- United States

- /

- Biotech

- /

- NasdaqGS:MYGN

Earnings Update: Myriad Genetics, Inc. Just Reported And Analysts Are Trimming Their Forecasts

It's shaping up to be a tough period for Myriad Genetics, Inc. (NASDAQ:MYGN), which a week ago released some disappointing quarterly results that could have a notable impact on how the market views the stock. Revenues fell 7.9% short of expectations, at US$186m. Earnings correspondingly dipped, with Myriad Genetics reporting a loss of US$0.28 per share, whereas analysts had previously modelled a profit in this period. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent forecasts to see whether analysts have changed their earnings models, following these results.

View our latest analysis for Myriad Genetics

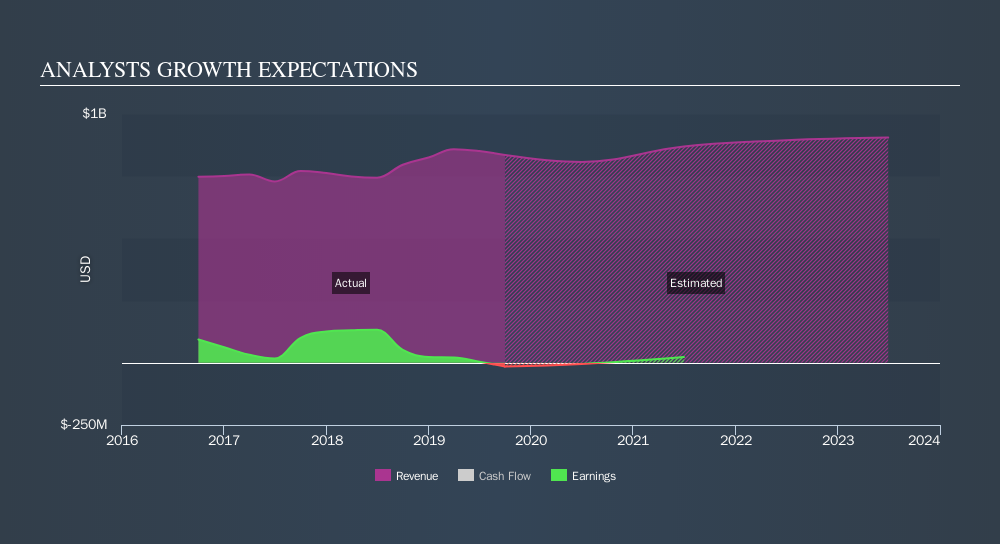

Following the recent earnings report, the consensus fromnine analysts covering Myriad Genetics expects revenues of US$807m in 2020, implying a perceptible 3.3% decline in sales compared to the last 12 months. Losses are forecast to balloon 66% to US$0.07 per share. In the lead-up to this report, analysts had been modelling revenues of US$873m and earnings per share (EPS) of US$0.48 in 2020. There looks to have been a significant drop in sentiment regarding Myriad Genetics's prospects after these latest results, with a small dip in to revenues and analysts now forecasting a loss instead of a profit.

The consensus price target fell 6.6% to US$30.90, with analysts clearly concerned about the company following the weaker revenue and earnings outlook. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Myriad Genetics analyst has a price target of US$47.00 per share, while the most pessimistic values it at US$18.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Zooming out to look at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up both against past performance, and against industry growth estimates. We would highlight that sales are expected to reverse, with the forecast 3.3% revenue decline a notable change from historical growth of 2.9% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same market are forecast to see their revenue grow 17% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - analysts also expect Myriad Genetics to grow slower than the wider market.

The Bottom Line

The most important thing to take away is that analysts are expecting Myriad Genetics to become unprofitable next year. Unfortunately, analysts also downgraded their revenue estimates, and our data indicates revenues are expected to perform worse than the wider market. Even so, earnings per share are more important to the intrinsic value of the business. The consensus price target fell measurably, with analysts seemingly not reassured by the latest results, leading to a lower estimate of Myriad Genetics's future valuation.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Myriad Genetics going out to 2023, and you can see them free on our platform here..

It might also be worth considering whether Myriad Genetics's debt load is appropriate, using our debt analysis tools on the Simply Wall St platform, here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MYGN

Myriad Genetics

A molecular diagnostic testing and precision medicine company, develops and provides molecular tests.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion