- Italy

- /

- Tech Hardware

- /

- BIT:ETH

Does Eurotech's (BIT:ETH) Statutory Profit Adequately Reflect Its Underlying Profit?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. In this article, we'll look at how useful this year's statutory profit is, when analysing Eurotech (BIT:ETH).

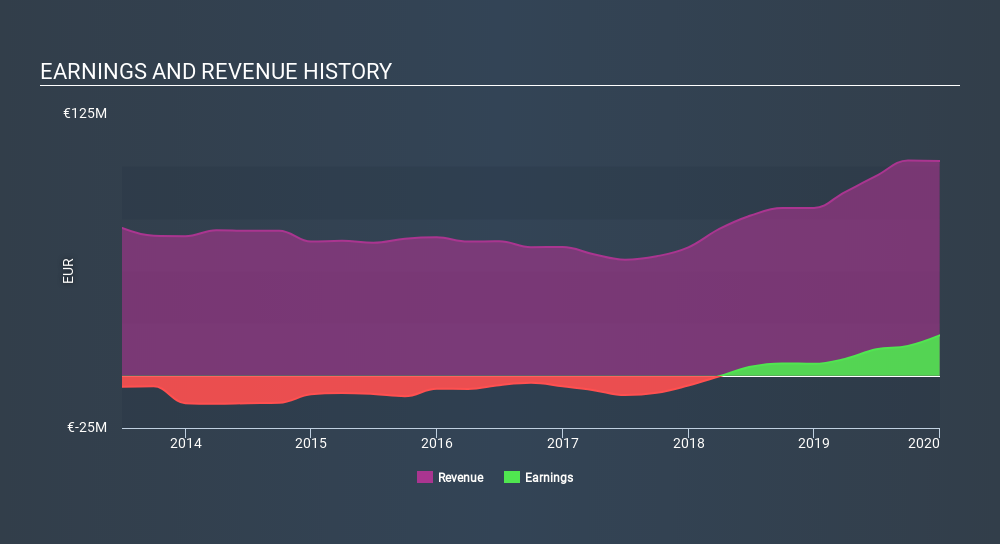

While Eurotech was able to generate revenue of €102.5m in the last twelve months, we think its profit result of €19.2m was more important. The chart below shows that revenue has improved over the last three years, and, even better, the company has moved from unprofitable to profitable.

See our latest analysis for Eurotech

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. Therefore, we think it makes sense to note and understand the impact that a tax benefit has had on Eurotech's statutory profit in the last twelve months. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

We can see that Eurotech received a tax benefit of €3.1m. This is of course a bit out of the ordinary, given it is more common for companies to be paying tax than receiving tax benefits! The receipt of a tax benefit is obviously a good thing, on its own. However, the devil in the detail is that these kind of benefits only impact in the year they are booked, and are often one-off in nature. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Our Take On Eurotech's Profit Performance

Eurotech reported that it received a tax benefit, rather than paid tax, in its last report. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Because of this, we think that it may be that Eurotech's statutory profits are better than its underlying earnings power. The silver lining is that its EPS growth over the last year has been really wonderful, even if it's not a perfect measure. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Be aware that Eurotech is showing 2 warning signs in our investment analysis and 1 of those is a bit concerning...

This note has only looked at a single factor that sheds light on the nature of Eurotech's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BIT:ETH

Eurotech

Provides edge computing and industrial Internet of Things (IIoT) solutions in Italy, Europe, North America, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Swiped Left by Wall Street: The BMBL Rebound Trade

Bayer to Achieve Fair Value of €40 Boosting Growth and Investor Confidence

Novo Nordisk (NVO): Is the "Easy Growth" Story Over?

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion