- Netherlands

- /

- Construction

- /

- ENXTAM:BAMNB

Does Koninklijke BAM Groep (AMS:BAMNB) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Koninklijke BAM Groep nv (AMS:BAMNB) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Koninklijke BAM Groep

What Is Koninklijke BAM Groep's Net Debt?

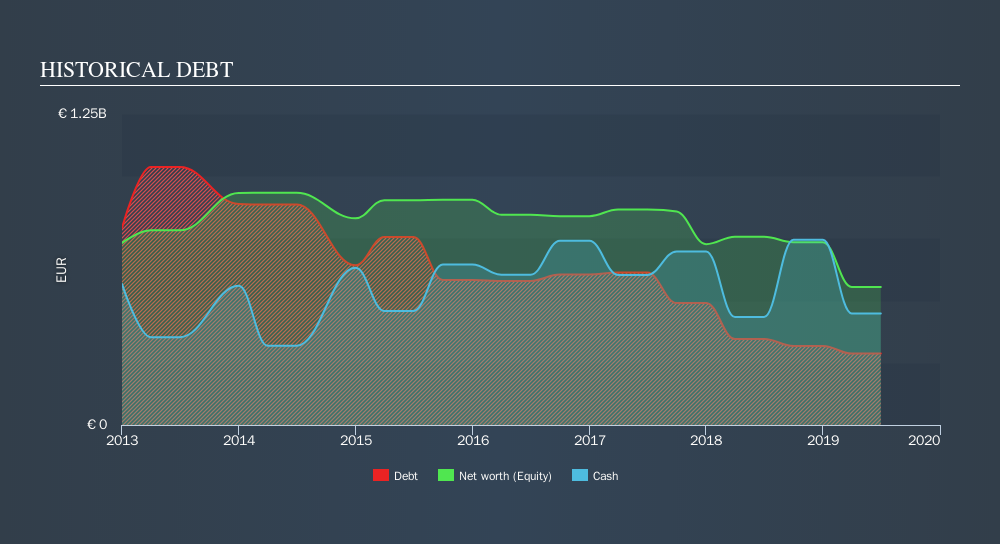

As you can see below, Koninklijke BAM Groep had €287.3m of debt at June 2019, down from €345.8m a year prior. But on the other hand it also has €448.6m in cash, leading to a €161.3m net cash position.

How Healthy Is Koninklijke BAM Groep's Balance Sheet?

The latest balance sheet data shows that Koninklijke BAM Groep had liabilities of €3.10b due within a year, and liabilities of €784.8m falling due after that. Offsetting this, it had €448.6m in cash and €1.93b in receivables that were due within 12 months. So it has liabilities totalling €1.50b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the €650.0m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Koninklijke BAM Groep would likely require a major re-capitalisation if it had to pay its creditors today. Given that Koninklijke BAM Groep has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

Although Koninklijke BAM Groep made a loss at the EBIT level, last year, it was also good to see that it generated €39m in EBIT over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Koninklijke BAM Groep's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Koninklijke BAM Groep may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last year, Koninklijke BAM Groep actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing up

Although Koninklijke BAM Groep's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €161.3m. And it impressed us with free cash flow of €160m, being 414% of its EBIT. So although we see some areas for improvement, we're not too worried about Koninklijke BAM Groep's balance sheet. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTAM:BAMNB

Koninklijke BAM Groep

Provides products and services in the construction and property, civil engineering, and public private partnerships (PPP) sectors worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)