- United States

- /

- Metals and Mining

- /

- NYSE:CMP

Did Changing Sentiment Drive Compass Minerals International's (NYSE:CMP) Share Price Down By 45%?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Compass Minerals International, Inc. (NYSE:CMP), since the last five years saw the share price fall 45%. Furthermore, it's down 10% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for Compass Minerals International

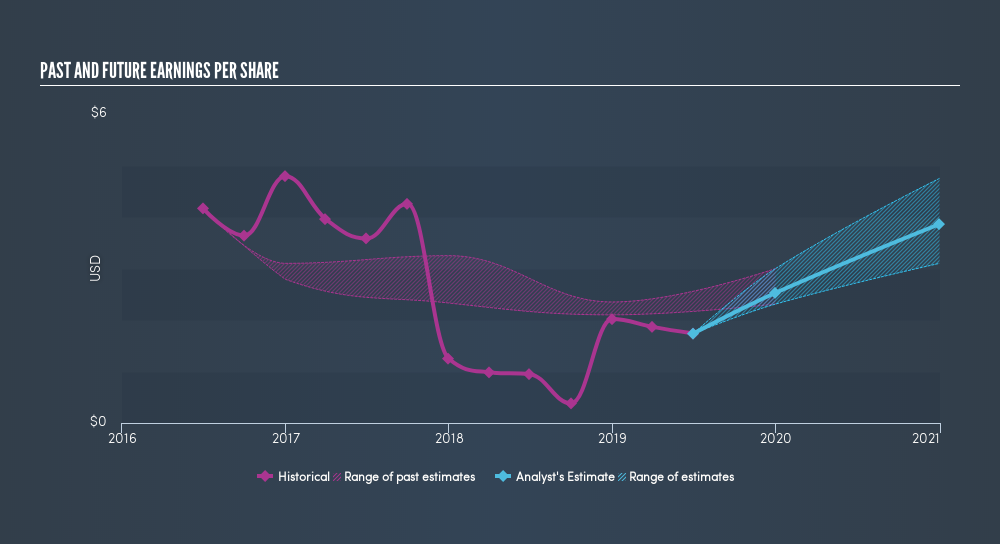

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Compass Minerals International's earnings per share (EPS) dropped by 14% each year. This fall in the EPS is worse than the 11% compound annual share price fall. The relatively muted share price reaction might be because the market expects the business to turn around.

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Compass Minerals International's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Compass Minerals International's TSR for the last 5 years was -33%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Compass Minerals International shareholders are down 16% for the year (even including dividends), but the market itself is up 0.5%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7.8% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Compass Minerals International by clicking this link.

Compass Minerals International is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:CMP

Compass Minerals International

Provides essential minerals in the United States, Canada, the United Kingdom, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives