- United States

- /

- Banks

- /

- NYSE:C

Citigroup (NYSE:C) Enhances Global Payment Solutions And Redeems €2 Billion Notes

Reviewed by Simply Wall St

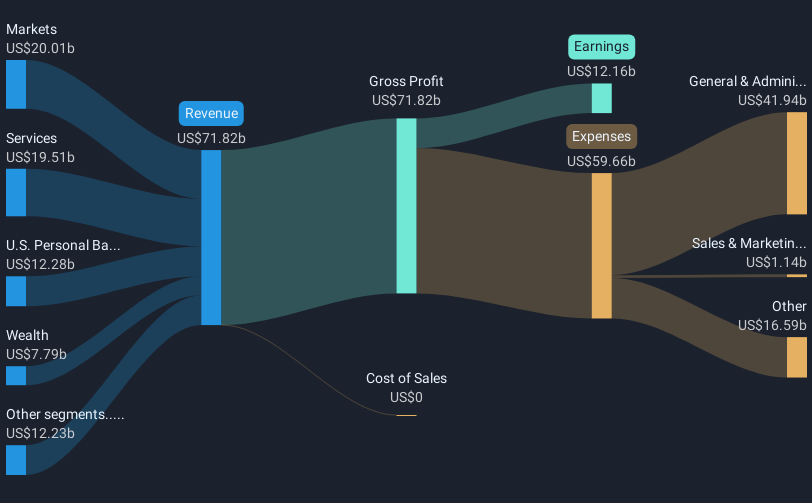

Citigroup (NYSE:C) recently announced a partnership with Papaya Global to enhance workforce payment solutions and the redemption of €1.75 billion in notes as part of its capital management strategy. During the last quarter, the company's stock price increased by 20%, aligning with market trends. This rise coincided with its inclusion in several Russell indices, highlighting investor confidence. Further bolstered by strong Q1 earnings and significant leadership changes, these developments likely complemented general market gains amidst ongoing U.S. economic and policy-related updates, reflecting the company's commitment to financial efficiency and global operational expansion.

Buy, Hold or Sell Citigroup? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent developments announced by Citigroup, particularly the partnership with Papaya Global and the redemption of €1.75 billion in notes, have the potential to significantly influence the company's narrative. These initiatives align with its focus on enhancing operational efficiency and global expansion. By integrating advanced payment solutions, Citigroup's bid to boost client experience may also support noninterest revenue growth, a key element in its strategic wealth management focus. This could provide a temporary boost to revenue and earnings forecasts as the company leverages technological advancements and efficient capital management to improve profitability.

Over a longer-term period of three years, Citigroup's total shareholder return reached 108.25%, indicating a very large appreciation when including both share price increases and dividends. This growth is noteworthy compared to its recent one-year performance, where Citigroup outperformed the US Banks industry, which returned 27.4% over the past year. This context highlights Citigroup's enduring strength and potential in navigating volatile market conditions.

The stock's recent price movement, which included a 20% increase during the last quarter, positions it close to the consensus analyst price target of US$87.38, with only a minor discount remaining. This indicates that the market may be pricing in some expectations of revenue and earnings improvements but could still offer upside if the company achieves its ambitious AI and wealth management goals. However, the macroeconomic and regulatory uncertainties remain potential challenges to sustaining such growth trajectories.

Gain insights into Citigroup's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:C

Citigroup

A diversified financial service holding company, provides various financial product and services to consumers, corporations, governments, and institutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives