- United States

- /

- Software

- /

- NasdaqGS:ADSK

Autodesk (NasdaqGS:ADSK) Welcomes New Board Members Jeff Epstein And Christie Simons

Reviewed by Simply Wall St

Autodesk (NasdaqGS:ADSK) recently appointed Jeff Epstein and A. Christine Simons to its Board of Directors, focusing on governance enhancements. This executive change aligns with the company’s overall strategy as it reported first-quarter results for 2025, with revenue growth of 15% compared to the previous year despite a decline in net income. During this period, geopolitical tensions and oil price fluctuations contributed to overall market volatility, which might have interacted with Autodesk's solid financial positioning. As the company's shares moved up 10% over the last quarter, this mirrored the broader market's annual growth.

Buy, Hold or Sell Autodesk? View our complete analysis and fair value estimate and you decide.

The recent appointment of Jeff Epstein and A. Christine Simons to Autodesk's Board of Directors could significantly influence the company's strategic direction, particularly in terms of governance enhancements. This executive change supports the company's focus on cloud and AI investments, which are critical for expanding its customer ecosystem and driving long-term revenue growth. Over the past three years, Autodesk's total shareholder return, which includes share price appreciation and dividends, was 53.36%, showcasing a robust performance.

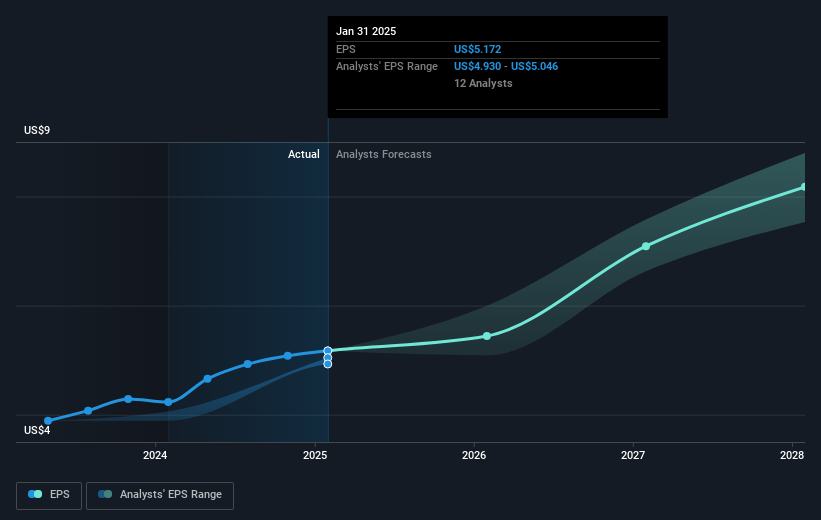

In the past year, Autodesk's shares outperformed the US Software industry, reflecting an upward trend that aligns with the company's ongoing transformation initiatives. The 10% share price increase over the last quarter brings the current share price to US$278.64, establishing a context of positive market response despite broader market volatility. Analysts' consensus price target of US$320.15 is 13% higher than the current price, indicating potential for further appreciation. However, the analysts' projections require Autodesk to maintain high growth in revenues and earnings to justify the price target, with assumptions of annual revenue growth of 11.2% and profit margins increasing to 20.8% in the next three years.

Although economic uncertainties and restructuring initiatives may pose risks to these projections, Autodesk's transition to predictable, recurring revenue streams is expected to support stability and growth. The planned share repurchases further indicate management's confidence in cash generation, potentially boosting earnings per share. This bolsters the company's positioning against market and industry averages, underscoring its competitive edge and growth potential in the dynamic software sector.

Gain insights into Autodesk's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADSK

Autodesk

Provides 3D design, engineering, and entertainment technology solutions worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion