recent strategic partnership with Radware enhances its cybersecurity offerings, potentially bolstering future cash flows amidst a volatile share price history and an unstable dividend track record.

- Our expertly prepared growth report on Maire implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Maire.

Cellnex Telecom (BME:CLNX)

Overview: Cellnex Telecom, S.A. operates as a manager of terrestrial telecommunications infrastructures across multiple European countries including Austria, Denmark, Spain, and others, with a market cap of €23.98 billion.

Operations: Cellnex Telecom generates revenue through the management of terrestrial telecommunications infrastructures across several European countries, including Austria, Denmark, Spain, and others.

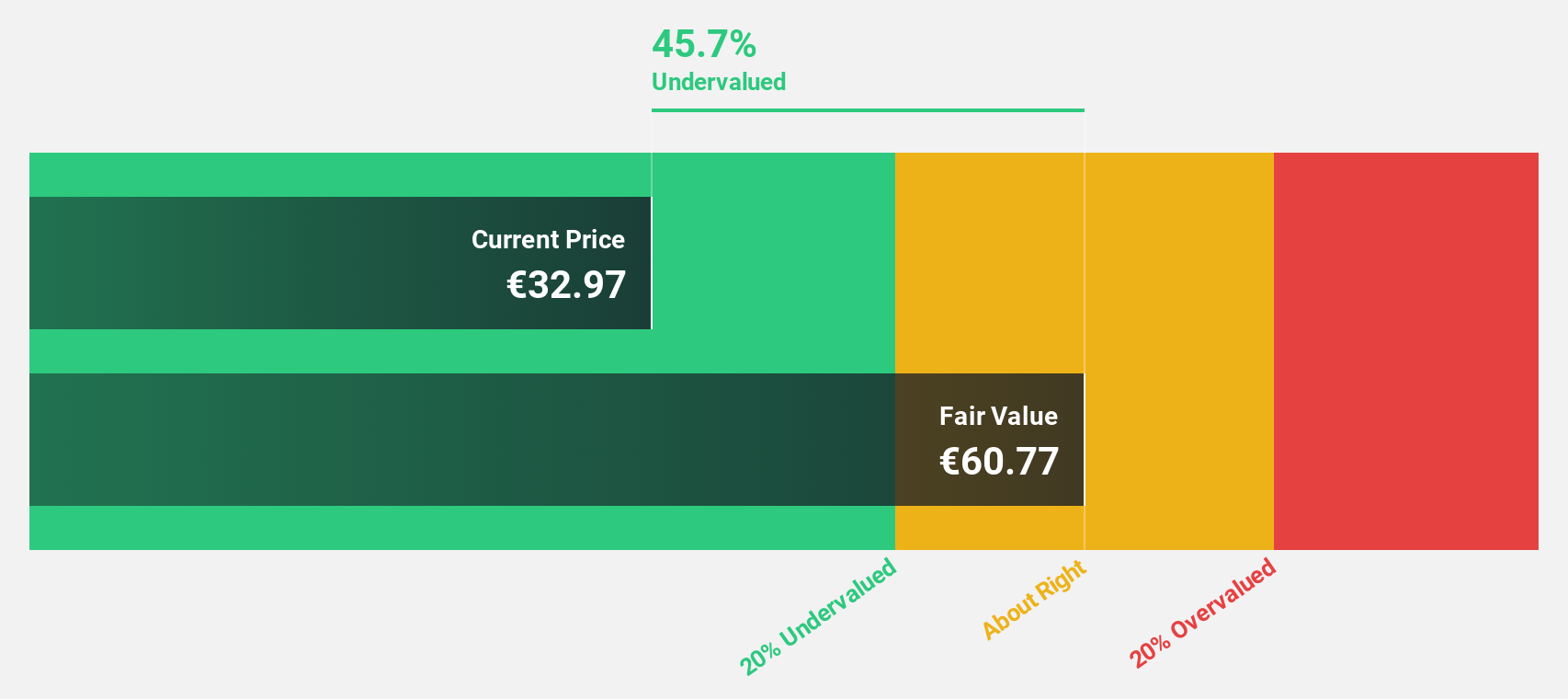

Estimated Discount To Fair Value: 44.1%

Cellnex Telecom is trading at €33.98, significantly below its estimated fair value of €60.77, indicating it is undervalued based on cash flows. The company is forecast to achieve profitability within three years, with earnings expected to grow by 49.35% annually. Recent strategic moves include a completed share buyback worth €800 million and potential sale discussions of its Swiss business for up to €2 billion, which could influence future cash flow dynamics positively.

- Our earnings growth report unveils the potential for significant increases in Cellnex Telecom's future results.

- Click to explore a detailed breakdown of our findings in Cellnex Telecom's balance sheet health report.

Thales (ENXTPA:HO)

Overview: Thales S.A. operates globally in the defence and security, aerospace and space, and digital identity and security sectors, with a market cap of €55.48 billion.

Operations: Thales generates revenue from its Aerospace segment (€5.64 billion), Cyber & Digital operations (€4.15 billion), and Defence (excluding Digital Identity & Security) activities (€11.32 billion).

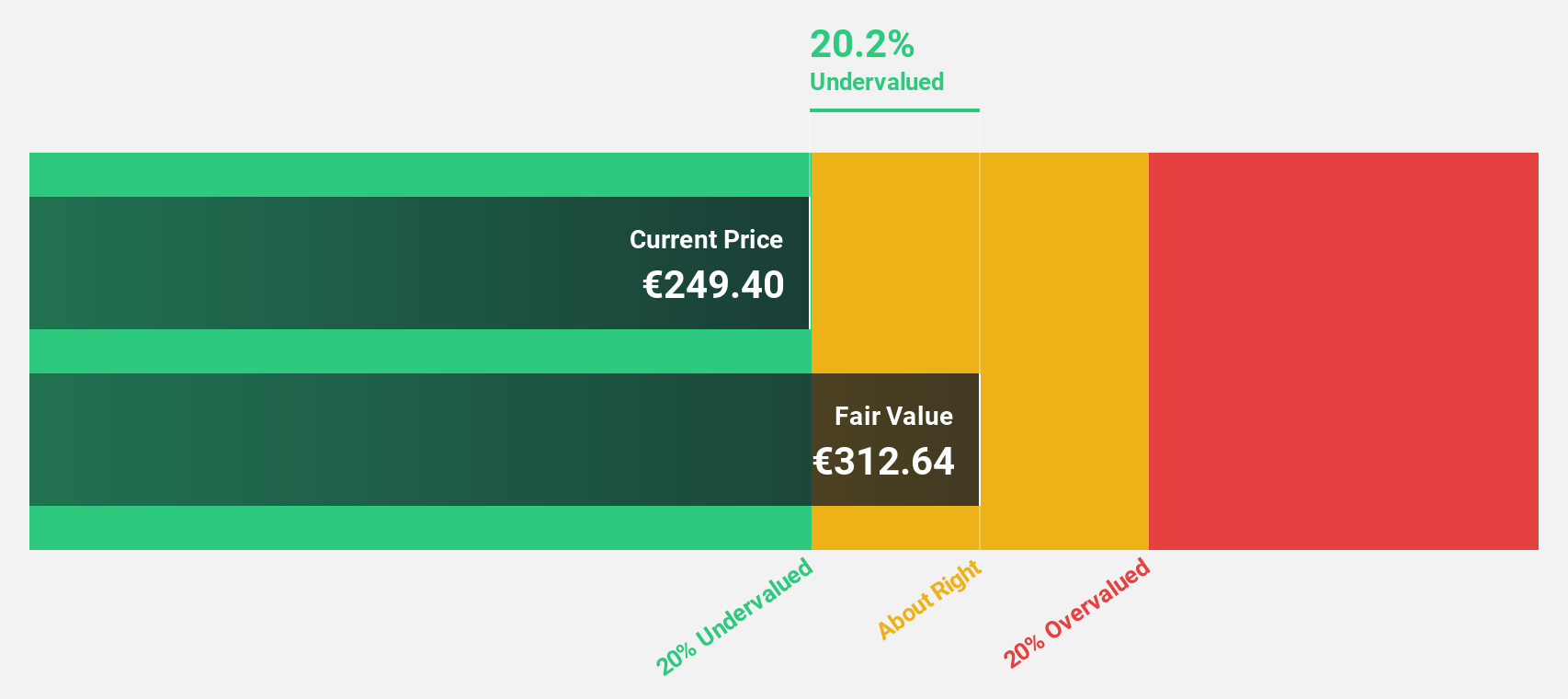

Estimated Discount To Fair Value: 15.8%

Thales is trading at €270.2, below its estimated fair value of €321.06, showing it is undervalued based on cash flows. Earnings are forecast to grow 17.94% annually, outpacing the French market's growth rate. Recent strategic partnerships with Michelin and Deloitte enhance Thales's position in software monetization and cybersecurity services, potentially bolstering future cash flow generation while maintaining a focus on selective mergers and acquisitions for strategic expansion.

- Insights from our recent growth report point to a promising forecast for Thales' business outlook.

- Navigate through the intricacies of Thales with our comprehensive financial health report here.

Summing It All Up

- Delve into our full catalog of 187 Undervalued European Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives