- United States

- /

- Electric Utilities

- /

- NasdaqGS:CEG

Constellation Energy (NasdaqGS:CEG) Secures 20-Year Clean Energy Deal With Meta

Reviewed by Simply Wall St

Constellation Energy (NasdaqGS:CEG) experienced a significant price move of 37% over the last quarter, primarily influenced by its recent partnership with Meta. This 20-year Power Purchase Agreement enhances the company's clean energy output at the Clinton Clean Energy Center and secures long-term operational sustainability, crucial both economically and environmentally. Supporting this, Constellation’s Q1 earnings showed sales growth, although net income declined. These developments have been broadly aligned with the market's upward trend, which has risen by 12% over the last year. While broader market movements provided some foundation, new agreements like these underscore the company's expansion efforts.

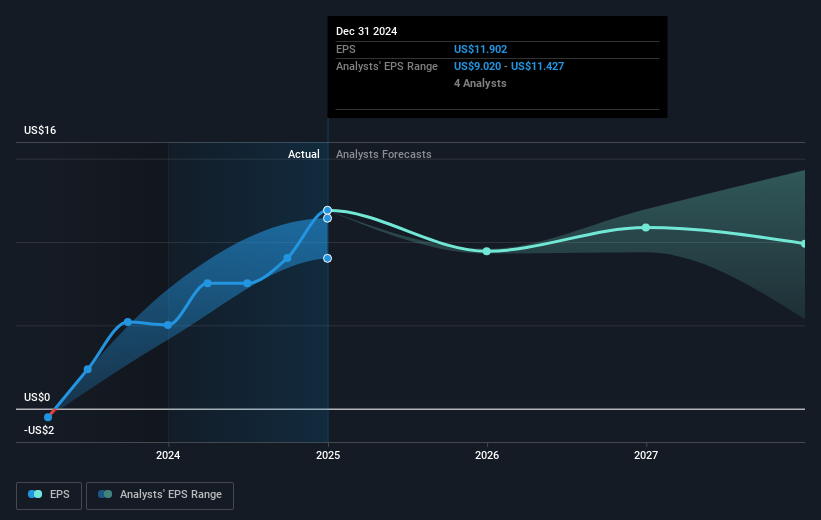

The recent partnership with Meta and the Power Purchase Agreement at the Clinton Clean Energy Center could significantly bolster Constellation Energy's revenue and earnings forecasts. By enhancing clean energy output, Constellation not only secures long-term operational sustainability but also positions itself advantageously in the growing demand for AI-driven data centers. Analysts' forecasts already reflect similar insights with a future earnings growth projection to US$3.3 billion by 2028, a substantial increase from current levels, despite a slight anticipated annual revenue decline.

Constellation Energy's total shareholder return over the past three years, a robust 383.17%, outpaces the performance of many peers within the industry. This historical performance underscores the company’s capacity to generate value for its investors over a significant time horizon. However, when evaluating the company's performance against the market in the past year, Constellation’s growth aligns with broader market movements, which rose by 12%.

Currently, Constellation's share price is US$273.82, slightly below the consensus analyst price target of US$280.74. This suggests a modest upside potential of about 2.5%, according to analysts. The company's strategic moves, coupled with growth prospects, continue to sustain investor interest, but potential short-term volatility and execution risks remain considerations. Investors should weigh these factors carefully, considering their assumptions and expectations against forecasts.

Learn about Constellation Energy's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CEG

Constellation Energy

Produces and sells energy products and services in the United States.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives