- United States

- /

- Biotech

- /

- NasdaqGS:BNTX

BioNTech (NasdaqGS:BNTX) Enters Global Co-Development Agreement With Bristol Myers Squibb

Reviewed by Simply Wall St

BioNTech (NasdaqGS:BNTX) has seen a significant price movement in the past week, with its stock rising by 15%, compared to a 2% increase in the broader market. The recent co-development and co-commercialization agreement between BioNTech and Bristol Myers Squibb for the bispecific antibody BNT327 may have supported this upswing. Additionally, the anticipation surrounding BioNTech’s presentations at the ASCO Annual Meeting, showcasing promising clinical trial data, possibly added weight to the positive sentiment. While the market has performed well, these focused developments in BioNTech's oncology pipeline likely provided an additional boost.

Buy, Hold or Sell BioNTech? View our complete analysis and fair value estimate and you decide.

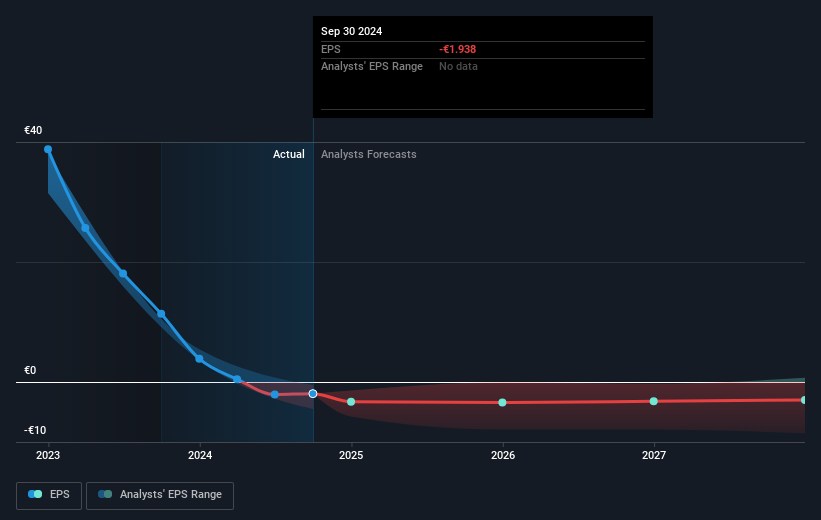

The co-development agreement between BioNTech and Bristol Myers Squibb for the bispecific antibody BNT327, alongside BioNTech's presentations at the ASCO Annual Meeting, could significantly impact its revenue and earnings forecasts. The collaboration and new clinical data may enhance BioNTech’s oncology portfolio, potentially driving revenue growth from innovative treatments and first-in-class approvals. Despite this, high R&D expenses and dependency on COVID-19 vaccine sales remain critical risks that could affect financial stability if not offset by new product launches.

Over a five-year period, BioNTech has achieved a total return of 134.10%, indicating strong longer-term appreciation. This contrasts with the past year's performance, where the company outperformed the US Biotech industry, which experienced a decline of 13.1%. Despite this favorable long-term total return, the current share price, having climbed 15% recently, still falls short of analyst price targets, suggesting a potential growth opportunity if analyst expectations for the stock materialize.

The valuation report we've compiled suggests that BioNTech's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioNTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BNTX

BioNTech

A biotechnology company, develops and commercializes immunotherapies to treat cancer and infectious diseases in Germany.

Adequate balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives