- United States

- /

- Software

- /

- NYSE:YOU

Clear Secure (YOU) Partners With Nordic To Enhance Healthcare Information Security

Reviewed by Simply Wall St

Clear Secure (YOU) recently announced a partnership with Nordic, enhancing healthcare information security and access for patients and providers, alongside a 29% share price increase over the last quarter. This upswing could align with such significant partnerships and the integration with Epic, signaling strong expansion efforts. Additionally, the company's share buyback program and improved Q2 financial results may have reinforced investor confidence. While the broader market also rose, with the S&P 500 and Nasdaq hitting all-time highs amid inflation data, Clear Secure's specific initiatives likely added significant weight to its substantial quarterly gains.

We've identified 2 warning signs for Clear Secure (1 is significant) that you should be aware of.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

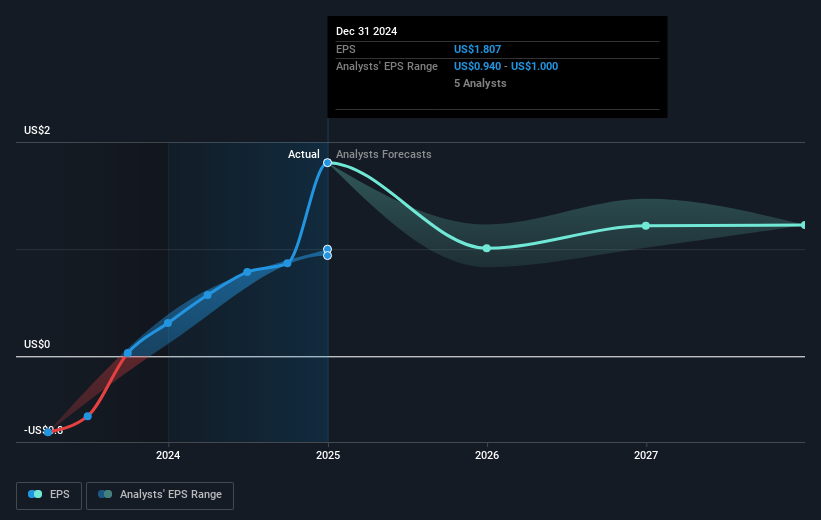

The recent partnership news and ensuing share price rise of 29% over the last quarter signify Clear Secure's strategic positioning in healthcare information security, potentially enhancing revenue streams and enterprise value. This partnership, alongside integration with Epic, highlights Clear's expansion ambitions amid a challenging landscape of regulatory and privacy risks. The announced share buyback and improved Q2 earnings may have bolstered investor sentiment, aligning with analysts' expectations for potential revenue growth in the coming years, though these are balanced by forecasted margin pressures and earnings decline to $144.1 million by 2028.

Over the past year, Clear Secure achieved a total shareholder return of 26.30% despite broader market trends. This performance surpasses the US market’s annual return of 19.4%, yet lags behind the US Software industry’s 32% return. Currently, the company's share price of $32.11 remains slightly below the $34.00 analyst price target, suggesting a modest 5.89% upside potential from current levels. The combination of market optimism and strategic initiatives appear to provide a basis for analyst consensus, though investors are advised to closely evaluate the implications of evolving digital identity landscape dynamics on future financial outcomes.

Explore Clear Secure's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YOU

Clear Secure

Operates a secure identity platform under the CLEAR brand name primarily in the United States.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives