Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Pulse Seismic Inc. (TSE:PSD) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Pulse Seismic

What Is Pulse Seismic's Debt?

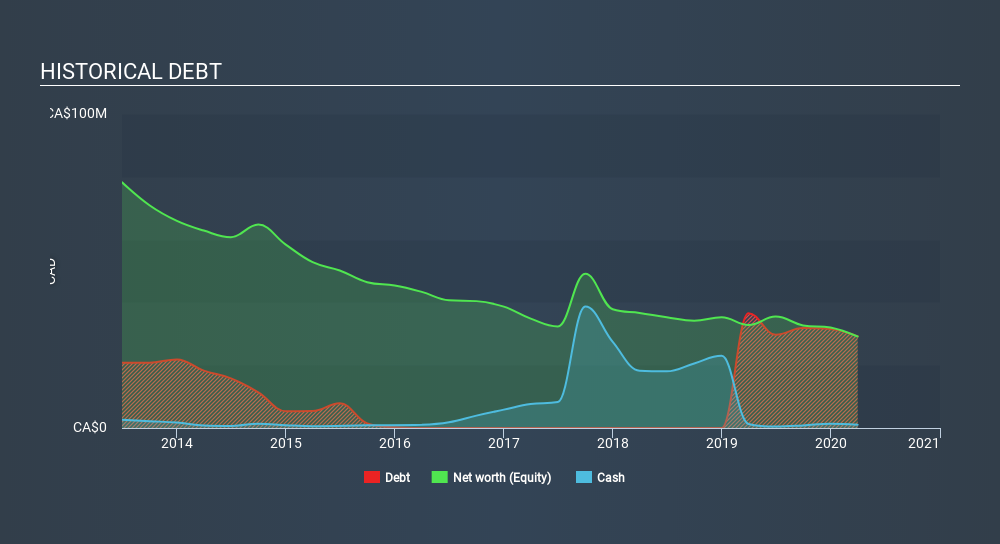

The image below, which you can click on for greater detail, shows that Pulse Seismic had debt of CA$29.2m at the end of March 2020, a reduction from CA$36.6m over a year. However, it does have CA$1.04m in cash offsetting this, leading to net debt of about CA$28.1m.

How Strong Is Pulse Seismic's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Pulse Seismic had liabilities of CA$4.91m due within 12 months and liabilities of CA$29.8m due beyond that. Offsetting this, it had CA$1.04m in cash and CA$4.51m in receivables that were due within 12 months. So its liabilities total CA$29.2m more than the combination of its cash and short-term receivables.

Pulse Seismic has a market capitalization of CA$72.6m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Pulse Seismic has a quite reasonable net debt to EBITDA multiple of 1.8, its interest cover seems weak, at 0.43. In large part that's it has so much depreciation and amortisation. These charges may be non-cash, so they could be excluded when it comes to paying down debt. But the accounting charges are there for a reason -- some assets are seen to be losing value. In any case, it's safe to say the company has meaningful debt. We also note that Pulse Seismic improved its EBIT from a last year's loss to a positive CA$883k. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Pulse Seismic's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, Pulse Seismic actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Pulse Seismic's interest cover was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its conversion of EBIT to free cash flow. Looking at all this data makes us feel a little cautious about Pulse Seismic's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Pulse Seismic you should know about.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:PSD

Pulse Seismic

Acquires, markets, and licenses two-dimensional (2D) and three-dimensional (3D) seismic data for the energy sector in Canada.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Very Bullish

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Very Bullish

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026