- China

- /

- Electronic Equipment and Components

- /

- SZSE:000970

August 2025's Asian Stock Picks For Estimated Value Opportunities

Reviewed by Simply Wall St

As global trade tensions and economic uncertainties weigh on markets, Asian indices have experienced mixed performances, with China's economy showing signs of slowing growth and Japan's market facing renewed pressure from international developments. In this environment, identifying undervalued stocks in Asia could present potential opportunities for investors seeking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiaocaiyuan International Holding (SEHK:999) | HK$10.27 | HK$20.32 | 49.5% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥157.17 | CN¥311.32 | 49.5% |

| Wuxi Zhenhua Auto PartsLtd (SHSE:605319) | CN¥33.56 | CN¥65.39 | 48.7% |

| NEOWIZ (KOSDAQ:A095660) | ₩26950.00 | ₩52750.47 | 48.9% |

| LigaChem Biosciences (KOSDAQ:A141080) | ₩149100.00 | ₩288985.41 | 48.4% |

| Hibino (TSE:2469) | ¥2440.00 | ¥4729.93 | 48.4% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.80 | NZ$1.58 | 49.5% |

| GEM (SZSE:002340) | CN¥6.53 | CN¥12.93 | 49.5% |

| cottaLTD (TSE:3359) | ¥444.00 | ¥871.79 | 49.1% |

| Andes Technology (TWSE:6533) | NT$277.50 | NT$541.97 | 48.8% |

We're going to check out a few of the best picks from our screener tool.

LigaChem Biosciences (KOSDAQ:A141080)

Overview: LigaChem Biosciences Inc., a clinical stage biopharmaceutical company, focuses on discovering and developing medicines for unmet medical needs and has a market capitalization of approximately ₩5.41 trillion.

Operations: The company's revenue is primarily derived from its Pharmaceutical Business segment, which generated approximately ₩20.86 billion, and its New Drug Research and Development segment, contributing around ₩125.56 billion.

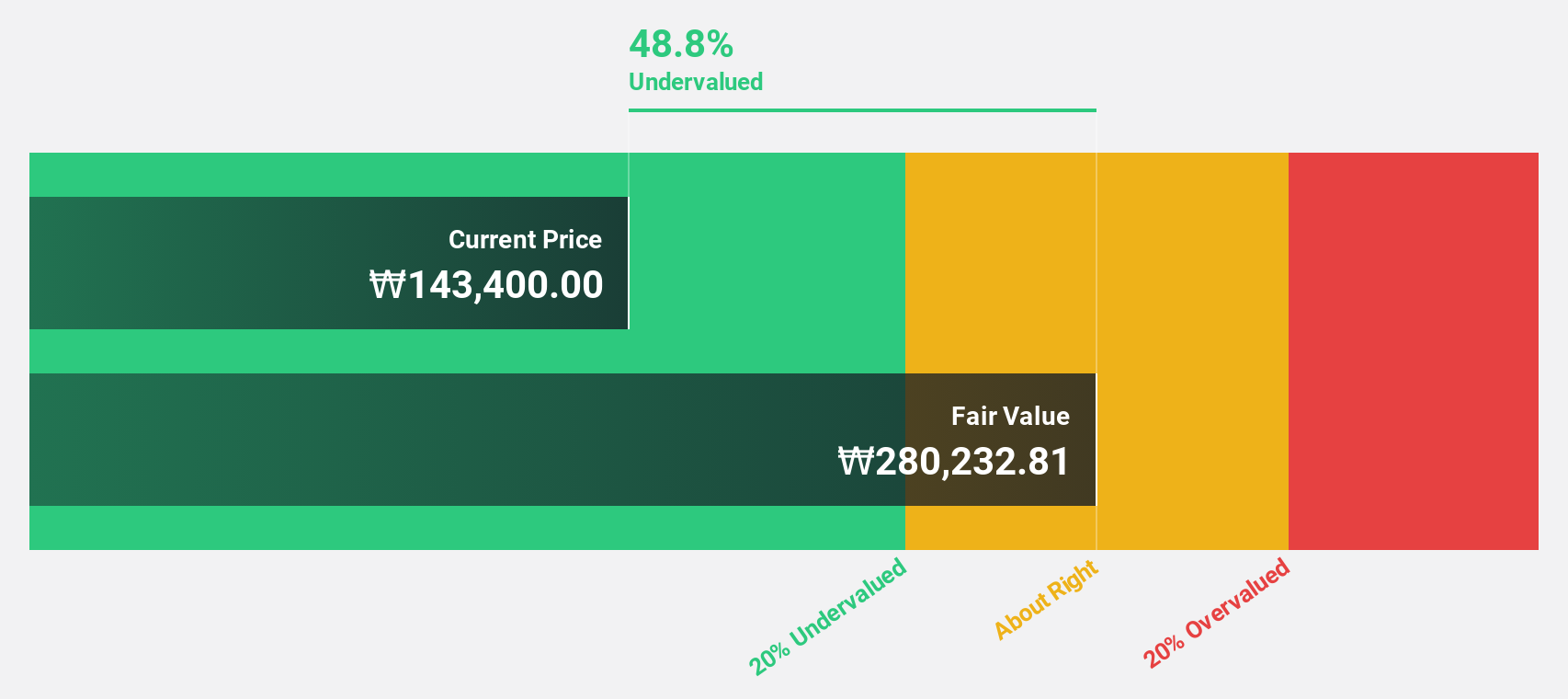

Estimated Discount To Fair Value: 48.4%

LigaChem Biosciences is trading at ₩149,100, significantly below its estimated fair value of ₩288,985.41. Despite recent share price volatility and low forecasted return on equity (7.4%), the company has become profitable this year with earnings expected to grow 50.5% annually, outpacing the KR market's 22.2%. Recent developments include a completed share buyback and ongoing Phase 1 trials for LNCB74 targeting advanced solid tumors, highlighting potential growth avenues amid robust cash flow prospects.

- Upon reviewing our latest growth report, LigaChem Biosciences' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in LigaChem Biosciences' balance sheet health report.

Beijing Zhong Ke San Huan High-Tech (SZSE:000970)

Overview: Beijing Zhong Ke San Huan High-Tech Co., Ltd. operates in the high-tech sector, focusing on the production and development of advanced magnetic materials, with a market cap of CN¥16.90 billion.

Operations: Beijing Zhong Ke San Huan High-Tech Co., Ltd. generates its revenue primarily from the production and development of advanced magnetic materials.

Estimated Discount To Fair Value: 25.1%

Beijing Zhong Ke San Huan High-Tech is currently trading at CNY 14.04, well below its estimated fair value of CNY 18.75. The company reported a turnaround with net income of CNY 43.99 million for the first half of 2025, compared to a loss last year, indicating improved financial health despite recent sales decline. Earnings are forecasted to grow significantly at 46.8% annually over the next three years, surpassing market averages and suggesting strong cash flow potential amidst low return on equity forecasts.

- The analysis detailed in our Beijing Zhong Ke San Huan High-Tech growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Beijing Zhong Ke San Huan High-Tech.

Silergy (TWSE:6415)

Overview: Silergy Corp. designs, manufactures, and sells integrated circuit products and related technical services in China and internationally, with a market cap of NT$129.60 billion.

Operations: The company's revenue is primarily derived from its semiconductors segment, which generated NT$18.71 billion.

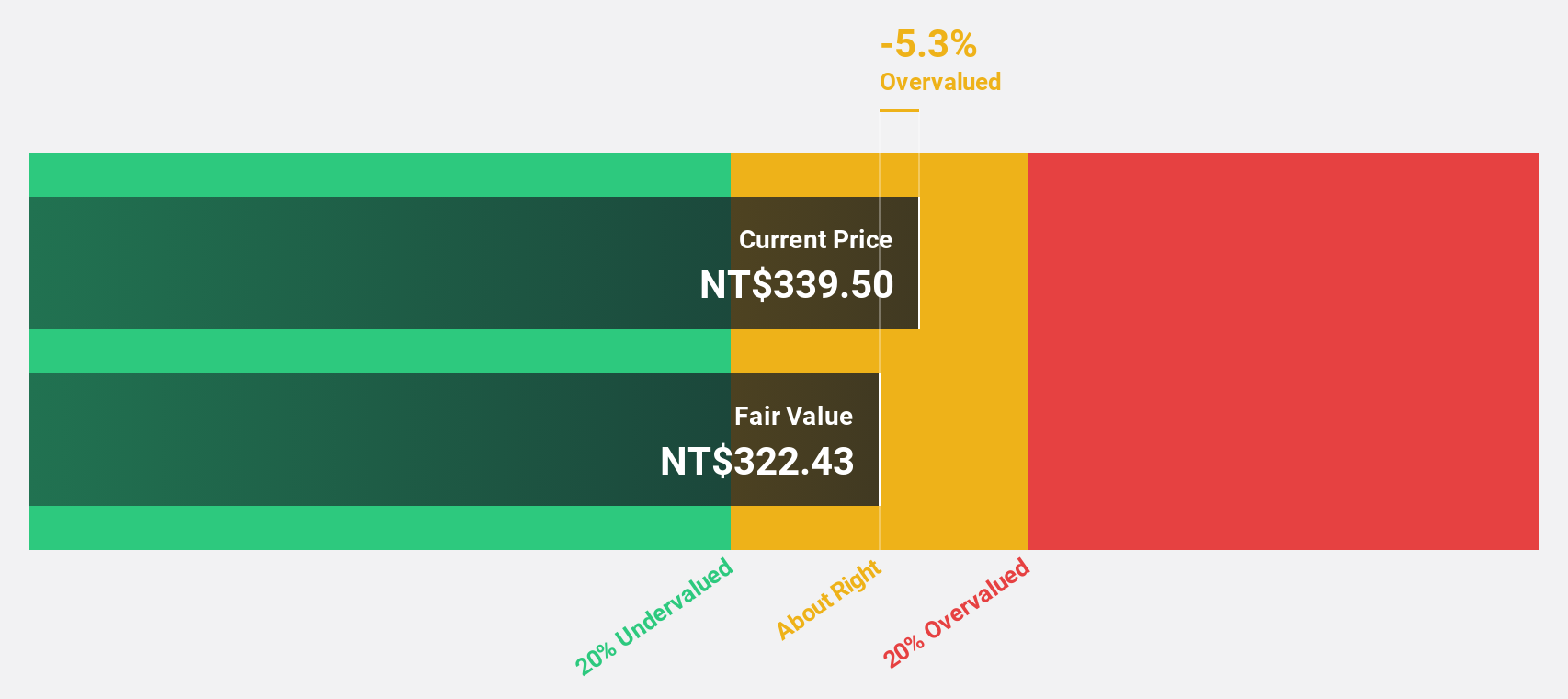

Estimated Discount To Fair Value: 33%

Silergy is trading at NT$335, significantly below its estimated fair value of NT$500.22, highlighting potential undervaluation based on cash flows. The company reported strong Q1 2025 results with net income rising to TWD 358.56 million from TWD 78.01 million a year ago, suggesting robust financial performance despite a low forecasted return on equity of 14.9% in three years. Recent board changes may influence strategic direction positively amidst expected significant earnings growth of 34.1% annually over the next three years.

- The growth report we've compiled suggests that Silergy's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Silergy stock in this financial health report.

Next Steps

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 266 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Beijing Zhong Ke San Huan High-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000970

Beijing Zhong Ke San Huan High-Tech

Beijing Zhong Ke San Huan High-Tech Co., Ltd.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)