- India

- /

- Healthcare Services

- /

- NSEI:LOTUSEYE

Does Lotus Eye Hospital and Institute (NSE:LOTUSEYE) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

So if you're like me, you might be more interested in profitable, growing companies, like Lotus Eye Hospital and Institute (NSE:LOTUSEYE). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Lotus Eye Hospital and Institute

Lotus Eye Hospital and Institute's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Lotus Eye Hospital and Institute has grown EPS by 44% per year, over the last three years. Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that Lotus Eye Hospital and Institute is growing revenues, and EBIT margins improved by 7.1 percentage points to 7.3%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

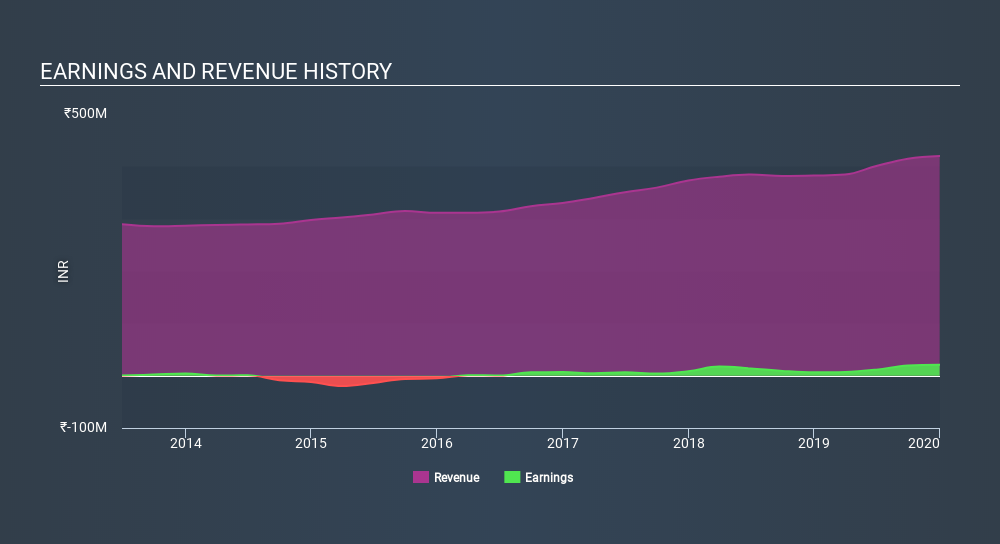

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Since Lotus Eye Hospital and Institute is no giant, with a market capitalization of ₹644m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Lotus Eye Hospital and Institute Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news for Lotus Eye Hospital and Institute shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that S. Sundaramoorthy, the of the company, paid ₹2.3m for shares at around ₹21.72 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Lotus Eye Hospital and Institute insiders own more than a third of the company. In fact, they own 68% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, Lotus Eye Hospital and Institute is a very small company, with a market cap of only ₹644m. So despite a large proportional holding, insiders only have ₹438m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Lotus Eye Hospital and Institute Worth Keeping An Eye On?

Lotus Eye Hospital and Institute's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Lotus Eye Hospital and Institute belongs on the top of your watchlist. Still, you should learn about the 2 warning signs we've spotted with Lotus Eye Hospital and Institute (including 1 which makes us a bit uncomfortable) .

As a growth investor I do like to see insider buying. But Lotus Eye Hospital and Institute isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:LOTUSEYE

Lotus Eye Hospital and Institute

A specialty eye care hospital, provides eye care and related services in India.

Flawless balance sheet with questionable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)