- United States

- /

- Chemicals

- /

- NYSE:DD

DuPont de Nemours (NYSE:DD) Collaborates With Epicore For Enhanced Worker Safety Solutions

Reviewed by Simply Wall St

DuPont de Nemours (NYSE:DD) recently experienced a notable share price increase of 15% over the last month. This upward movement coincided with DuPont's collaboration announcement with Epicore Biosystems to enhance worker safety, which bolstered investor confidence. The potential long-term value of integrating wearable hydration technology with protective garments could have added weight to this positive momentum. Despite the broader market remaining relatively flat during the period, DuPont's strategic partnership likely contributed positively, especially considering its focus on addressing climate-related worker safety challenges amidst a backdrop of steady economic indicators.

Be aware that DuPont de Nemours is showing 3 weaknesses in our investment analysis.

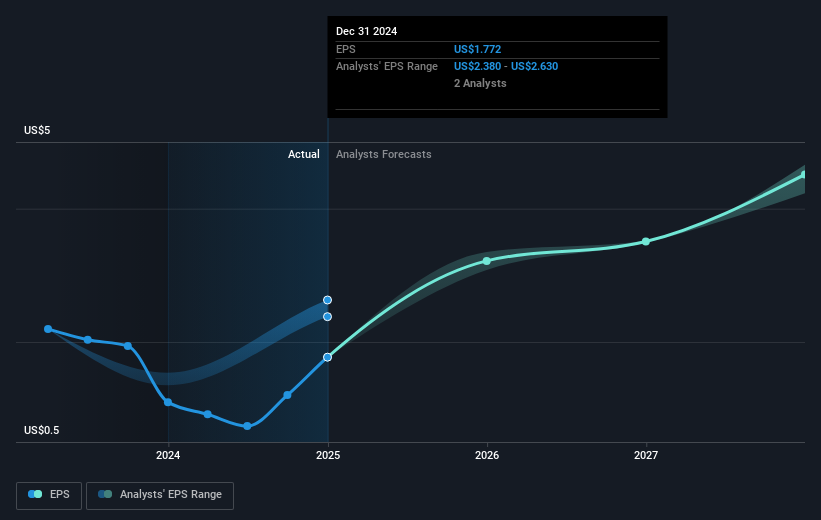

The recent collaboration between DuPont de Nemours and Epicore Biosystems could positively influence DuPont’s narrative of diversifying and targeting specific market opportunities, particularly in worker safety and wearable technology. This initiative aligns with DuPont's strategy to expand its technological solutions, potentially enhancing its revenue and earnings forecasts. Given the expected benefits in worker safety applications, DuPont may experience increased demand for its products, reinforcing its position in addressing climate-related worker safety challenges.

Over the past five years, DuPont's total return, including share price and dividends, amounted to 50.64%. However, compared to the broader Chemicals industry and the overall US market, DuPont experienced underperformance over the past year, with the US market returning 11.7% while DuPont recorded a declining trend. This broader context suggests that while the short-term news provided a positive boost, the company's longer-term performance showcases resilience amidst changing market dynamics.

The recent price increase propels DuPont's current share price closer to the consensus analyst price target of US$85.81, making it approximately 24.2% higher than today's price of US$65.04. This alignment with the price target underscores potential investor confidence in DuPont's future earnings growth and strategic initiatives like the aforementioned collaboration. Investors should consider whether these forecasts and the price target adequately reflect DuPont's ongoing initiatives and their potential impact on long-term value creation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DD

DuPont de Nemours

Provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives