BRP (TSX:DOO) Completes Follow-on Equity Offering Raising C$136 Million

Reviewed by Simply Wall St

BRP (TSX:DOO) saw its share price increase by 38% last quarter, an impressive feat amidst a mixed broader market backdrop. The company's completion of a Follow-on Equity Offering raised CAD 136 million, potentially bolstering investor confidence. This capital influx coincided with a surge in net income and continued dividend payments, aligning with overall market trends that highlighted robust corporate performances. Meanwhile, BRP's focus on electric vehicles, including new product launches, echoed the tech sector's upbeat momentum led by companies like Tesla. Although the broader market trend was upward, BRP's strategic financial moves arguably added additional weight to its positive share price performance.

The recent 38% increase in BRP's share price reflects investor optimism, likely bolstered by the CAD 136 million capital influx from the Follow-on Equity Offering. Over a five-year span, the company's total shareholder return, including dividends, was 37.04%. Compared to the Canadian Leisure industry's negative 8.1% return over the past year, BRP's performance stands out despite its underperformance against the broader Canadian market's 22.2% return.

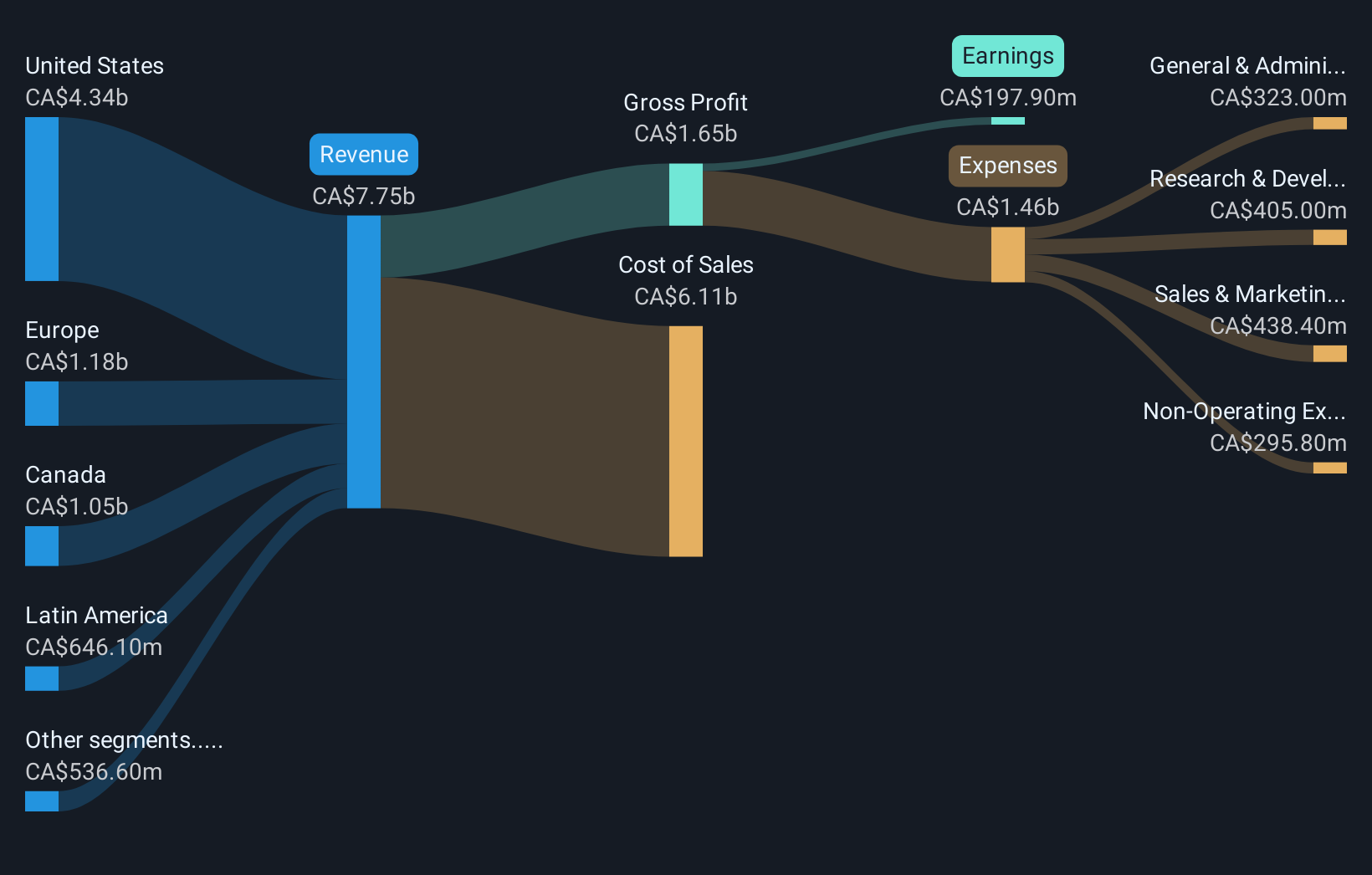

Given BRP's emphasis on electric vehicles and international expansion, the recent developments may further enhance revenue and earnings forecasts. Analysts project a 5.4% annual revenue growth and an impressive 22.1% annual earnings increase over the next few years, which is relatively robust compared to the wider market. With a current share price of CA$89.98 and an analyst consensus price target of CA$98.75, the modest 9.7% discount suggests that positive developments reflect ongoing confidence, supported by efficient inventory practices and technology-driven aftermarket services. However, uncertainties related to macroeconomic pressures and industry cycles could influence these projections.

Our expertly prepared valuation report BRP implies its share price may be lower than expected.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOO

BRP

Designs, develops, manufactures, and sells powersports vehicles and marine products in the Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives