- United States

- /

- Specialty Stores

- /

- NYSE:CVNA

Carvana (NYSE:CVNA) Reports Remarkable First-Quarter Earnings Growth

Reviewed by Simply Wall St

Carvana (NYSE:CVNA) has been making significant advancements in its business operations, including the recent launch of same-day vehicle delivery in Denver and the establishment of an Inspection and Reconditioning Center in Nashville. These strategic expansions, aimed at enhancing customer convenience and operational capacity, coincide with a substantial quarterly share price increase of 64%. During the same period, Carvana reported remarkable first-quarter earnings growth, which further aligns with the positive market sentiment despite the market remaining largely flat in recent days. These developments underscore the company's commitment to improving service delivery and its adaptability to market demands.

Carvana has 4 risks (and 1 which is significant) we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The introduction of same-day vehicle delivery in Denver and the new Inspection and Reconditioning Center in Nashville could have a significant influence on Carvana's operational efficiency and customer satisfaction. These advancements, coinciding with a significant share price jump, align with the company's aim to enhance service delivery. Over the last three years, Carvana's total return, including share price and dividends, increased by a notably large percentage, showcasing the company's substantial growth, even as the annual industry return was lower.

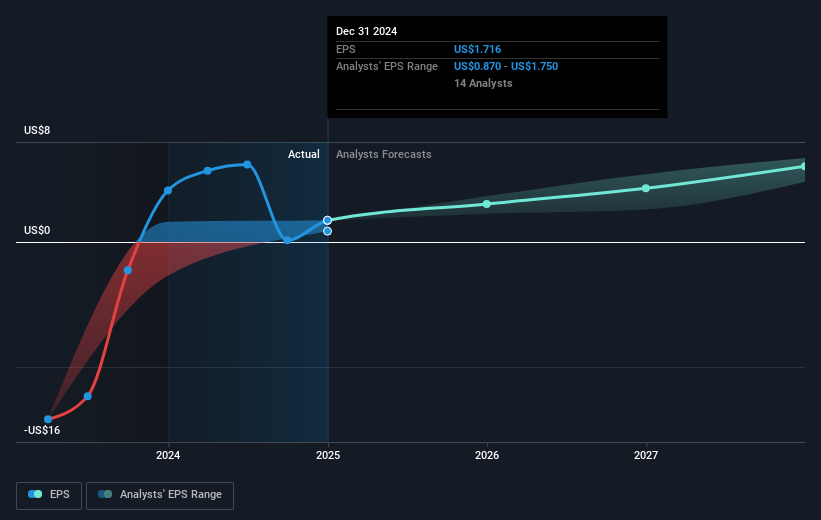

In the past year, Carvana outperformed both the US Specialty Retail industry and the broader market, with returns surpassing industry averages. This differentiation highlights Carvana's capacity to generate notable shareholder value amidst broader market conditions. The news mentioned may further bolster revenue and earnings forecasts as expansion and technology adoption are expected to foster sales growth and improved margins. With the share price closely aligning with the analyst consensus price target of $259.81, the market shows confidence in Carvana's capacity to meet these targets, considering both their ambitious growth strategies and potential risks. However, balancing debt levels and operational scaling remains crucial as the company navigates its path forward.

Understand Carvana's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CVNA

Carvana

Operates an e-commerce platform for buying and selling used cars in the United States.

High growth potential slight.

Similar Companies

Market Insights

Community Narratives