- Israel

- /

- Real Estate

- /

- TASE:AZRG

Azrieli Group Ltd's (TLV:AZRG) Attractive Combination: Does It Earn A Place In Your Dividend Portfolio?

Could Azrieli Group Ltd (TLV:AZRG) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

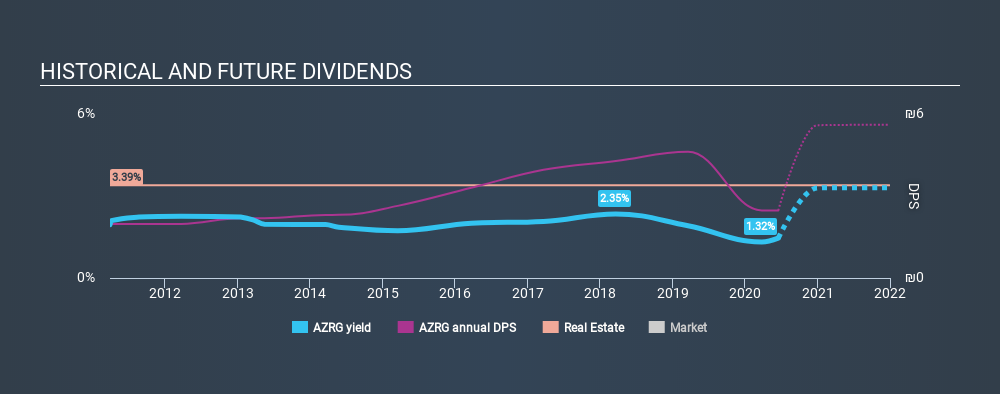

With a 1.5% yield and a nine-year payment history, investors probably think Azrieli Group looks like a reliable dividend stock. A 1.5% yield is not inspiring, but the longer payment history has some appeal. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Azrieli Group!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Azrieli Group paid out 20% of its profit as dividends. Given the low payout ratio, it is hard to envision the dividend coming under threat, barring a catastrophe.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Of the free cash flow it generated last year, Azrieli Group paid out 48% as dividends, suggesting the dividend is affordable. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Is Azrieli Group's Balance Sheet Risky?

As Azrieli Group has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA is a measure of a company's total debt. Net interest cover measures the ability to meet interest payments. Essentially we check that a) the company does not have too much debt, and b) that it can afford to pay the interest. Azrieli Group has net debt of 5.73 times its EBITDA, which implies meaningful risk if interest rates rise of earnings decline.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. Azrieli Group has EBIT of 8.72 times its interest expense, which we think is adequate. Despite a decent level of interest cover, shareholders should remain cautious about the high level of net debt. Rising rates or tighter debt markets have a nasty habit of making fools of highly-indebted dividend stocks.

We update our data on Azrieli Group every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Azrieli Group paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was ₪1.98 in 2011, compared to ₪2.47 last year. Dividends per share have grown at approximately 2.5% per year over this time. The dividends haven't grown at precisely 2.5% every year, but this is a useful way to average out the historical rate of growth.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. It's good to see Azrieli Group has been growing its earnings per share at 15% a year over the past five years. Rapid earnings growth and a low payout ratio suggests this company has been effectively reinvesting in its business. Should that continue, this company could have a bright future.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that Azrieli Group has low and conservative payout ratios. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. All things considered, Azrieli Group looks like a strong prospect. At the right valuation, it could be something special.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Azrieli Group (1 is a bit unpleasant!) that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Azrieli Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TASE:AZRG

Azrieli Group

Operates in the real estate industry primarily in Israel and the United States.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives