- United States

- /

- Entertainment

- /

- NYSEAM:TOON

Did Changing Sentiment Drive Genius Brands International's (NASDAQ:GNUS) Share Price Down A Painful 84%?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Genius Brands International, Inc. (NASDAQ:GNUS) for five whole years - as the share price tanked 84%. We also note that the stock has performed poorly over the last year, with the share price down 37%. The falls have accelerated recently, with the share price down 30% in the last three months.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Genius Brands International

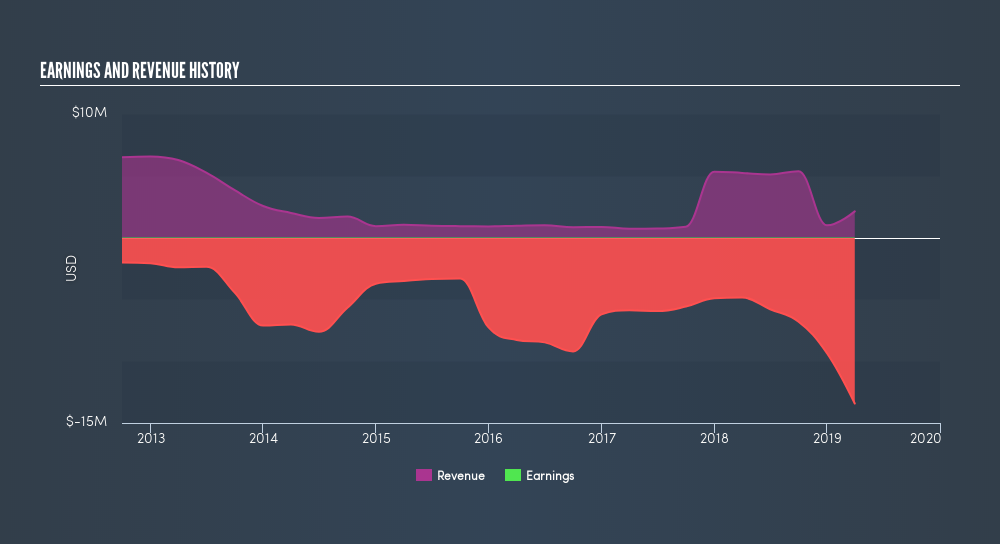

Given that Genius Brands International didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Genius Brands International saw its revenue increase by 27% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 31% each year, in the same time period. It could be that the stock was over-hyped before. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So it makes a lot of sense to check out what analysts think Genius Brands International will earn in the future (free profit forecasts).

A Different Perspective

While the broader market gained around 7.6% in the last year, Genius Brands International shareholders lost 37%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 31% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:TOON

Kartoon Studios

A content and brand management company, creates, produces, licenses, and broadcasts educational and multimedia animated content for children in the United States, Canada, the United Kingdom, and internationally.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives