- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding (NasdaqGS:CRDO) Anticipates Fiscal Year 2026 Revenue Surpassing US$800M

Reviewed by Simply Wall St

Credo Technology Group Holding (NasdaqGS:CRDO) experienced a significant stock price increase of 54% over the last quarter, buoyed by a strong set of financial results and corporate guidance. The company recently announced its fiscal year 2026 revenue is expected to surpass $800 million, with its latest quarterly report showing a significant improvement in both revenue and profits. These developments likely resonated positively with investors, reflecting confidence in Credo's growth trajectory. Additionally, the launch of their innovative PILOT platform may have further strengthened market sentiment. Despite the broader market's flat performance over the past week, Credo’s advancements added weight to the positive trends observed over the past year.

You should learn about the 2 weaknesses we've spotted with Credo Technology Group Holding.

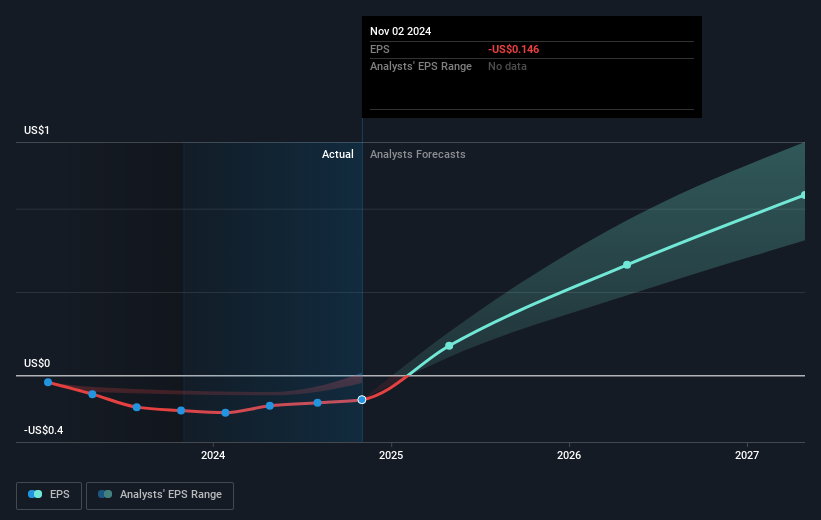

The recent developments at Credo Technology Group Holding are poised to reinforce the company's growth narrative. The introduction of the PILOT platform and optimism regarding fiscal year 2026 revenue expectations contribute to a positive outlook for revenue streams, potentially enhancing future earnings forecasts. The company's expansion into PCIe products and focus on optical DSP offer opportunities to capture a broader market, supporting its long-term growth trajectory. However, dependency on a single customer could present risks, necessitating vigilance in monitoring changes in revenue stability.

Over the past three years, Credo’s total shareholder return, including share price and dividends, surged by a very large 426.89%. This remarkable performance contrasts with the broader market and industry levels; specifically, over the past year, Credo outpaced the US Semiconductor industry's 11.7% return and the overall market's 12.6% return. While impressive, this level of volatility indicates the importance of cautious optimism when interpreting future prospects.

With the current share price positioned at US$43.21, it remains below the analyst consensus price target of US$67.47 by around 36.0%. This underscores investor expectations tied to future revenue and earnings expansion, which are integral for justifying such valuations. The stock's forward movement will likely hinge on Credo’s ability to deliver on its growth potential and mitigate any risks associated with client concentration. As such, investors should continuously evaluate these forecasts in relation to actual performance and market conditions.

Learn about Credo Technology Group Holding's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity Credo Technology Group Holding Ltd provides various high-speed connectivity solutions for optical and electrical Ethernet applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives