- United Kingdom

- /

- Machinery

- /

- AIM:SOM

Discover UK Penny Stocks: Ramsdens Holdings Among 3 Notable Picks

Reviewed by Simply Wall St

The London markets have recently faced headwinds, with the FTSE 100 index closing lower amid weak trade data from China, highlighting global economic uncertainties. In such a climate, investors often turn their attention to smaller companies that may offer unique opportunities for growth. Penny stocks, though an outdated term, still capture interest due to their potential for significant returns when backed by strong financials. This article will explore three notable UK penny stocks that stand out for their financial health and potential long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.585 | £513.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £3.425 | £276.7M | ✅ 4 ⚠️ 2 View Analysis > |

| FDM Group (Holdings) (LSE:FDM) | £1.25 | £136.64M | ✅ 2 ⚠️ 4 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.412 | £44.58M | ✅ 4 ⚠️ 3 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.81 | £299.52M | ✅ 5 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.80 | £288.03M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.625 | £130.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.19 | £189.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.805 | £11.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.57 | £78.98M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 299 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Ramsdens Holdings (AIM:RFX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ramsdens Holdings PLC provides diversified financial services in the United Kingdom and internationally, with a market cap of £108.39 million.

Operations: The company's revenue is derived from several segments: Pawnbroking (£13.69 million), Retail Jewellery Sales (£38.76 million), Foreign Currency Margin (£14.98 million), Purchases of Precious Metals (£35.47 million), and Income from Other Financial Services (£0.55 million).

Market Cap: £108.39M

Ramsdens Holdings PLC, with a market cap of £108.39 million, has demonstrated stable financial performance and growth potential. The company reported half-year sales of £51.6 million and net income of £4.43 million, reflecting significant year-on-year growth. Its diverse revenue streams include pawnbroking, retail jewellery sales, foreign currency margin, and precious metals purchases. Ramsdens' debt is well covered by operating cash flow, and it maintains a strong balance sheet with more cash than total debt. Recent announcements include a 25% interim dividend increase and plans for store expansion, indicating confidence in future profitability despite an unstable dividend track record previously noted.

- Unlock comprehensive insights into our analysis of Ramsdens Holdings stock in this financial health report.

- Evaluate Ramsdens Holdings' prospects by accessing our earnings growth report.

Somero Enterprises (AIM:SOM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling and contouring equipment with a market cap of £123.77 million.

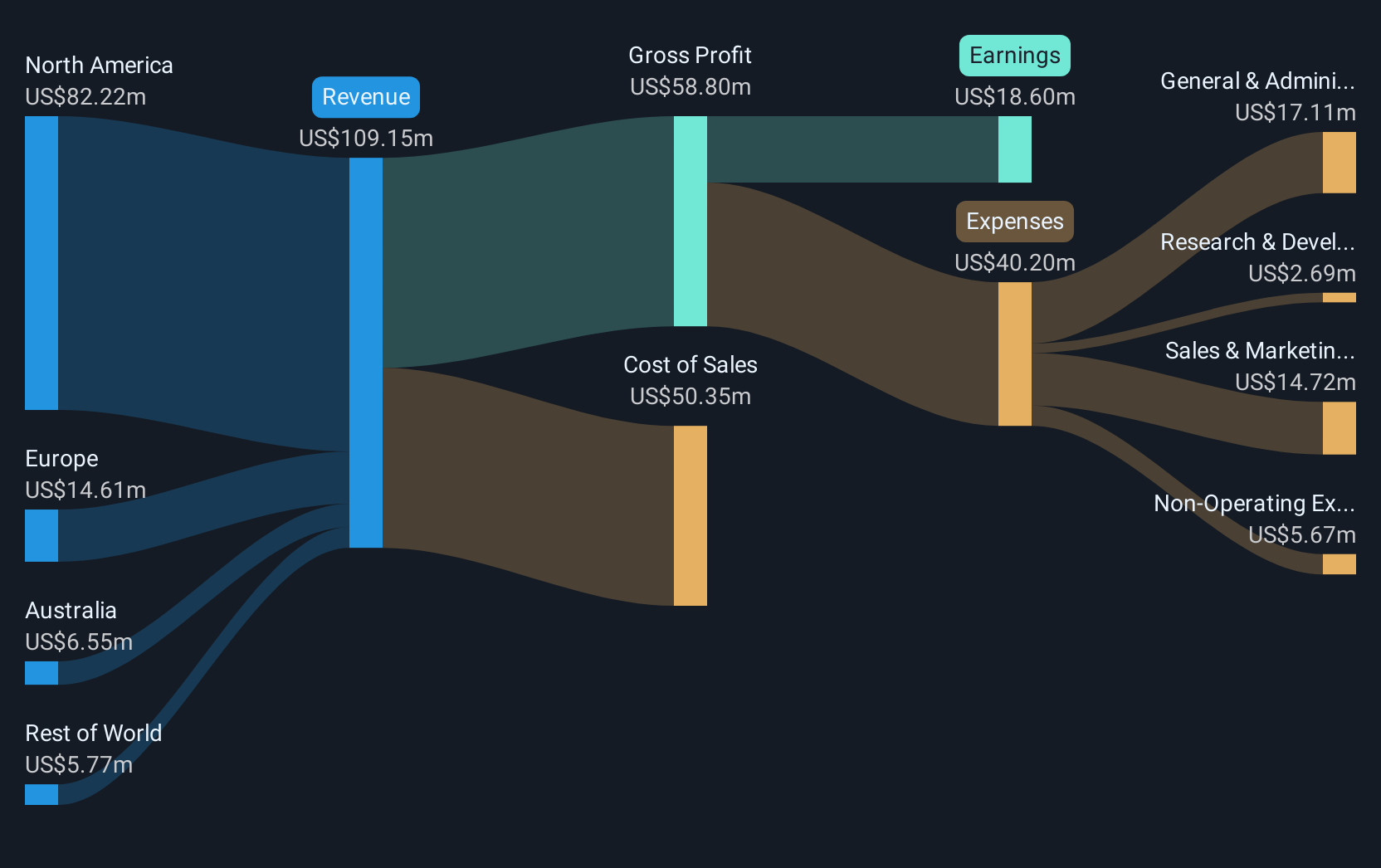

Operations: The company's revenue is primarily generated from its Construction Machinery & Equipment segment, totaling $109.15 million.

Market Cap: £123.77M

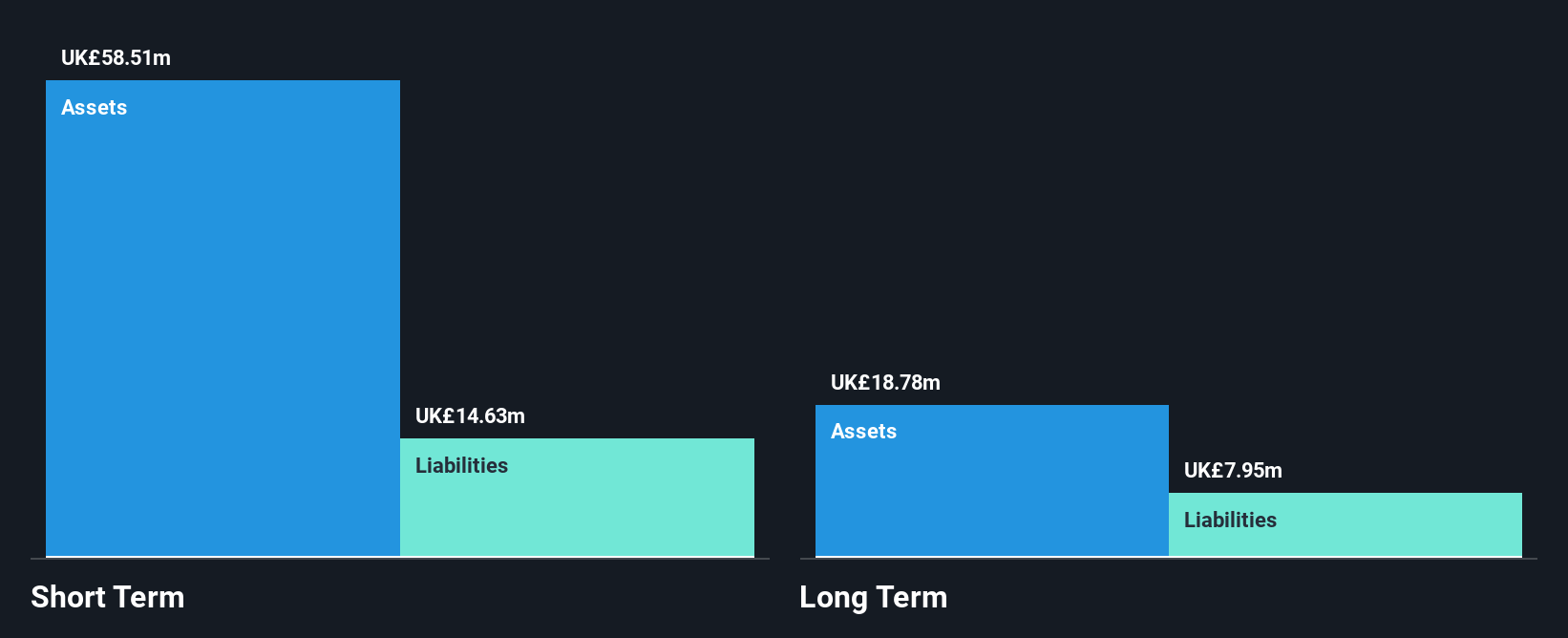

Somero Enterprises, Inc., with a market cap of £123.77 million, operates debt-free and demonstrates strong financial health, as its short-term assets of US$61.4 million comfortably cover both short and long-term liabilities. Despite a high return on equity at 22.1%, recent challenges include a lowered revenue forecast for 2025 to US$90 million from an initial US$105 million, coupled with negative earnings growth over the past year. The company offers high-quality earnings and has not diluted shareholders recently; however, its profit margins have declined from last year’s figures, reflecting potential volatility in profitability amidst industry headwinds.

- Click here to discover the nuances of Somero Enterprises with our detailed analytical financial health report.

- Explore historical data to track Somero Enterprises' performance over time in our past results report.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the UK, Ireland, and several Nordic countries, with a market cap of £1.21 billion.

Operations: The company generates revenue from its operations in the UK & Ireland, which amount to £5.35 billion, and the Nordics, contributing £3.42 billion.

Market Cap: £1.21B

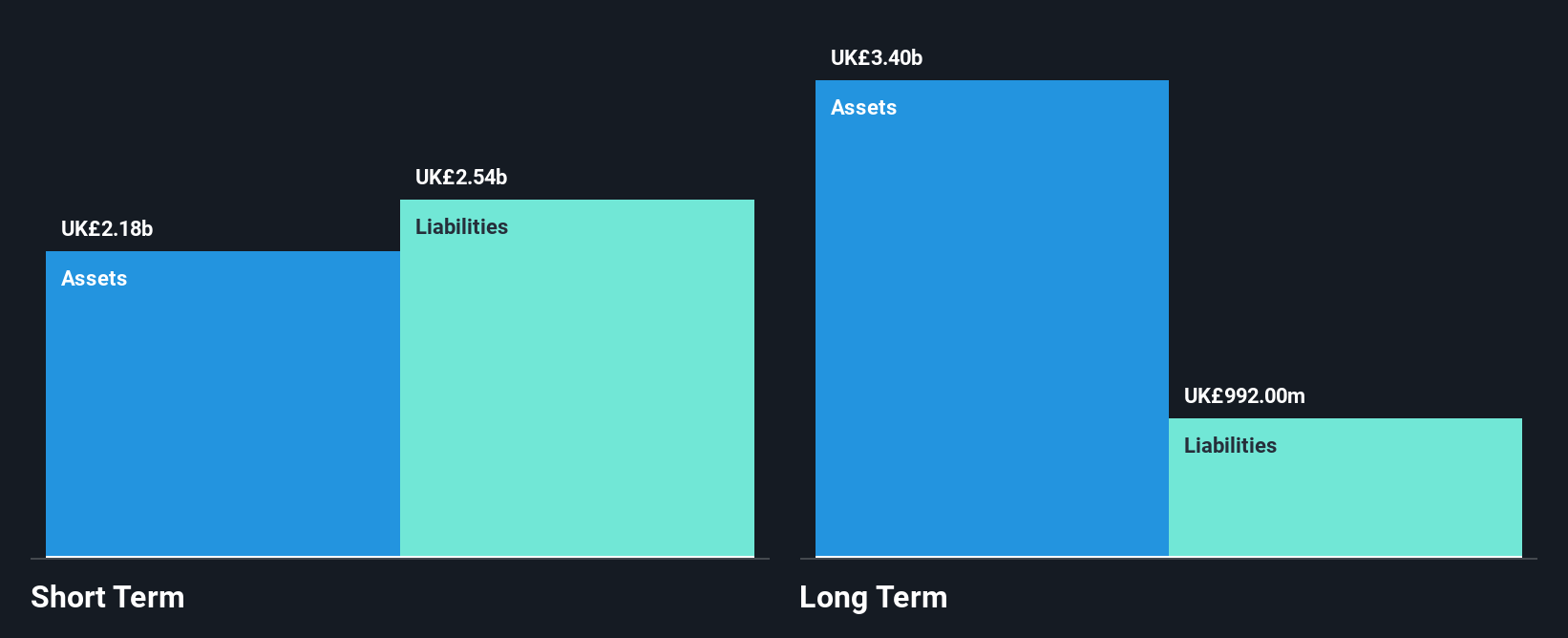

Currys plc, with a market cap of £1.21 billion, shows a mixed financial profile. It has stable weekly volatility and trades below UK market price-to-earnings ratios, suggesting potential value. Despite impressive earnings growth of 286.2% over the past year and reduced debt levels, its short-term assets (£1.9 billion) fall short of covering liabilities (£2.2 billion). The company’s interest payments are not well covered by EBIT (2.9x), but operating cash flow covers debt robustly at 1812%. Recent board changes include appointing Elaine Bucknor as a non-executive director, enhancing technology leadership amidst ongoing strategic shifts.

- Dive into the specifics of Currys here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Currys' future.

Key Takeaways

- Navigate through the entire inventory of 299 UK Penny Stocks here.

- Curious About Other Options? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SOM

Somero Enterprises

Designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives