Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Energy One (ASX:EOL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Energy One

Energy One's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Energy One has grown EPS by 40% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). On the one hand, Energy One's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

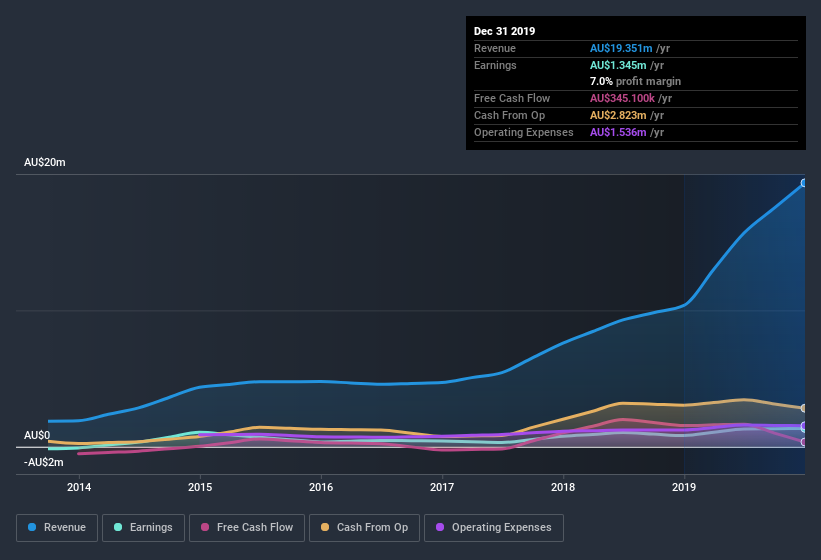

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Energy One isn't a huge company, given its market capitalization of AU$108m. That makes it extra important to check on its balance sheet strength.

Are Energy One Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news is that Energy One insiders spent a whopping AU$1.8m on stock in just one year, and I didn't see any selling. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by Non-Independent Director Ian Ferrier for AU$880k worth of shares, at about AU$2.20 per share.

On top of the insider buying, we can also see that Energy One insiders own a large chunk of the company. Indeed, with a collective holding of 63%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. With that sort of holding, insiders have about AU$68m riding on the stock, at current prices. That's nothing to sneeze at!

Is Energy One Worth Keeping An Eye On?

Energy One's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Energy One belongs on the top of your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Energy One , and understanding them should be part of your investment process.

As a growth investor I do like to see insider buying. But Energy One isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Energy One, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

Valuation is complex, but we're here to simplify it.

Discover if Energy One might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:EOL

Energy One

Provides software products, outsourced operations, and advisory services to wholesale energy, environmental, and carbon trading markets in the Australasia, and Europe.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives