As European markets show mixed returns amid hopes of interest rate cuts in the U.S. and UK, investors are closely monitoring economic indicators such as inflation and GDP revisions. In this environment, dividend stocks can offer a measure of stability and income, making them an attractive option for those seeking to navigate uncertain market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.33% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.65% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.14% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| Evolution (OM:EVO) | 4.92% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.13% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.42% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.39% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.44% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 5.36% | ★★★★★☆ |

Click here to see the full list of 207 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

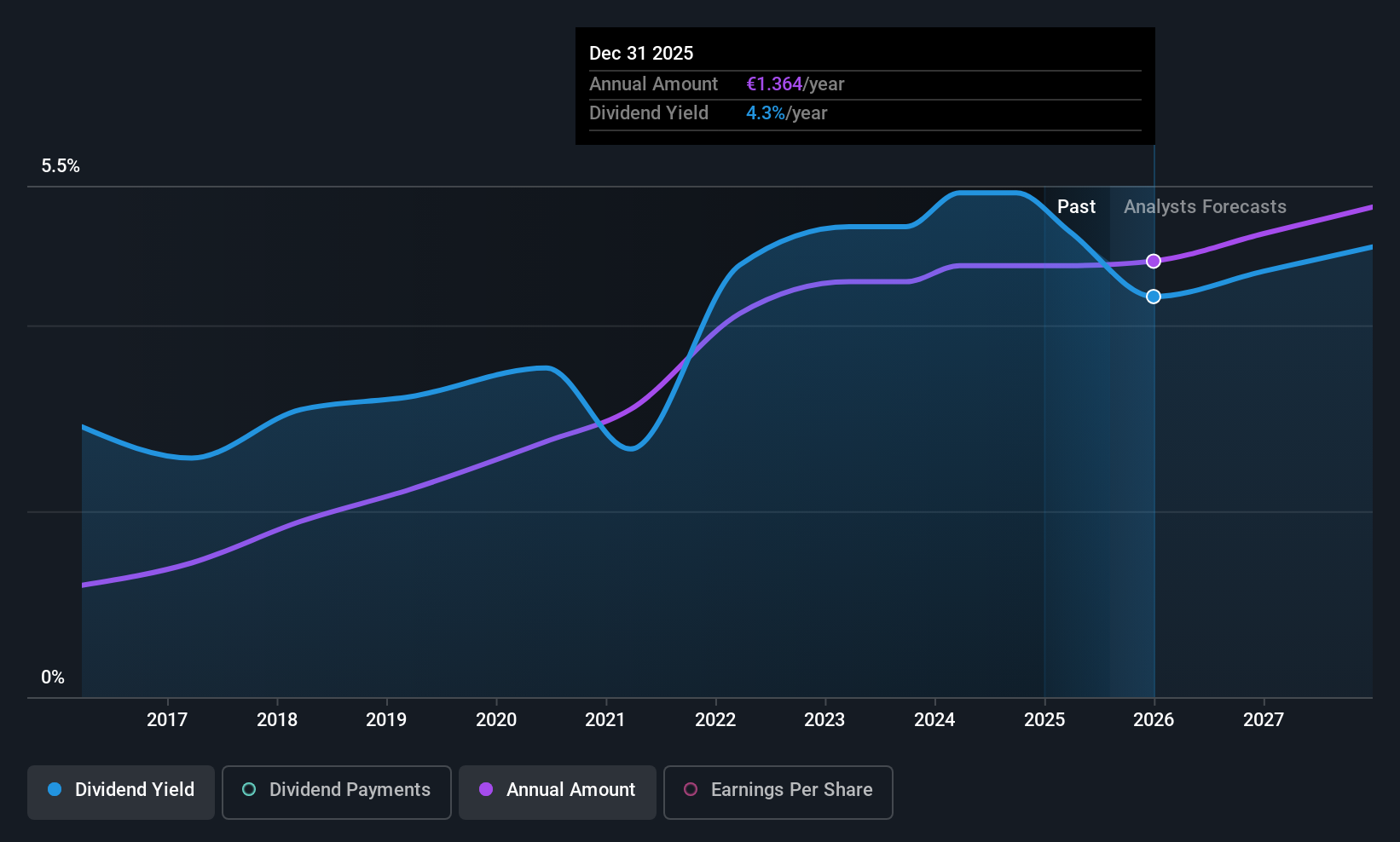

Sopra Steria Group (ENXTPA:SOP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sopra Steria Group SA offers consulting, digital, and software development services both in France and internationally, with a market cap of €2.60 billion.

Operations: Sopra Steria Group's revenue is primarily derived from France (€2.39 billion), followed by Other Europe (€2.01 billion) and the United Kingdom (€931 million).

Dividend Yield: 3.4%

Sopra Steria Group's dividend profile is mixed. While the company offers a well-covered dividend with a low payout ratio of 32.7% and cash payout ratio of 22.8%, its dividends have been volatile over the past decade, impacting reliability. Despite this, dividends have increased over time. The stock trades at good value compared to peers, though its yield of 3.43% is below top-tier French market payers. Recent executive changes may influence future stability and strategy.

- Get an in-depth perspective on Sopra Steria Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Sopra Steria Group is trading behind its estimated value.

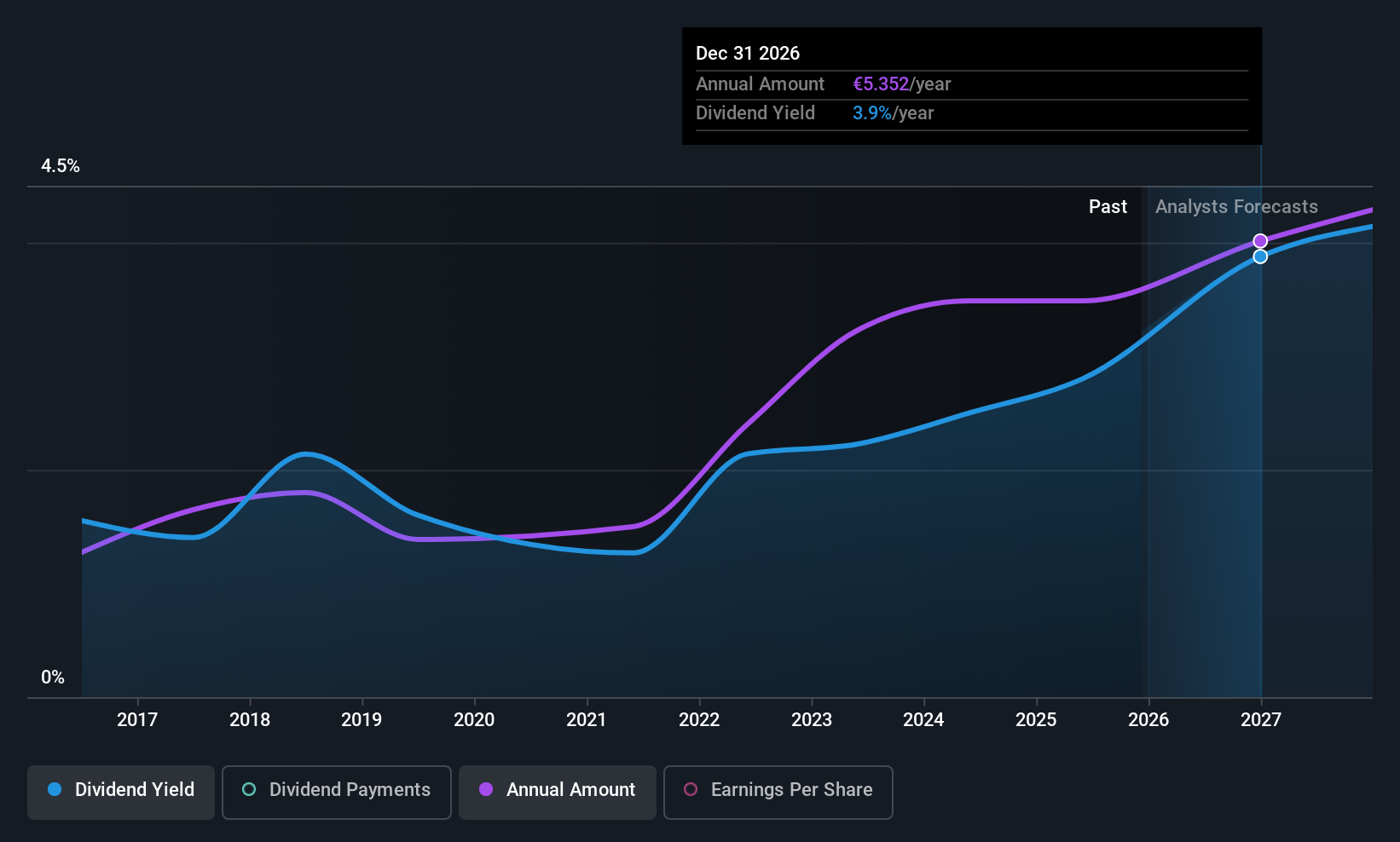

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various global regions with a market cap of €5.32 billion.

Operations: Valmet Oyj's revenue is primarily derived from its Process Performance Solutions segment, which generated €1.50 billion.

Dividend Yield: 4.7%

Valmet Oyj's dividend profile shows both strengths and weaknesses. The company's dividends have been stable and growing over the past decade, but a high payout ratio of 91.1% indicates they are not well covered by earnings, though cash flows do cover the payouts with a 54.3% cash payout ratio. The current yield of 4.68% is below the top tier in Finland but remains reliable for investors seeking consistent returns. Recent projects in renewable energy and paper production highlight Valmet's commitment to sustainable growth, potentially influencing future dividend sustainability positively despite temporary operational layoffs planned in Finland to improve cost efficiency.

- Take a closer look at Valmet Oyj's potential here in our dividend report.

- Upon reviewing our latest valuation report, Valmet Oyj's share price might be too pessimistic.

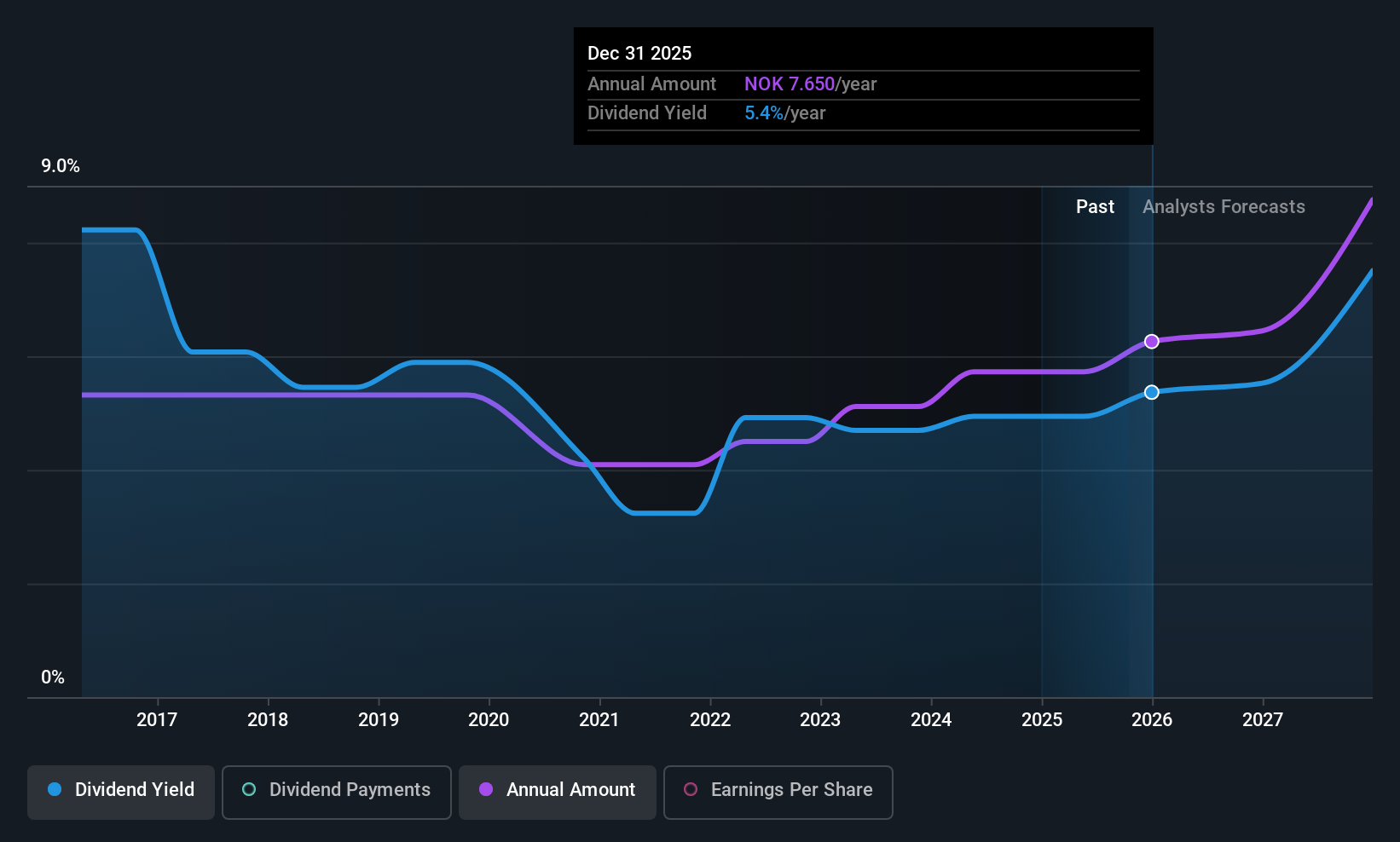

Atea (OB:ATEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atea ASA delivers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK17.05 billion.

Operations: Atea ASA generates revenue from several segments, with Norway contributing NOK9.27 billion, Sweden NOK13.73 billion, Denmark NOK8.56 billion, Finland NOK3.48 billion, and the Baltics NOK1.90 billion.

Dividend Yield: 4.6%

Atea's dividend profile presents a mixed outlook. While its dividends have been stable and growing over the past decade, a high payout ratio of 98.2% suggests they are not well covered by earnings, though cash flows do support the payouts with an 83.5% cash payout ratio. The current yield of 4.58% is below Norway's top tier but remains reliable for consistent returns. A recent Euro 130 million NATO contract could bolster future revenue streams, potentially influencing dividend sustainability positively despite current coverage challenges.

- Navigate through the intricacies of Atea with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Atea shares in the market.

Where To Now?

- Dive into all 207 of the Top European Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)