- Spain

- /

- Commercial Services

- /

- BME:CASH

European Market Highlights 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the European markets experience a period of cautious optimism, with major stock indexes showing modest gains amid ongoing assessments of interest rate policies and trade concerns, investors are increasingly on the lookout for stocks that may be trading below their estimated value. In such an environment, identifying undervalued stocks can be crucial, as these opportunities often arise when market sentiment is misaligned with a company's intrinsic worth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Witted Megacorp Oyj (HLSE:WITTED) | €1.425 | €2.74 | 47.9% |

| Truecaller (OM:TRUE B) | SEK41.32 | SEK82.50 | 49.9% |

| Robit Oyj (HLSE:ROBIT) | €1.18 | €2.27 | 48% |

| Noratis (XTRA:NUVA) | €0.785 | €1.56 | 49.6% |

| Lingotes Especiales (BME:LGT) | €5.90 | €11.32 | 47.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.38 | €0.74 | 48.4% |

| Eurofins Scientific (ENXTPA:ERF) | €60.80 | €116.93 | 48% |

| E-Globe (BIT:EGB) | €0.67 | €1.32 | 49.2% |

| Echo Investment (WSE:ECH) | PLN5.58 | PLN10.71 | 47.9% |

| Atea (OB:ATEA) | NOK143.20 | NOK285.10 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Next Geosolutions Europe (BIT:NXT)

Overview: Next Geosolutions Europe SpA offers marine geoscience and offshore construction support services across Europe, Asia, and North America, with a market cap of €573.60 million.

Operations: The company's revenue primarily comes from its Engineering Services segment, which generated €215.59 million.

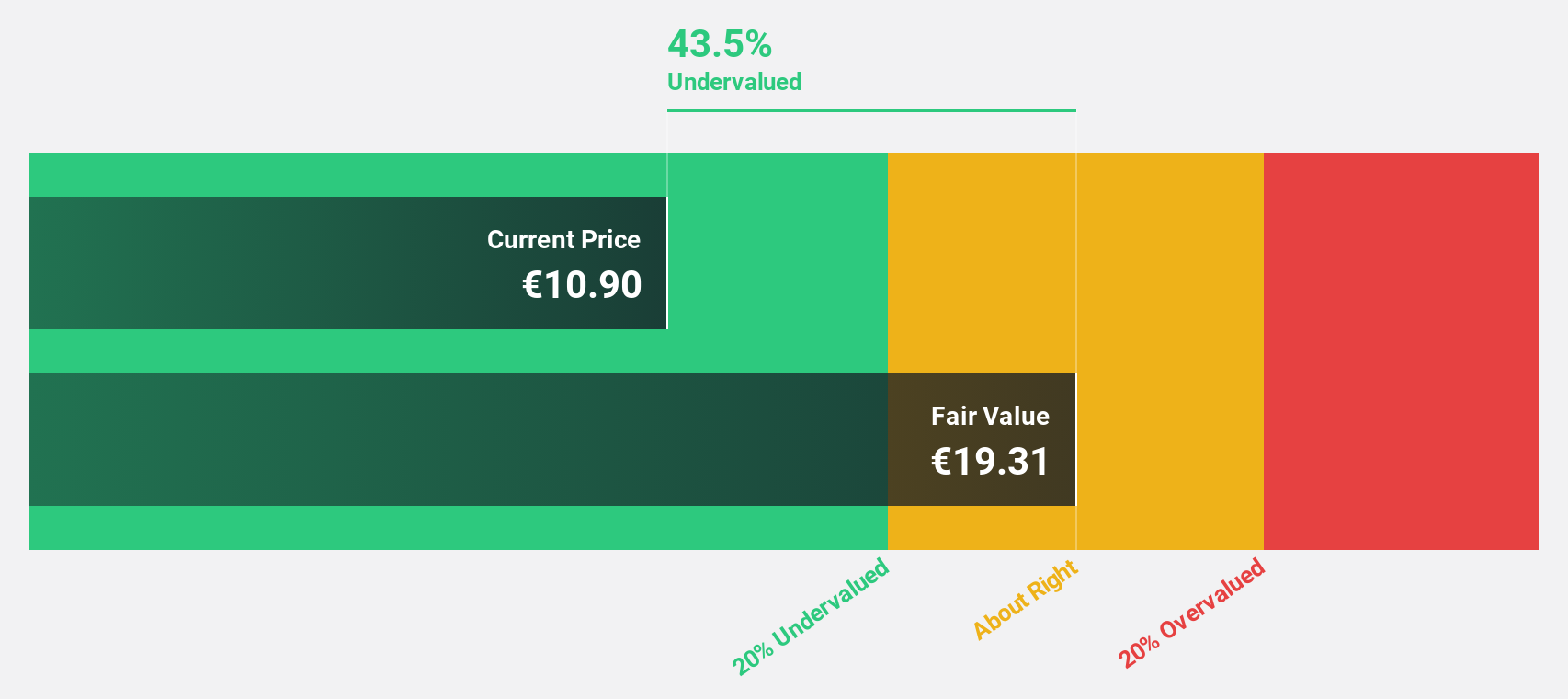

Estimated Discount To Fair Value: 38.6%

Next Geosolutions Europe is trading at €11.95, significantly below its estimated fair value of €19.46, indicating potential undervaluation based on cash flows. Despite recent volatility in its share price, the company demonstrates strong fundamentals with earnings expected to grow 21.9% annually—outpacing the Italian market's 9.2%. Recent half-year results show net income growth to €25.4 million from €21.1 million last year, underscoring robust financial performance amidst fluctuating sales figures.

- The analysis detailed in our Next Geosolutions Europe growth report hints at robust future financial performance.

- Dive into the specifics of Next Geosolutions Europe here with our thorough financial health report.

Prosegur Cash (BME:CASH)

Overview: Prosegur Cash, S.A. offers integrated cash cycle management and automated payment solutions for various sectors including financial institutions and retail establishments across Europe, LATAM, and internationally, with a market cap of €1.07 billion.

Operations: Prosegur Cash, S.A. generates revenue by providing cash cycle management and payment automation services to sectors such as financial institutions, retail businesses, government agencies, central banks, mints, and jewellery stores across Europe and LATAM.

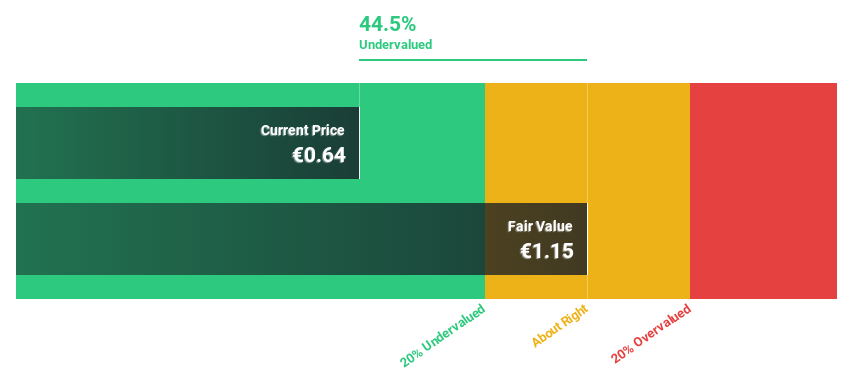

Estimated Discount To Fair Value: 46.9%

Prosegur Cash is currently trading at €0.73, well below its estimated fair value of €1.37, reflecting significant undervaluation based on cash flows. Despite a high debt level and a dividend yield of 5.55% not fully covered by earnings, the company shows promising growth potential with earnings forecasted to rise 19.2% annually—outpacing the Spanish market's growth rate. Recent half-year results reveal improved net income at €45.94 million from last year's €38.27 million, highlighting financial resilience amidst modest revenue growth projections.

- In light of our recent growth report, it seems possible that Prosegur Cash's financial performance will exceed current levels.

- Click here to discover the nuances of Prosegur Cash with our detailed financial health report.

Dynavox Group (OM:DYVOX)

Overview: Dynavox Group AB (publ) develops and sells assistive technology products for individuals with impaired communication skills, with a market capitalization of approximately SEK12.40 billion.

Operations: The company's revenue primarily comes from its computer hardware segment, which generated SEK2.25 billion.

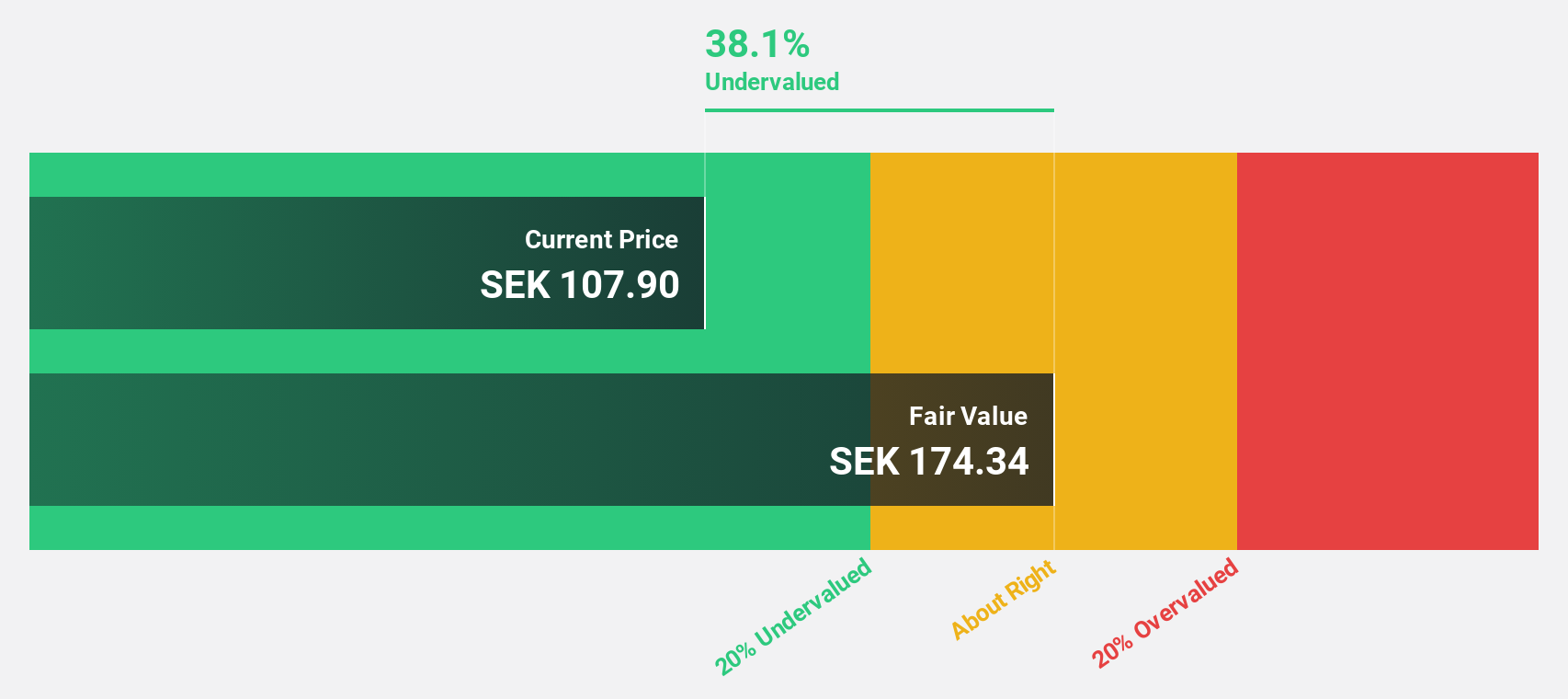

Estimated Discount To Fair Value: 45.3%

Dynavox Group is trading at SEK 116, significantly below its estimated fair value of SEK 211.88, suggesting substantial undervaluation based on cash flows. Despite a high debt level and recent insider selling, the company exhibits strong growth prospects with earnings expected to increase by 49.5% annually over the next three years—far surpassing the Swedish market's average growth rate. Recent earnings reports show sales improvement but a slight dip in net income compared to last year.

- The growth report we've compiled suggests that Dynavox Group's future prospects could be on the up.

- Navigate through the intricacies of Dynavox Group with our comprehensive financial health report here.

Make It Happen

- Explore the 215 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CASH

Prosegur Cash

Provides integrated cash cycle management solutions and automating payments in retail establishments and ATM management for financial institutions, retail establishments, business, government agencies, central banks, mints, and jewellery stores in Europe, LATAM, and internationally.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives