- Australia

- /

- Construction

- /

- ASX:SXE

ASX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The Australian market has shown mixed signals recently, with IT stocks recovering from a rough patch and materials lagging despite strong gold prices. In light of these fluctuations, investors often look to penny stocks for potential opportunities, as they represent smaller or newer companies that might offer significant value. Although the term "penny stock" may seem outdated, it remains relevant for those seeking to uncover hidden gems in the market; we've identified three such stocks that combine financial strength with promising prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.425 | A$121.8M | ✅ 4 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.86 | A$87.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.845 | A$52.62M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.81 | A$431.87M | ✅ 4 ⚠️ 3 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.71 | A$274.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Veris (ASX:VRS) | A$0.068 | A$35.82M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.71 | A$3.09B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.23 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.51 | A$232.38M | ✅ 3 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.37 | A$131.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 413 stocks from our ASX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Southern Cross Electrical Engineering Limited, with a market cap of A$627.70 million, offers electrical, instrumentation, communications, security, fire, and maintenance services and products across Australia.

Operations: The company generates revenue of A$801.45 million from its electrical services segment.

Market Cap: A$627.7M

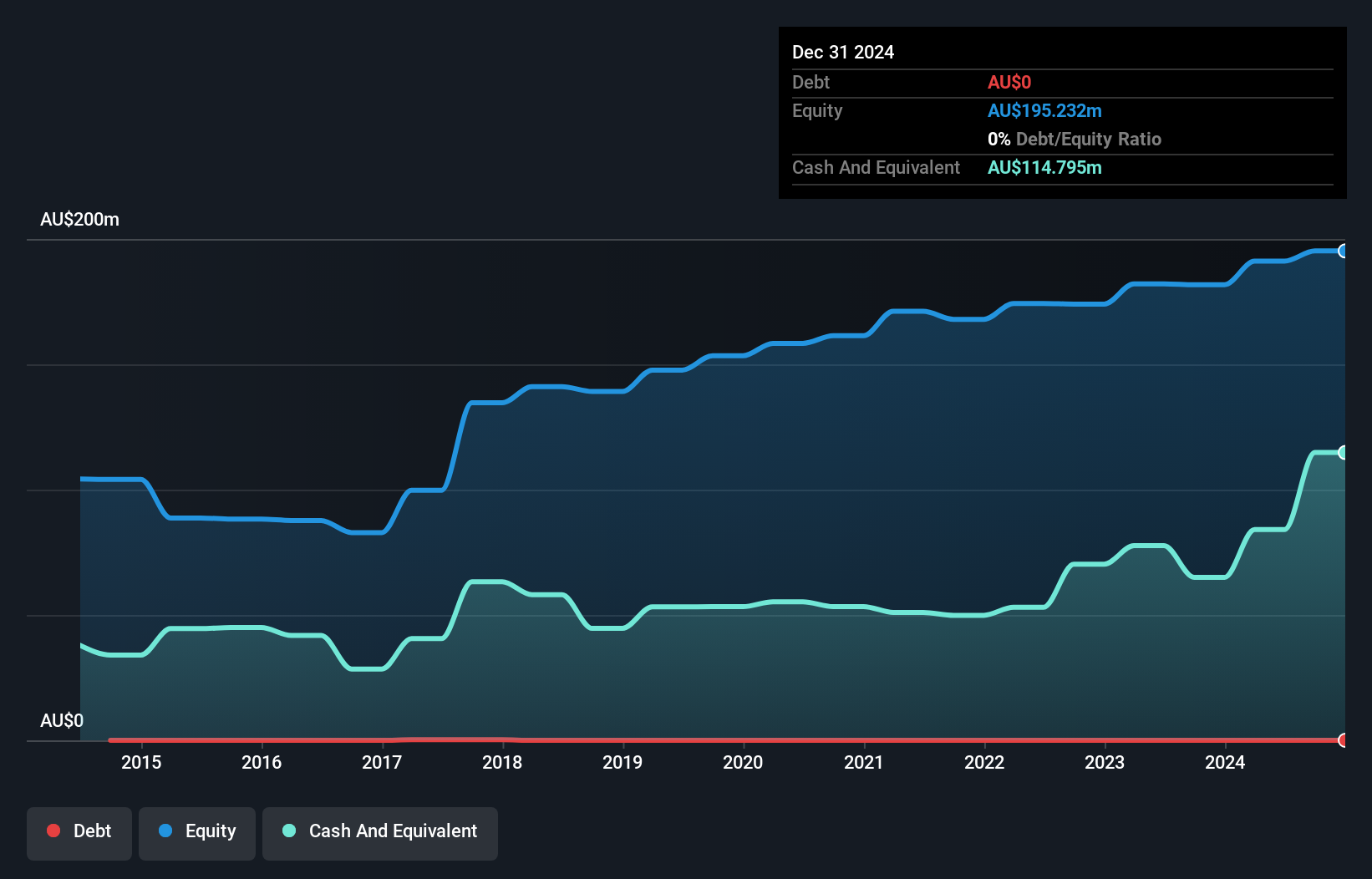

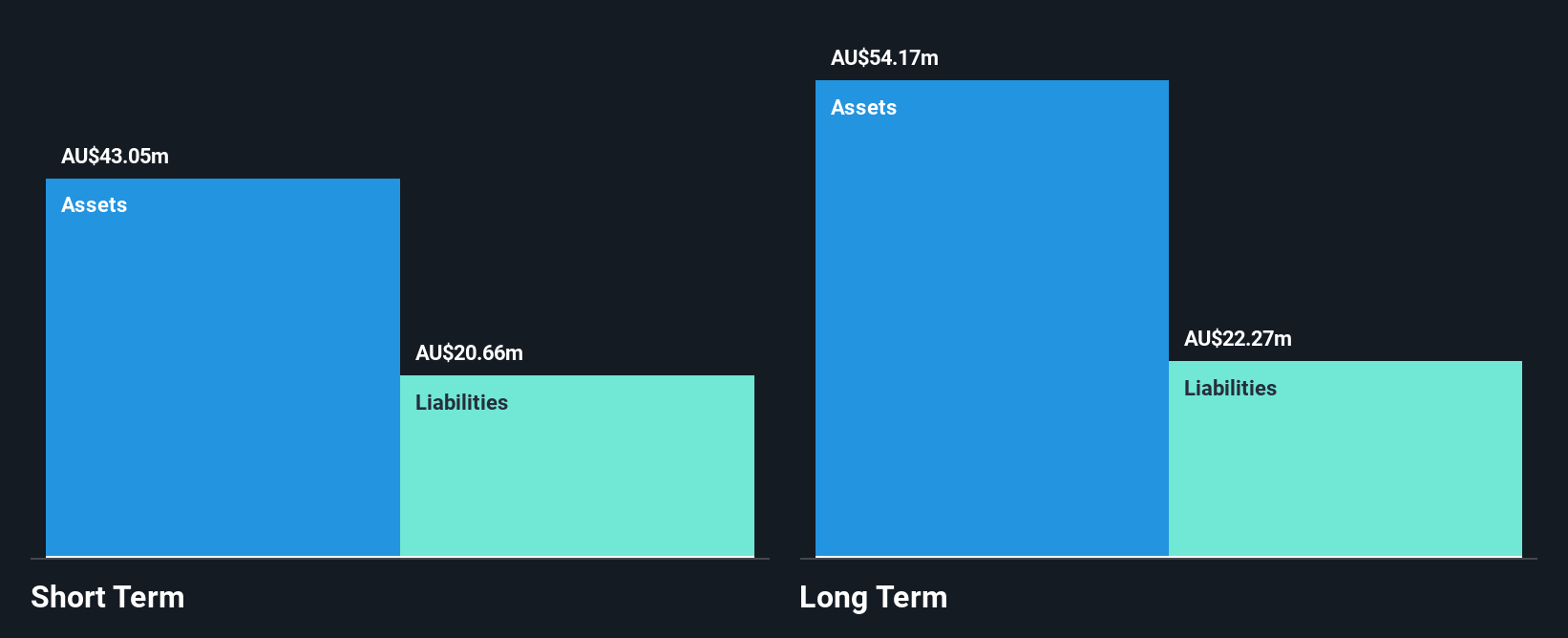

Southern Cross Electrical Engineering Limited, with a market cap of A$627.70 million, has demonstrated strong financial performance, with earnings growing 44.5% over the past year, significantly outpacing the construction industry average. Despite having a low return on equity at 15.5%, the company remains debt-free and maintains high-quality earnings. Its short-term assets comfortably cover both short and long-term liabilities, indicating robust financial health. However, investors should be cautious of recent significant insider selling and an unstable dividend track record. The experienced management team adds to its stability in a volatile penny stock environment.

- Unlock comprehensive insights into our analysis of Southern Cross Electrical Engineering stock in this financial health report.

- Evaluate Southern Cross Electrical Engineering's prospects by accessing our earnings growth report.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited offers integrated payment solutions and value-added services in Australia, with a market cap of A$552.53 million.

Operations: The company's revenue is primarily generated from its Payments segment, which accounts for A$460.86 million, followed by the Banking segment with A$14.78 million.

Market Cap: A$552.53M

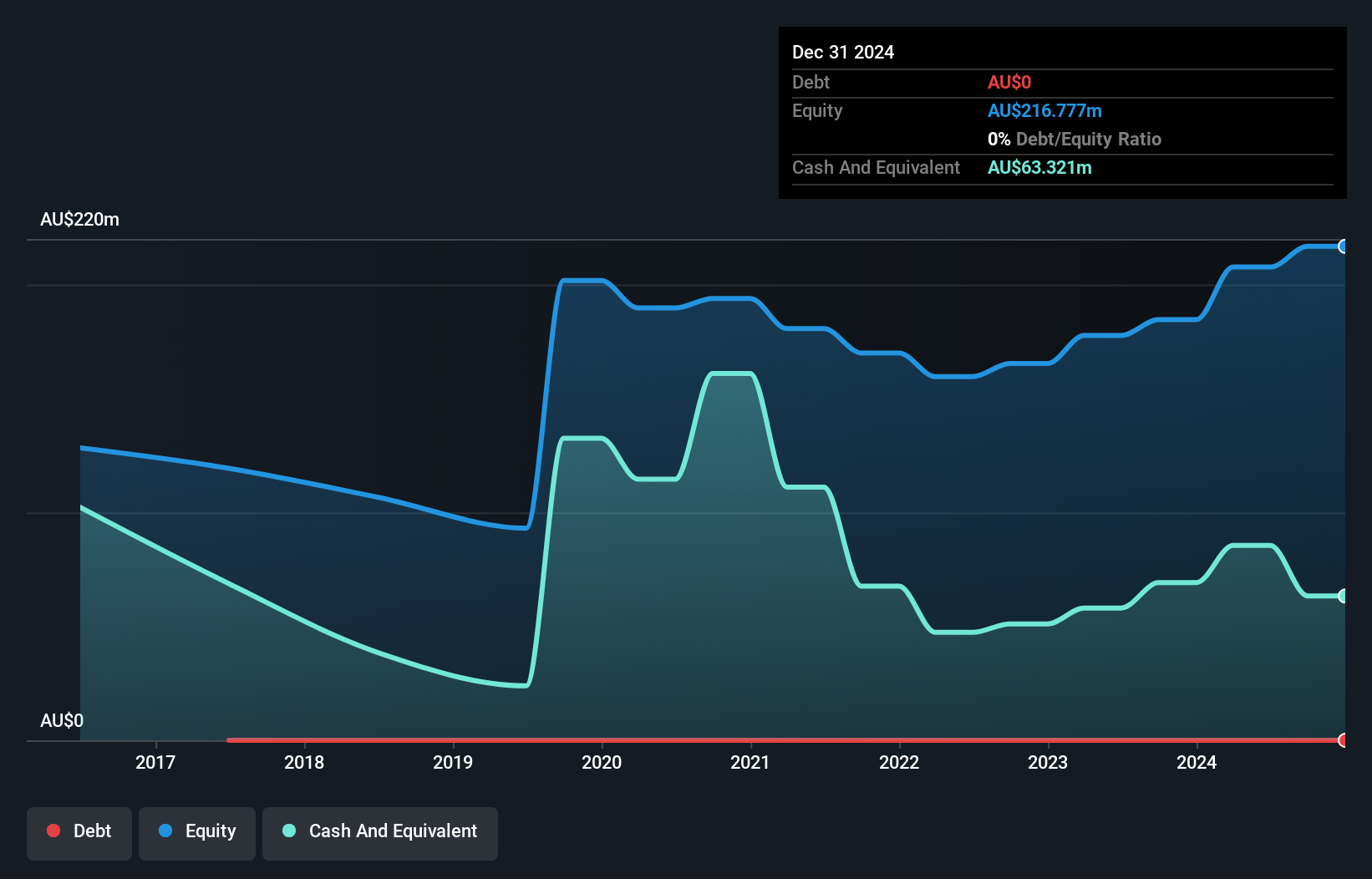

Tyro Payments Limited, with a market cap of A$552.53 million, offers integrated payment solutions and maintains a debt-free balance sheet. Its short-term assets exceed both short and long-term liabilities, reflecting solid financial health. Although Tyro's profit margins have declined from 5.5% to 3.7%, it has achieved profitability over the past five years with earnings growing significantly per year on average during that time frame. Despite recent negative earnings growth, forecasts suggest a modest annual growth rate of 7.96%. The company's experienced management team provides stability amidst the inherent volatility associated with penny stocks.

- Jump into the full analysis health report here for a deeper understanding of Tyro Payments.

- Examine Tyro Payments' earnings growth report to understand how analysts expect it to perform.

VEEM (ASX:VEE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: VEEM Ltd designs, manufactures, and sells marine propulsion and stabilization systems in Australia with a market cap of A$168.61 million.

Operations: The company's revenue is primarily generated from its Machinery & Industrial Equipment segment, which accounts for A$68.62 million.

Market Cap: A$168.61M

VEEM Ltd, with a market cap of A$168.61 million, is involved in the marine and defence sectors. The company has recently secured significant contracts, including a USD 33 million agreement with Northrop Grumman and a USD 65 million contract with ASC, highlighting its growing presence in the defence industry. Despite declining profit margins from 8.7% to 4.4%, VEEM maintains satisfactory debt coverage and high-quality earnings. The recent addition of David Singleton to the board brings valuable expertise in engineering and international business, potentially enhancing strategic growth opportunities within its expanding defence segment.

- Dive into the specifics of VEEM here with our thorough balance sheet health report.

- Learn about VEEM's future growth trajectory here.

Seize The Opportunity

- Click here to access our complete index of 413 ASX Penny Stocks.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SXE

Southern Cross Electrical Engineering

Provides electrical, instrumentation, communications, security, fire, and maintenance services and products in Australia.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)