- United States

- /

- Machinery

- /

- NYSE:DE

Deere (NYSE:DE) Board Declares Quarterly US$1.62 Dividend Payable August 2025

Reviewed by Simply Wall St

Deere (NYSE:DE) recently declared a quarterly dividend of $1.62 per share, indicating a firm commitment to shareholder returns. Over the past month, Deere's stock price moved 10.38%, reflecting, in part, the company's fiscal position. The declaration of the dividend might have added weight to this movement, while the release of Deere's earnings report, which showed declines in sales and net income, potentially countered it. As the S&P 500 also experienced gains, influenced by strong sector performances and broader economic factors, Deere's stock move aligns with broader positive market trends.

We've discovered 1 risk for Deere that you should be aware of before investing here.

Deere's recent dividend declaration signals a robust commitment to enhancing shareholder value, contrasting with the company's recent earnings report that showcased declines in sales and net income. Over the long-term, Deere has achieved a total shareholder return, including dividends, of 242.88% over the past five years. This considerable return reflects the company's ability to maintain value for its investors despite recent challenges.

In comparison, Deere's recent performance has seen it outperform the US Machinery industry over the last year, which returned 7.3%, indicating resilience even amidst sector-specific challenges. The recent share price movement, with a 10.38% increase, narrows its discount to consensus analyst price targets, suggesting that current market enthusiasm aligns closely with analyst expectations.

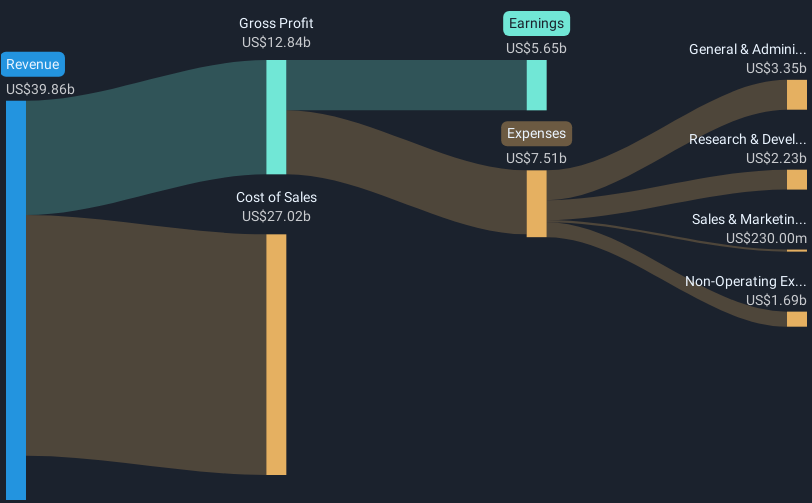

The news of Deere's strategic initiatives, like cost management and inventory adjustments, potentially impacts revenue and earnings forecasts. While revenues are forecasted to undergo a moderate annual decline of 0.5% over the next three years, earnings are expected to rise 12.3% per year. The adoption of precision agriculture technology, especially in Brazil, is anticipated to enhance these figures. The current share price of US$475.3 reflects a modest 3% discrepancy to the analyst price target of US$489.89, implying confidence in Deere's strategic responses to market conditions.

Jump into the full analysis health report here for a deeper understanding of Deere.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DE

Deere

Engages in the manufacture and distribution of various equipment worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives