- Australia

- /

- Personal Products

- /

- ASX:EZZ

ASX Penny Stocks To Watch In August 2025

Reviewed by Simply Wall St

The ASX200 has traded fairly flat today, with the telecommunications sector leading gains while energy lagged behind. Amidst this mixed performance, investors are increasingly looking towards penny stocks as an area of interest. Though often seen as a relic from past market eras, penny stocks offer unique opportunities for growth at lower price points, especially when they exhibit strong financials and solid fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.45 | A$124.67M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.49 | A$117.93M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.4025 | A$77.22M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.965 | A$461M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.715 | A$3.09B | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$3.10 | A$1.05B | ✅ 4 ⚠️ 2 View Analysis > |

| Bravura Solutions (ASX:BVS) | A$2.08 | A$927.98M | ✅ 3 ⚠️ 3 View Analysis > |

| Austco Healthcare (ASX:AHC) | A$0.37 | A$137.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$4.51 | A$218.27M | ✅ 3 ⚠️ 1 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.855 | A$149.41M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 450 stocks from our ASX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

EZZ Life Science Holdings (ASX:EZZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EZZ Life Science Holdings Limited is involved in the formulation, production, marketing, and sale of health and wellbeing products across Australia, New Zealand, Mainland China, and internationally with a market cap of A$117.93 million.

Operations: The company's revenue is primarily derived from its Company Owned segment, contributing A$71.78 million, with an additional A$3.26 million generated from Brought in Lines.

Market Cap: A$117.93M

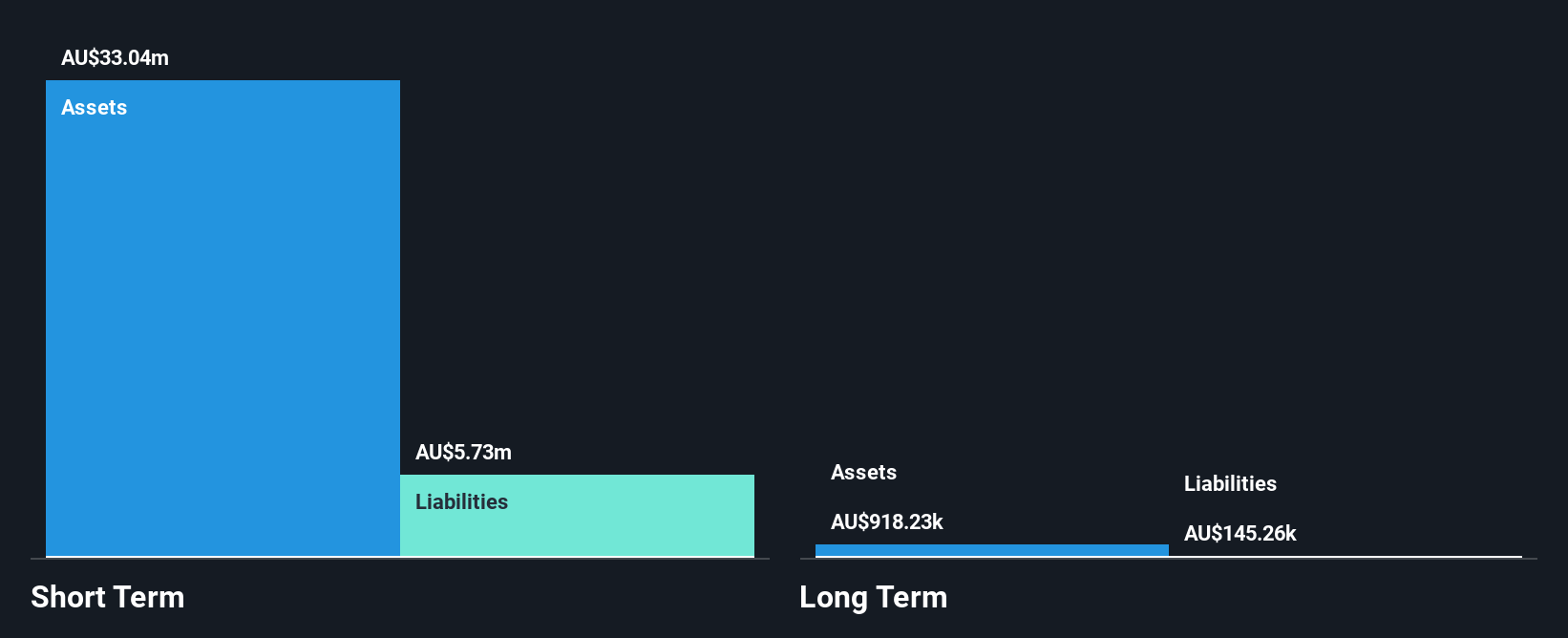

EZZ Life Science Holdings presents a compelling case within the penny stock category, with its robust financial health and growth trajectory. The company boasts a high Return on Equity of 37.5% and has seen significant earnings growth of 159.7% over the past year, surpassing both its historical average and industry benchmarks. EZZ is debt-free, enhancing its financial stability, while short-term assets comfortably cover liabilities. Despite trading at a substantial discount to estimated fair value, potential investors should note the stock's higher volatility compared to most Australian stocks. Management and board experience further bolster confidence in operational oversight.

- Navigate through the intricacies of EZZ Life Science Holdings with our comprehensive balance sheet health report here.

- Learn about EZZ Life Science Holdings' future growth trajectory here.

United Overseas Australia (ASX:UOS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: United Overseas Australia Ltd, along with its subsidiaries, is involved in the development and resale of land and buildings across Malaysia, Singapore, Vietnam, and Australia, with a market capitalization of A$1.12 billion.

Operations: The company generates revenue from its operations in Malaysia (MYR 1.04 billion), Singapore (MYR 0.45 billion), Vietnam (MYR 0.32 billion), and Australia (MYR 0.18 billion).

Market Cap: A$1.12B

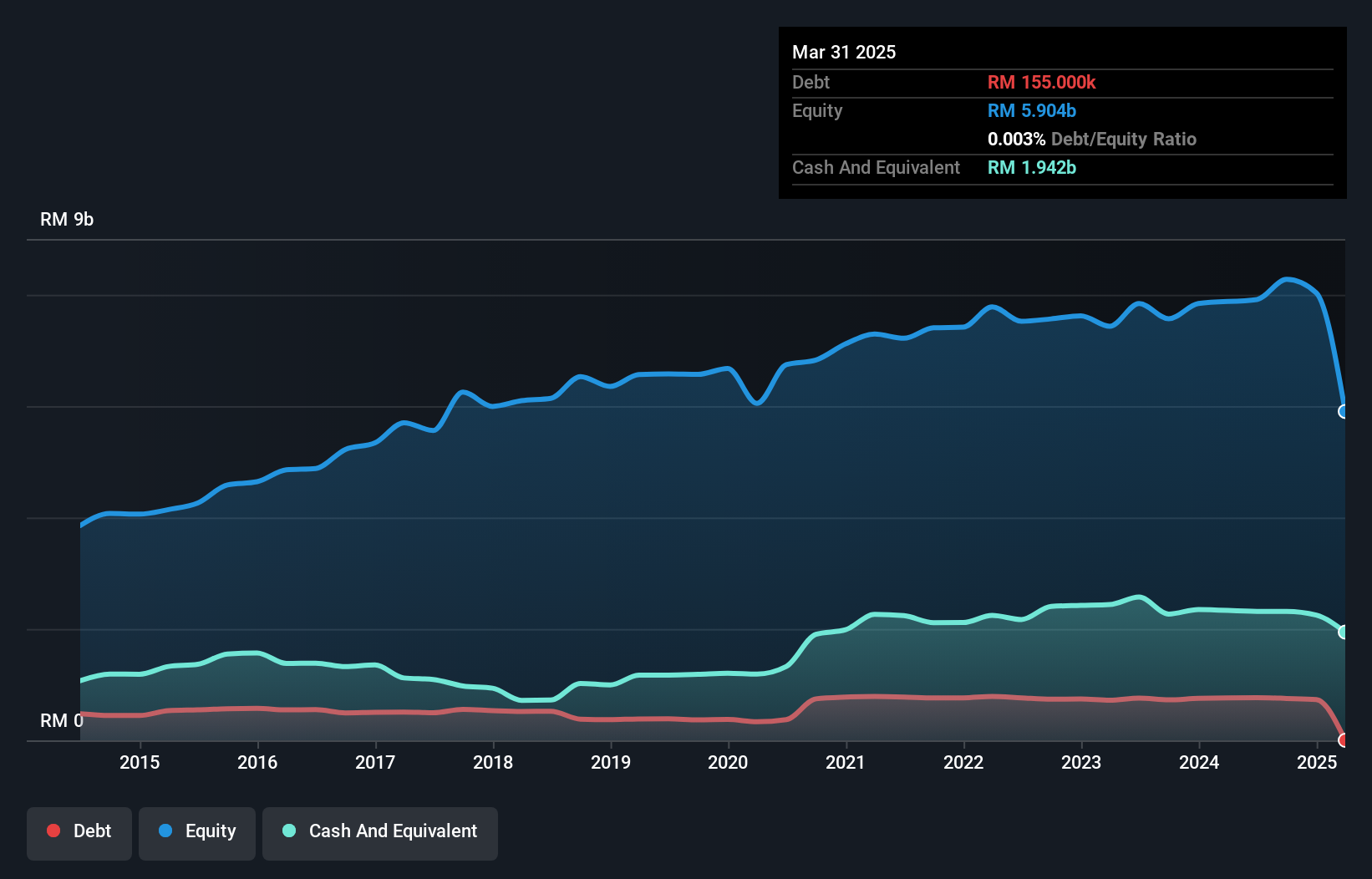

United Overseas Australia's recent earnings report highlights robust growth, with sales and net income significantly up from the previous year. The company's management and board are highly experienced, contributing to its strategic direction. Financially, UOS is strong; it has more cash than debt and its short-term assets exceed both long-term liabilities and short-term obligations. Earnings growth outpaces the industry average, supported by high-quality earnings and stable volatility. However, its return on equity remains low, and profit margins have declined compared to last year. Despite an unstable dividend history, UOS's valuation appears attractive with a low price-to-earnings ratio relative to the market.

- Jump into the full analysis health report here for a deeper understanding of United Overseas Australia.

- Understand United Overseas Australia's track record by examining our performance history report.

Web Travel Group (ASX:WEB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Web Travel Group Limited operates as an online travel booking service provider in Australia, the United Arab Emirates, the United Kingdom, and internationally, with a market cap of A$1.60 billion.

Operations: The company generates revenue from its Business to Business Travel (B2B) segment, which amounts to A$328.4 million.

Market Cap: A$1.6B

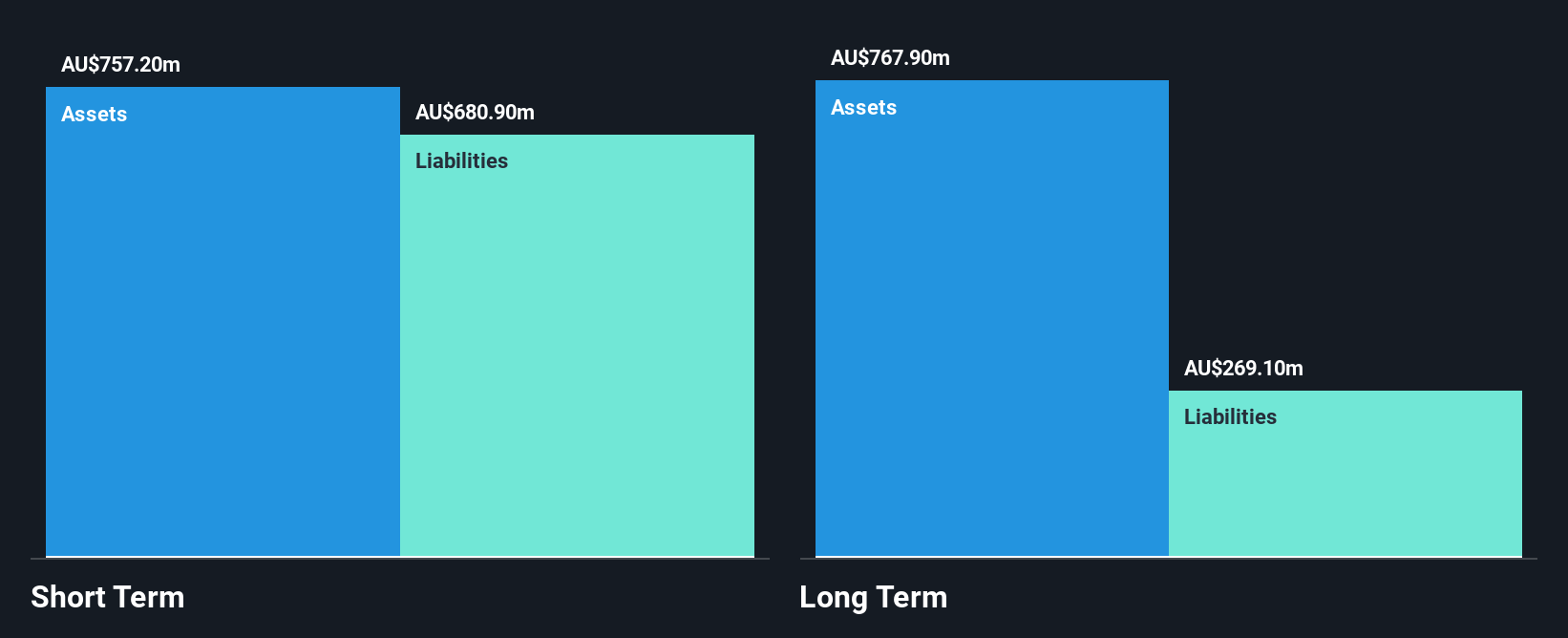

Web Travel Group's recent financial performance shows mixed results, with revenue reaching A$328.4 million but net profit margins decreasing to 3.4% from 24.6% last year due to a significant one-off loss of A$47.2 million. Despite negative earnings growth over the past year, the company remains profitable over a five-year span and is forecasted to grow earnings by 31.52% annually. The board's experience is bolstered by new appointments, enhancing governance as it navigates increased debt levels and insider selling concerns while maintaining strong asset coverage for liabilities and well-covered interest payments on debt obligations.

- Click here to discover the nuances of Web Travel Group with our detailed analytical financial health report.

- Gain insights into Web Travel Group's future direction by reviewing our growth report.

Next Steps

- Get an in-depth perspective on all 450 ASX Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EZZ Life Science Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:EZZ

EZZ Life Science Holdings

Engages in formulation, production, marketing, and sale of the health and wellbeing products in Australia, New Zealand, Mainland China, and South-East Asia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)