- United States

- /

- Tech Hardware

- /

- NasdaqGS:STX

Discover DoorDash And 2 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. markets navigate a period of mixed signals, with recent interest rate cuts and record highs in tech-heavy indices like the Nasdaq, investors are keenly observing opportunities that may arise from these fluctuations. In such an environment, identifying stocks that are potentially undervalued can be crucial for those looking to capitalize on market inefficiencies and strategic growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| TowneBank (TOWN) | $32.58 | $64.47 | 49.5% |

| Tenable Holdings (TENB) | $28.64 | $56.63 | 49.4% |

| NeuroPace (NPCE) | $10.13 | $19.72 | 48.6% |

| NBT Bancorp (NBTB) | $39.905 | $78.43 | 49.1% |

| Enovix (ENVX) | $11.77 | $22.82 | 48.4% |

| e.l.f. Beauty (ELF) | $126.99 | $251.46 | 49.5% |

| Eagle Bancorp (EGBN) | $16.66 | $33.24 | 49.9% |

| Compass (COMP) | $7.61 | $15.20 | 49.9% |

| Beacon Financial (BBT) | $23.12 | $44.76 | 48.3% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $19.24 | $38.00 | 49.4% |

Let's uncover some gems from our specialized screener.

DoorDash (DASH)

Overview: DoorDash, Inc. operates a commerce platform that connects merchants, consumers, and independent contractors both in the United States and internationally, with a market cap of $111.68 billion.

Operations: The company's revenue segment includes Internet Information Providers, generating $11.90 billion.

Estimated Discount To Fair Value: 18.2%

DoorDash's stock is trading at US$266.06, below its estimated fair value of US$325.17, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly at 39.4% annually over the next three years, surpassing the broader U.S. market growth rate of 15.7%. Despite recent insider selling and a forecasted low return on equity, DoorDash's strategic partnerships in autonomous delivery and expanding service offerings bolster its future revenue prospects and operational efficiency.

- Our growth report here indicates DoorDash may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in DoorDash's balance sheet health report.

Seagate Technology Holdings (STX)

Overview: Seagate Technology Holdings plc provides data storage technology and infrastructure solutions across Singapore, the United States, the Netherlands, and internationally, with a market cap of $47.72 billion.

Operations: Seagate's revenue segments include data storage technology and infrastructure solutions delivered across various international markets, including Singapore, the United States, and the Netherlands.

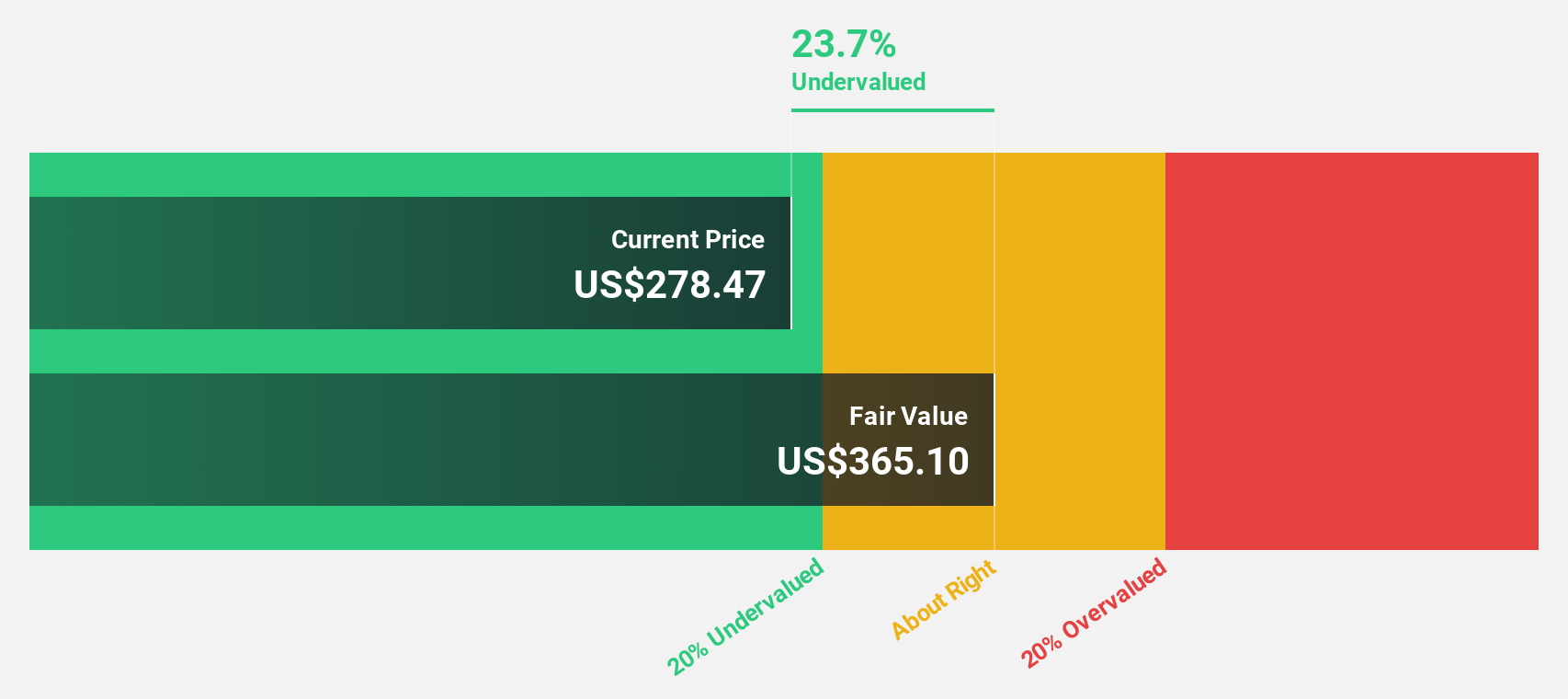

Estimated Discount To Fair Value: 28.5%

Seagate Technology Holdings, trading at US$265.62, is significantly undervalued compared to its estimated fair value of US$371.56, based on discounted cash flow analysis. Despite facing high debt levels and substantial insider selling recently, the company's earnings grew by 102.1% over the past year and are forecasted to outpace the U.S. market with a 19.1% annual growth rate. Recent earnings reports show strong financial performance with net income rising to US$549 million from US$305 million year-on-year.

- Upon reviewing our latest growth report, Seagate Technology Holdings' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Seagate Technology Holdings with our detailed financial health report.

Amer Sports (AS)

Overview: Amer Sports, Inc. is a company that designs, manufactures, markets, distributes, and sells sports equipment, apparel, footwear, and accessories across various regions including Europe, the Middle East, Africa, the Americas, Mainland China, Hong Kong, Macau, Taiwan and the Asia Pacific with a market cap of $18.20 billion.

Operations: The company's revenue segments include Technical Apparel at $2.44 billion, Outdoor Performance at $2.04 billion, and Ball & Racquet Sports at $1.22 billion.

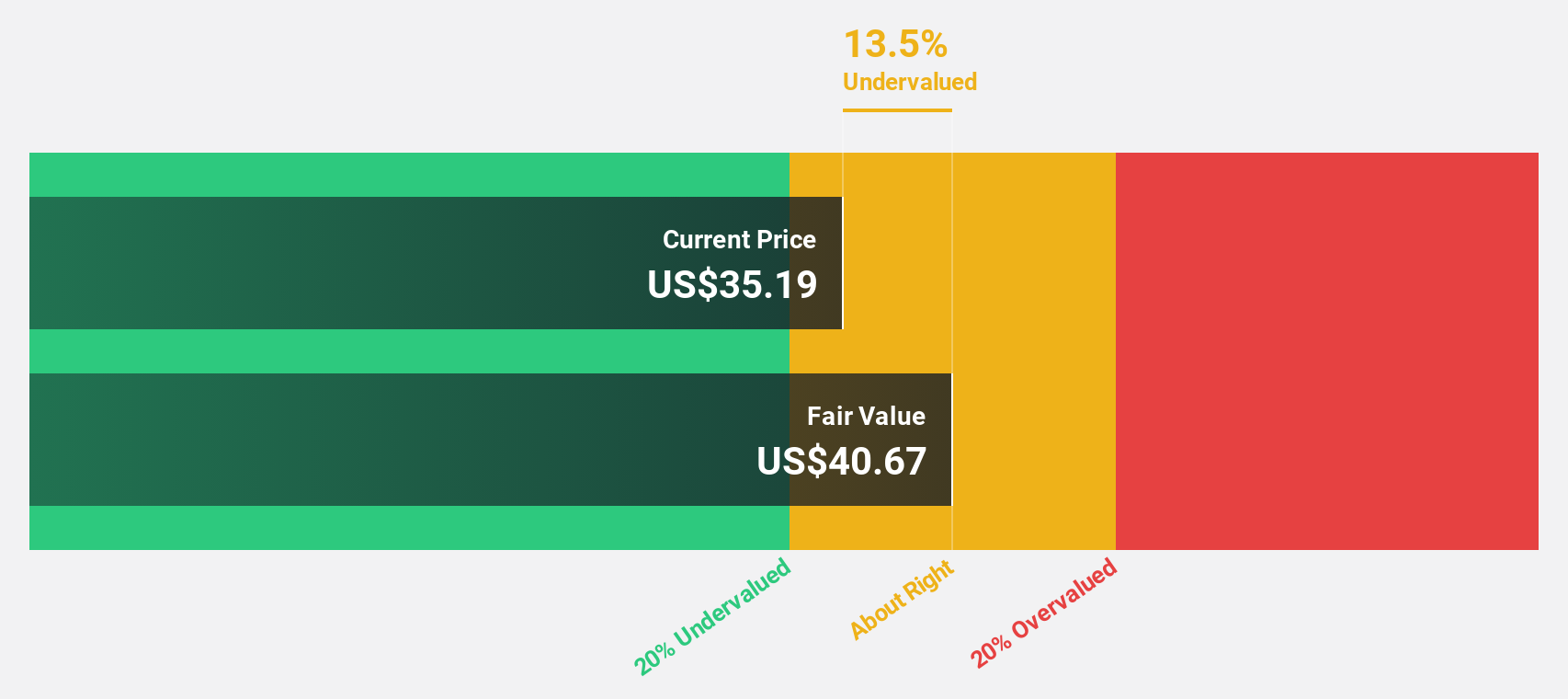

Estimated Discount To Fair Value: 21.1%

Amer Sports, trading at US$32.14, appears undervalued with a fair value estimate of US$40.74 based on discounted cash flow analysis. Despite recent significant insider selling, the company has turned profitable this year and forecasts robust earnings growth of 29.7% annually over the next three years, surpassing market averages. Recent guidance revisions indicate strong revenue growth expectations in the high 20s percentage for Q3 2025 and annual revenue growth between 20-21%.

- The growth report we've compiled suggests that Amer Sports' future prospects could be on the up.

- Navigate through the intricacies of Amer Sports with our comprehensive financial health report here.

Seize The Opportunity

- Click this link to deep-dive into the 179 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STX

Seagate Technology Holdings

Engages in the provision of data storage technology and infrastructure solutions in Singapore, the United States, the Netherlands, and internationally.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives