- United States

- /

- Banks

- /

- NasdaqCM:EMCF

Do You Know What Emclaire Financial Corp's (NASDAQ:EMCF) P/E Ratio Means?

To the annoyance of some shareholders, Emclaire Financial (NASDAQ:EMCF) shares are down a considerable in the last month. Even longer term holders have taken a real hit with the stock declining 9.9% in the last year.

All else being equal, a sharp share price increase should make a stock less attractive to potential investors. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

See our latest analysis for Emclaire Financial

How Does Emclaire Financial's P/E Ratio Compare To Its Peers?

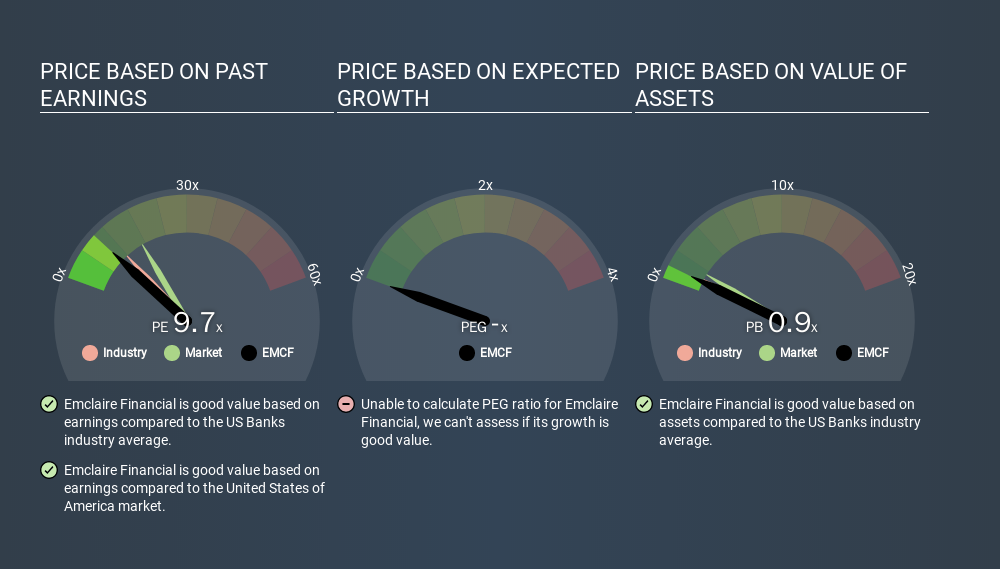

Emclaire Financial's P/E of 9.72 indicates relatively low sentiment towards the stock. We can see in the image below that the average P/E (11.4) for companies in the banks industry is higher than Emclaire Financial's P/E.

Emclaire Financial's P/E tells us that market participants think it will not fare as well as its peers in the same industry. While current expectations are low, the stock could be undervalued if the situation is better than the market assumes. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. If earnings are growing quickly, then the 'E' in the equation will increase faster than it would otherwise. And in that case, the P/E ratio itself will drop rather quickly. Then, a lower P/E should attract more buyers, pushing the share price up.

Emclaire Financial's 66% EPS improvement over the last year was like bamboo growth after rain; rapid and impressive. And earnings per share have improved by 16% annually, over the last three years. So we'd absolutely expect it to have a relatively high P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. So it won't reflect the advantage of cash, or disadvantage of debt. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting Emclaire Financial's P/E?

Emclaire Financial has net debt worth 15% of its market capitalization. It would probably deserve a higher P/E ratio if it was net cash, since it would have more options for growth.

The Bottom Line On Emclaire Financial's P/E Ratio

Emclaire Financial trades on a P/E ratio of 9.7, which is below the US market average of 16.6. The company does have a little debt, and EPS growth was good last year. If the company can continue to grow earnings, then the current P/E may be unjustifiably low. What can be absolutely certain is that the market has become more pessimistic about Emclaire Financial over the last month, with the P/E ratio falling from 9.7 back then to 9.7 today. For those who prefer to invest with the flow of momentum, that might be a bad sign, but for deep value investors this stock might justify some research.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. Although we don't have analyst forecasts shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:EMCF

Emclaire Financial

Emclaire Financial Corp operates as the bank holding company for The Farmers National Bank of Emlenton that provides retail and commercial financial products and services to individuals and businesses in western Pennsylvania.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives