As the European markets experience mixed returns with the pan-European STOXX Europe 600 Index remaining flat, investors are closely monitoring inflation trends and labor market stability across the region. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those seeking steady returns amidst economic fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.45% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.08% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.72% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.88% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.36% | ★★★★★★ |

| ERG (BIT:ERG) | 5.42% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.12% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.42% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

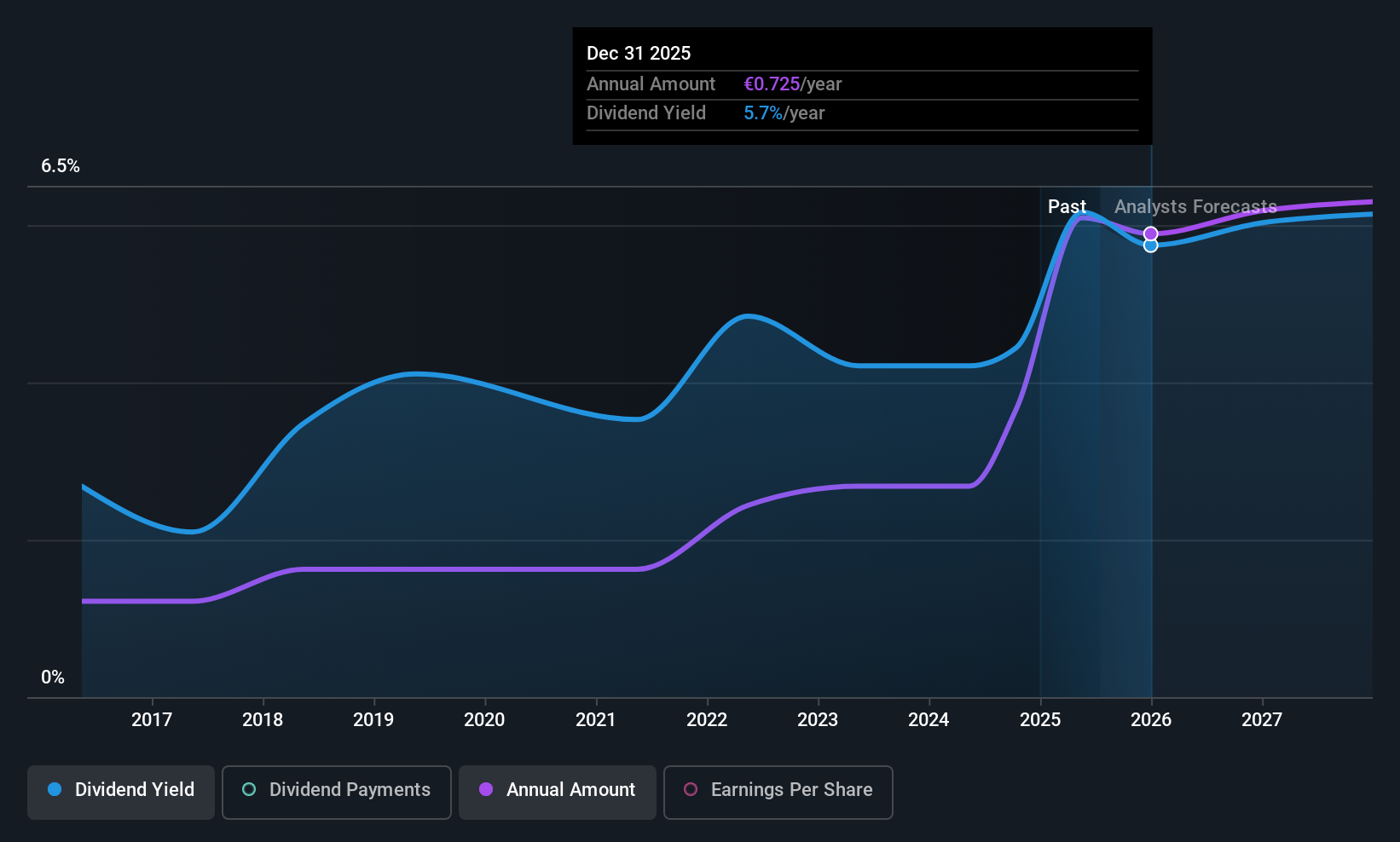

Credito Emiliano (BIT:CE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credito Emiliano S.p.A., along with its subsidiaries, operates in Italy focusing on commercial banking and wealth management, with a market cap of €4.43 billion.

Operations: Credito Emiliano S.p.A. generates revenue through various segments including Insurance (€95.30 million), Private Banking (€303.80 million), Asset Management (€161.10 million), Commercial Banking (€1.32 billion), and Parabanking, Consumer Credit, IT Technology (€235.40 million).

Dividend Yield: 5.8%

Credito Emiliano offers an attractive dividend yield, ranking in the top 25% of Italian market payers. Despite a history of volatility, dividends have grown over the past decade and are well-covered by earnings with a current payout ratio of 41.2%. The company initiated a share buyback program to enhance shareholder value. However, investors should note its low allowance for bad loans and forecasted earnings decline over the next three years.

- Navigate through the intricacies of Credito Emiliano with our comprehensive dividend report here.

- Our valuation report unveils the possibility Credito Emiliano's shares may be trading at a discount.

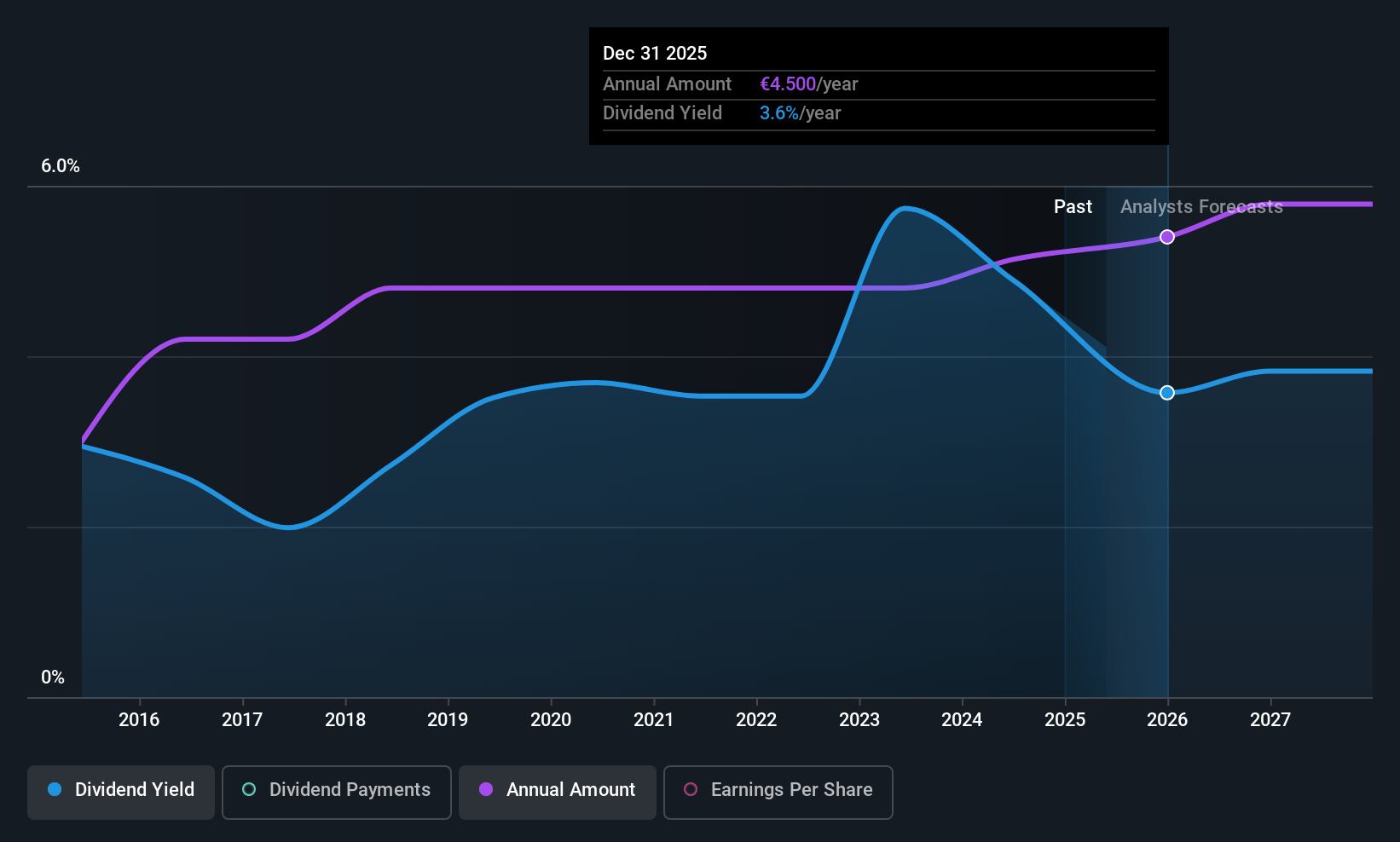

What's Cooking Group (ENXTBR:WHATS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: What's Cooking Group NV, with a market cap of €202.32 million, operates through its subsidiaries to produce and sell meat products and ready meals.

Operations: The company's revenue segments include ready meals, which generated €403.55 million.

Dividend Yield: 4.1%

What's Cooking Group's dividend yield of 4.13% is relatively low for top-tier Belgian payers, though dividends have been stable and growing over the past decade. Recent announcements include a special cash dividend of €5.50 and an annual increase to €3.15 per share, payable in July 2025. Despite a high payout ratio of 90.1%, dividends are well-covered by cash flows with a low cash payout ratio of 24.5%.

- Click to explore a detailed breakdown of our findings in What's Cooking Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of What's Cooking Group shares in the market.

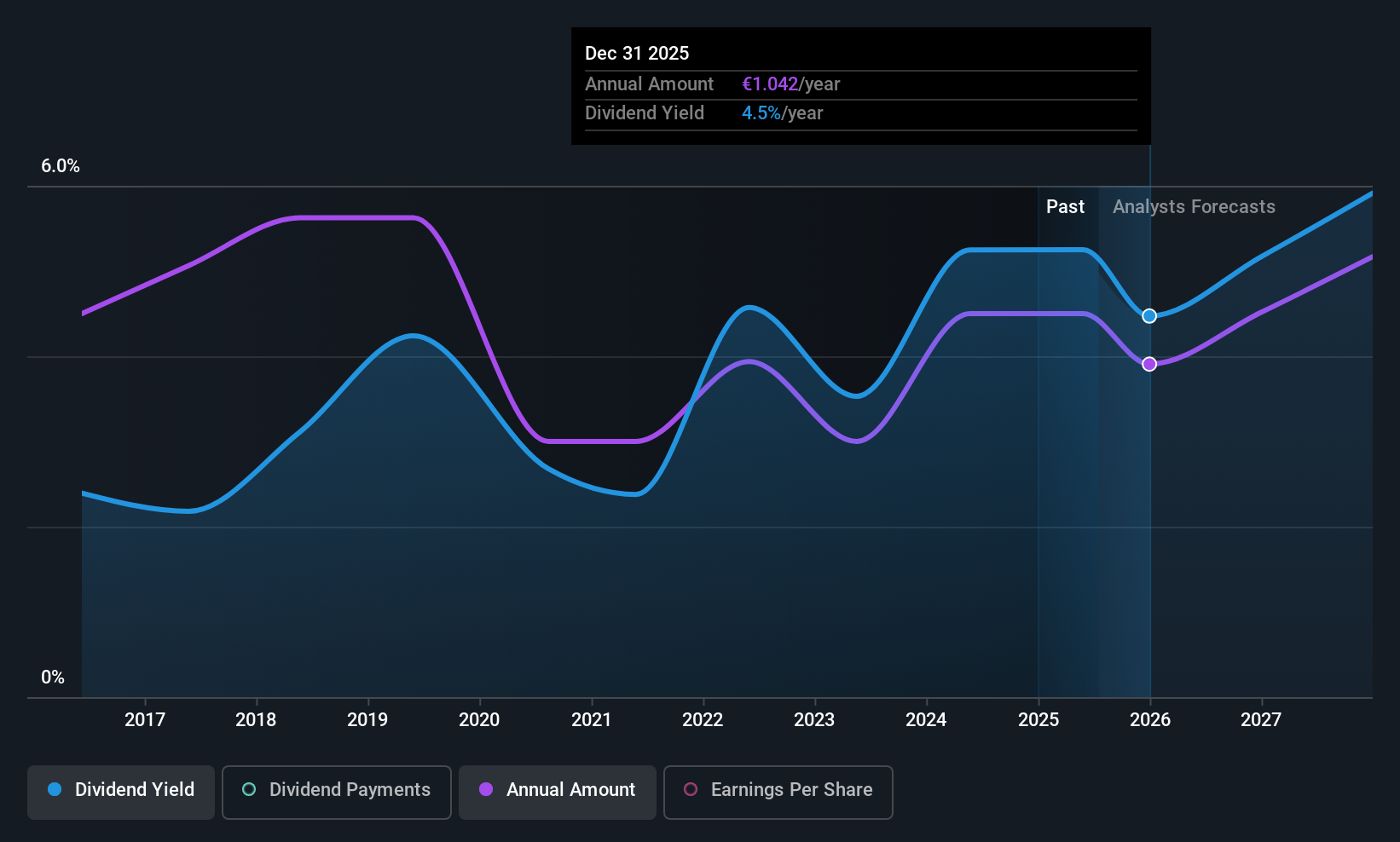

INDUS Holding (XTRA:INH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: INDUS Holding AG is a private equity firm that focuses on mergers and acquisitions as well as corporate spin-offs, with a market capitalization of €588.78 million.

Operations: INDUS Holding AG generates its revenue from three main segments: Engineering (€591.88 million), Infrastructure (€563.96 million), and Materials Solutions (€559.08 million).

Dividend Yield: 5.1%

INDUS Holding offers a dividend yield of 5.9%, placing it in the top 25% of German payers. Despite a payout ratio of 51.6% and cash payout ratio of 48.8%, suggesting sustainability, dividends have been volatile over the past decade without growth. Recent approval at the AGM for a €1.20 per share dividend reflects reliability, though financial position concerns persist with debt not well covered by operating cash flow despite trading below fair value estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of INDUS Holding.

- In light of our recent valuation report, it seems possible that INDUS Holding is trading behind its estimated value.

Summing It All Up

- Unlock our comprehensive list of 230 Top European Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CE

Credito Emiliano

Engages in commercial banking and wealth management activities in Italy.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.