- United States

- /

- Banks

- /

- NasdaqCM:FLIC

Did You Manage To Avoid First of Long Island's (NASDAQ:FLIC) 45% Share Price Drop?

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. Unfortunately, that's been the case for longer term The First of Long Island Corporation (NASDAQ:FLIC) shareholders, since the share price is down 45% in the last three years, falling well short of the market return of around 10%. And more recent buyers are having a tough time too, with a drop of 37% in the last year. Furthermore, it's down 41% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 24% in the same period.

View our latest analysis for First of Long Island

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, First of Long Island actually managed to grow EPS by 7.6% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. We like that First of Long Island has actually grown its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

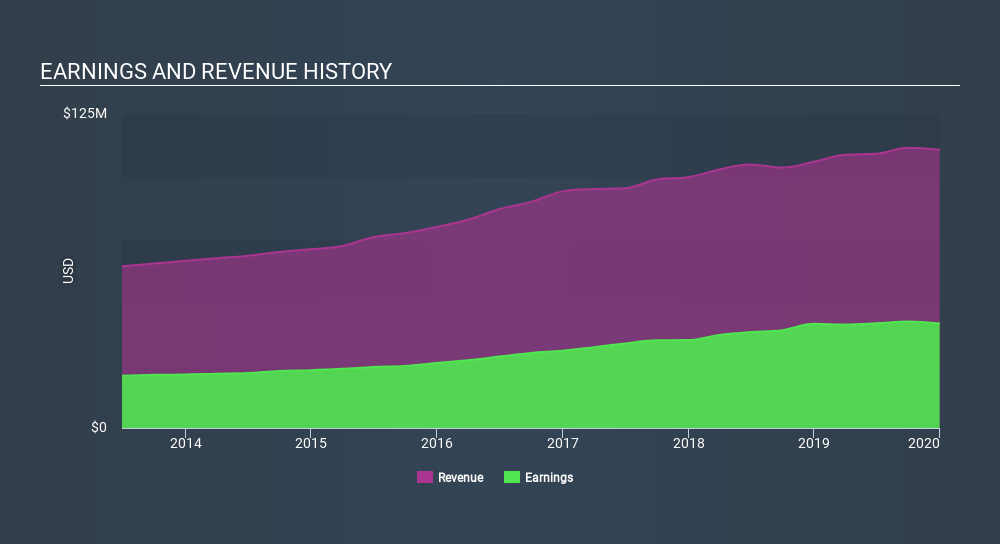

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for First of Long Island in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, First of Long Island's TSR for the last 3 years was -40%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that First of Long Island shareholders are down 34% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 14%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.0% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with First of Long Island , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:FLIC

First of Long Island

Operates as a bank holding company for The First National Bank of Long Island that provides financial services to small and medium market businesses, professional service firms, not-for-profits, municipalities, and consumers in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives