ASX Stocks That May Be Trading Below Their Estimated Value July 2025

Reviewed by Simply Wall St

The Australian market recently experienced a downward slide as investors reacted to Reserve Bank comments cautioning against expectations of an August rate cut, while global uncertainties such as impending US tariffs add further complexity. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities, especially when considering sectors like Real Estate and Health Care that have shown varied performance.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Praemium (ASX:PPS) | A$0.74 | A$1.44 | 48.6% |

| PolyNovo (ASX:PNV) | A$1.325 | A$2.58 | 48.7% |

| PointsBet Holdings (ASX:PBH) | A$1.205 | A$2.08 | 42.1% |

| Hillgrove Resources (ASX:HGO) | A$0.038 | A$0.073 | 47.6% |

| Fenix Resources (ASX:FEX) | A$0.305 | A$0.49 | 37.5% |

| Elders (ASX:ELD) | A$7.32 | A$14.56 | 49.7% |

| Domino's Pizza Enterprises (ASX:DMP) | A$18.45 | A$29.55 | 37.6% |

| Collins Foods (ASX:CKF) | A$9.12 | A$15.67 | 41.8% |

| Charter Hall Group (ASX:CHC) | A$19.63 | A$35.43 | 44.6% |

| Advanced Braking Technology (ASX:ABV) | A$0.082 | A$0.16 | 49.6% |

Here's a peek at a few of the choices from the screener.

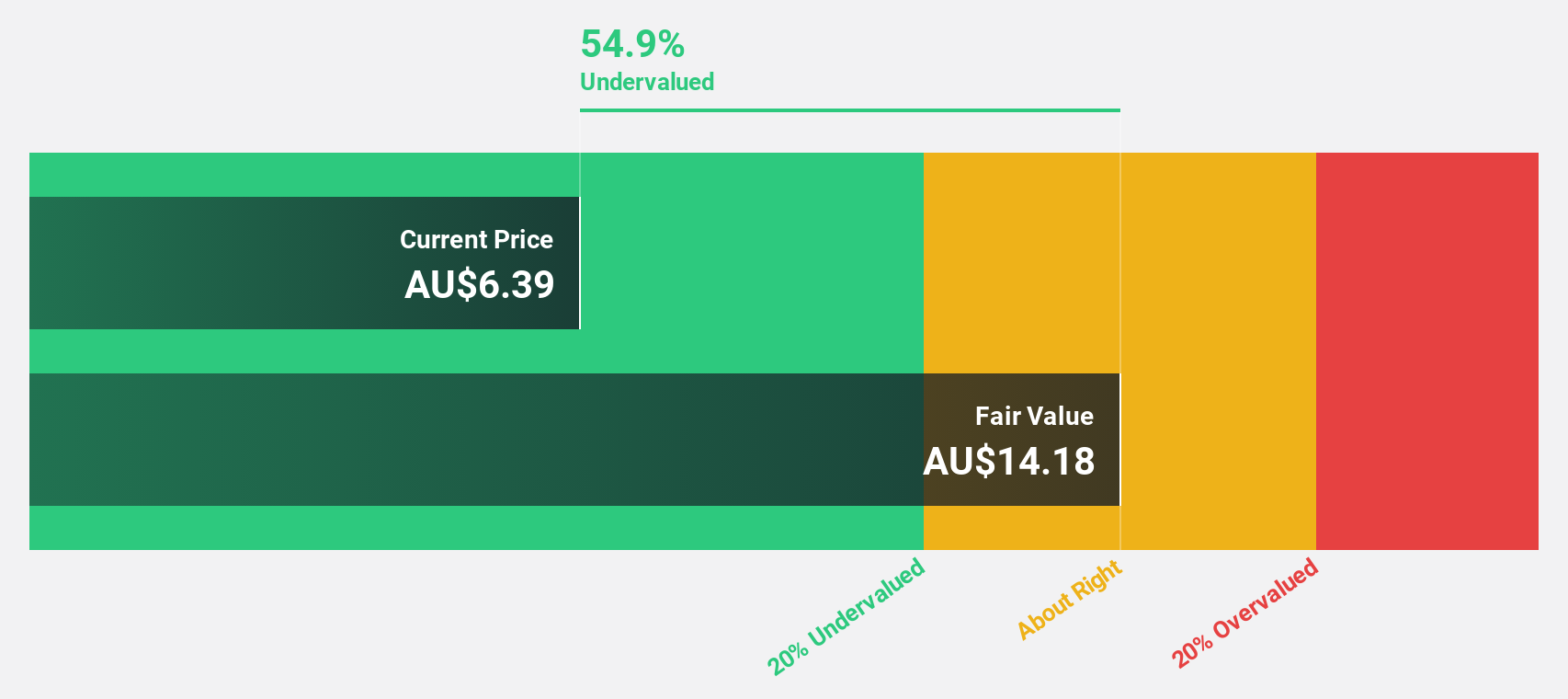

Elders (ASX:ELD)

Overview: Elders Limited offers agricultural products and services to rural and regional customers mainly in Australia, with a market cap of A$1.40 billion.

Operations: Elders generates revenue from its Branch Network (A$2.70 billion), Wholesale Products (A$362.96 million), and Feed and Processing Services (A$142.30 million).

Estimated Discount To Fair Value: 49.7%

Elders is trading at A$7.32, significantly below its estimated fair value of A$14.56, indicating it may be undervalued based on cash flows. Despite recent shareholder dilution, Elders' earnings are forecast to grow substantially at 25.6% annually, outpacing the Australian market's growth rate of 11%. Recent half-year results showed net income increasing from A$11.59 million to A$33.62 million year-over-year, underscoring strong financial performance amidst large one-off items impacting results.

- The growth report we've compiled suggests that Elders' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Elders' balance sheet health report.

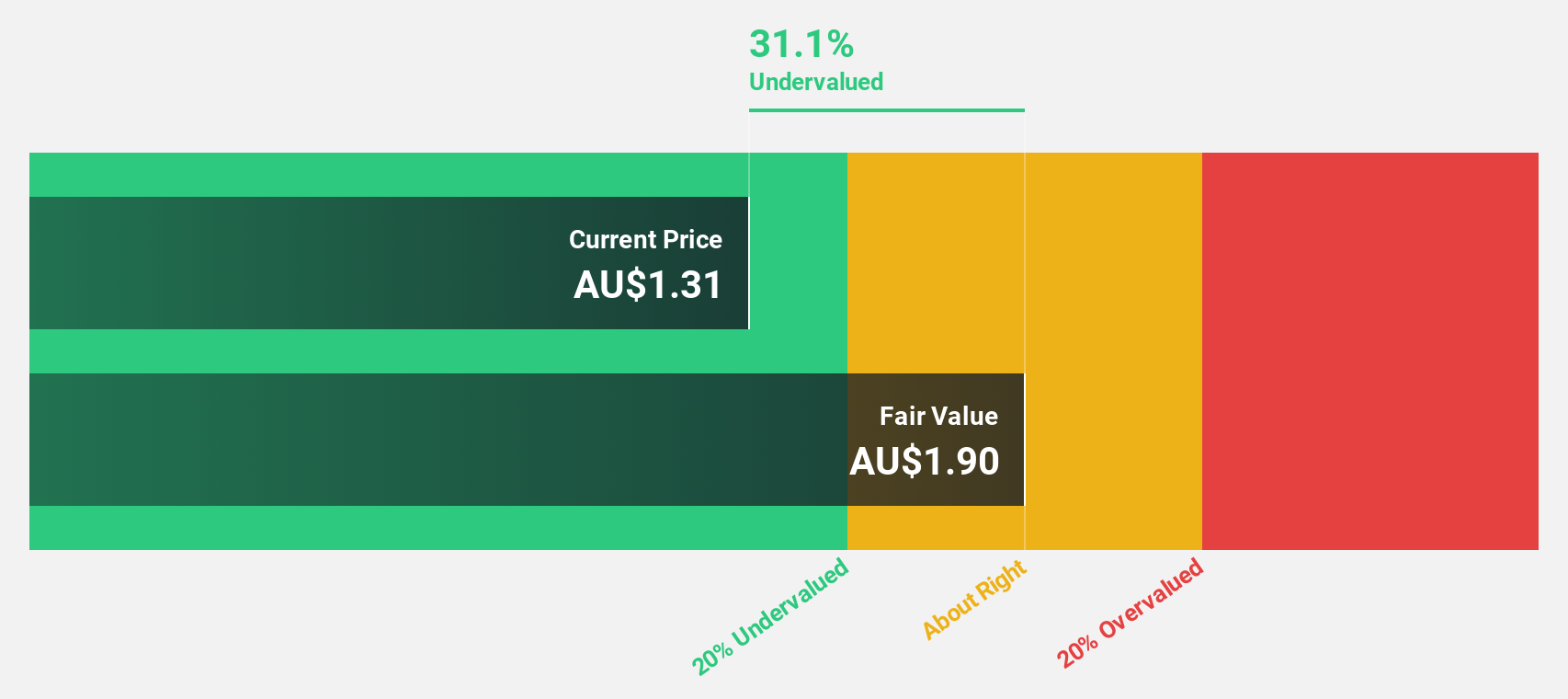

Nuix (ASX:NXL)

Overview: Nuix Limited offers investigative analytics and intelligence software solutions across various regions including the Asia Pacific, the Americas, Europe, the Middle East, and Africa, with a market cap of A$823.53 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, generating A$227.37 million.

Estimated Discount To Fair Value: 24.7%

Nuix, trading at A$2.49, is valued below its fair value estimate of A$3.3, highlighting potential undervaluation based on cash flows. Despite a slower revenue growth forecast of 13.8% annually compared to 20%, Nuix's earnings are expected to rise significantly by 51.8% per year and achieve profitability within three years, surpassing market averages. Recent board changes might impact strategic direction as the company seeks a new Non-Executive Director following Jeff Bleich's departure.

- Our growth report here indicates Nuix may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Nuix.

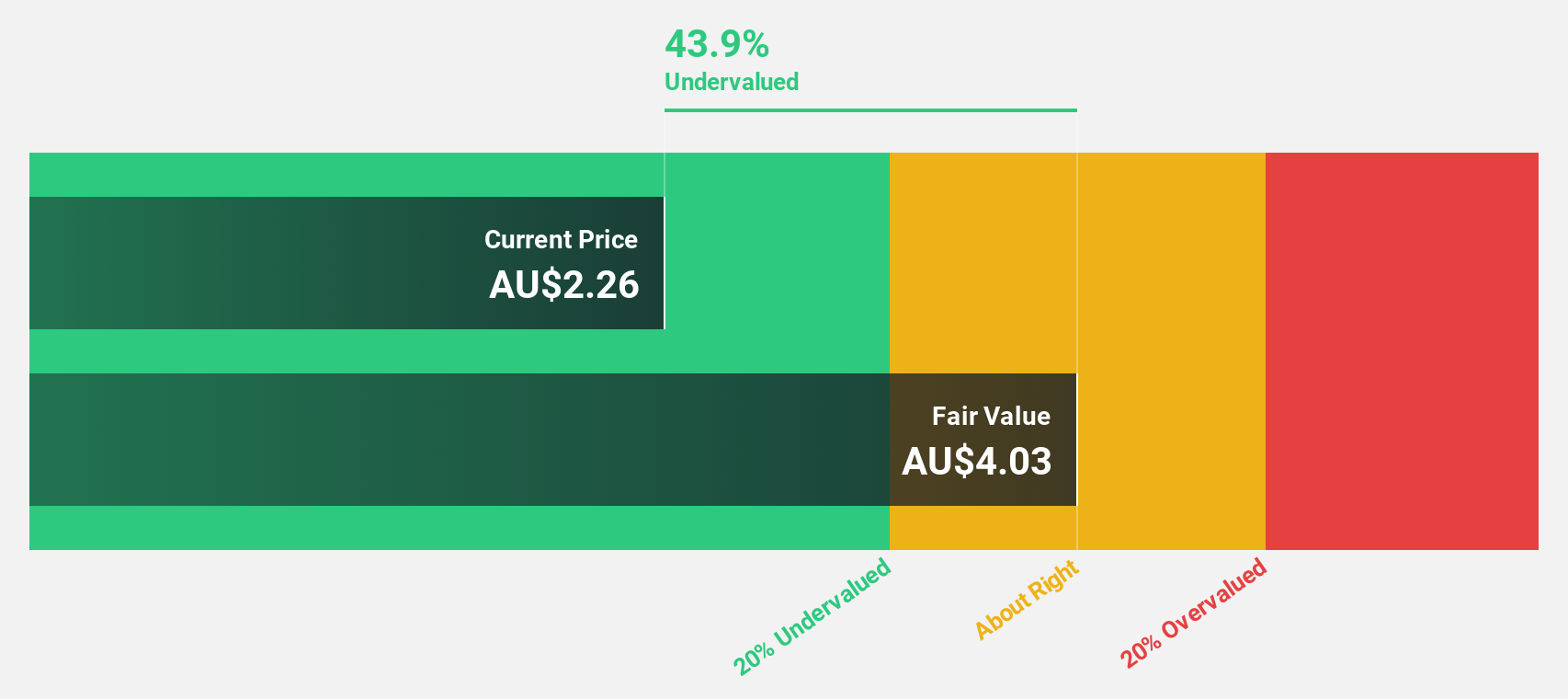

PolyNovo (ASX:PNV)

Overview: PolyNovo Limited designs, manufactures, and sells biodegradable medical devices across the United States, Australia, New Zealand, and internationally with a market cap of A$915.37 million.

Operations: The company's revenue comes entirely from the development, manufacturing, and commercialization of the NovoSorb technology, amounting to A$115.58 million.

Estimated Discount To Fair Value: 48.7%

PolyNovo, trading at A$1.33 and below its fair value of A$2.58, appears undervalued based on cash flows. While revenue growth is expected to be moderate at 14.5% annually, earnings are forecast to grow significantly by 33.2% per year, outpacing the Australian market's average. Despite high non-cash earnings levels, PolyNovo's strong earnings growth potential and a forecasted return on equity of 23.1% in three years underscore its investment appeal amidst recent corporate updates.

- Insights from our recent growth report point to a promising forecast for PolyNovo's business outlook.

- Navigate through the intricacies of PolyNovo with our comprehensive financial health report here.

Summing It All Up

- Investigate our full lineup of 31 Undervalued ASX Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Market Insights

Community Narratives