As the ASX200 rebounded with optimism fueled by positive inflation data and potential interest rate cuts, investors saw strong performances in sectors like Staples, Real Estate, and Discretionary. In this buoyant market environment, dividend stocks such as IVE Group offer appealing opportunities for those seeking steady income streams amidst fluctuating economic conditions.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Super Retail Group (ASX:SUL) | 7.76% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 8.20% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 3.14% | ★★★★★☆ |

| New Hope (ASX:NHC) | 9.69% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.54% | ★★★★★☆ |

| Lycopodium (ASX:LYL) | 6.77% | ★★★★★☆ |

| Lindsay Australia (ASX:LAU) | 6.80% | ★★★★★☆ |

| IPH (ASX:IPH) | 6.65% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.97% | ★★★★★☆ |

| Accent Group (ASX:AX1) | 6.71% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

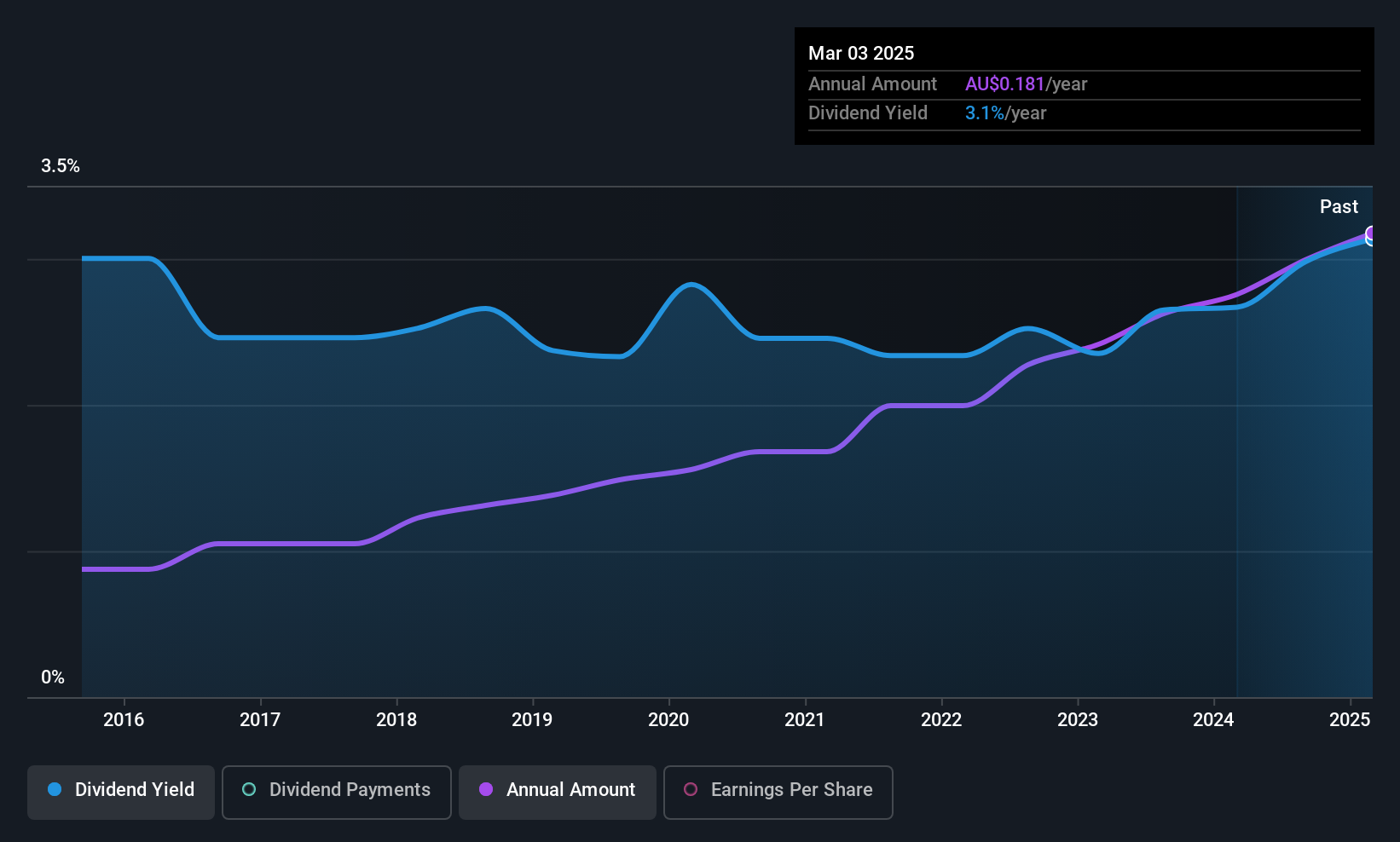

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited operates in the marketing sector in Australia, with a market capitalization of A$448.67 million.

Operations: IVE Group Limited generates its revenue primarily through its advertising segment, which accounts for A$975.43 million.

Dividend Yield: 6.2%

IVE Group offers a compelling dividend yield of 6.19%, ranking in the top 25% of Australian dividend payers. Despite its high level of debt, the company trades at a significant discount to its estimated fair value, suggesting potential upside. While IVE's dividends are well-covered by earnings and cash flows, their reliability is questionable due to volatility over the past nine years. Investors should note that earnings grew significantly last year and are forecasted to continue growing.

- Dive into the specifics of IVE Group here with our thorough dividend report.

- According our valuation report, there's an indication that IVE Group's share price might be on the cheaper side.

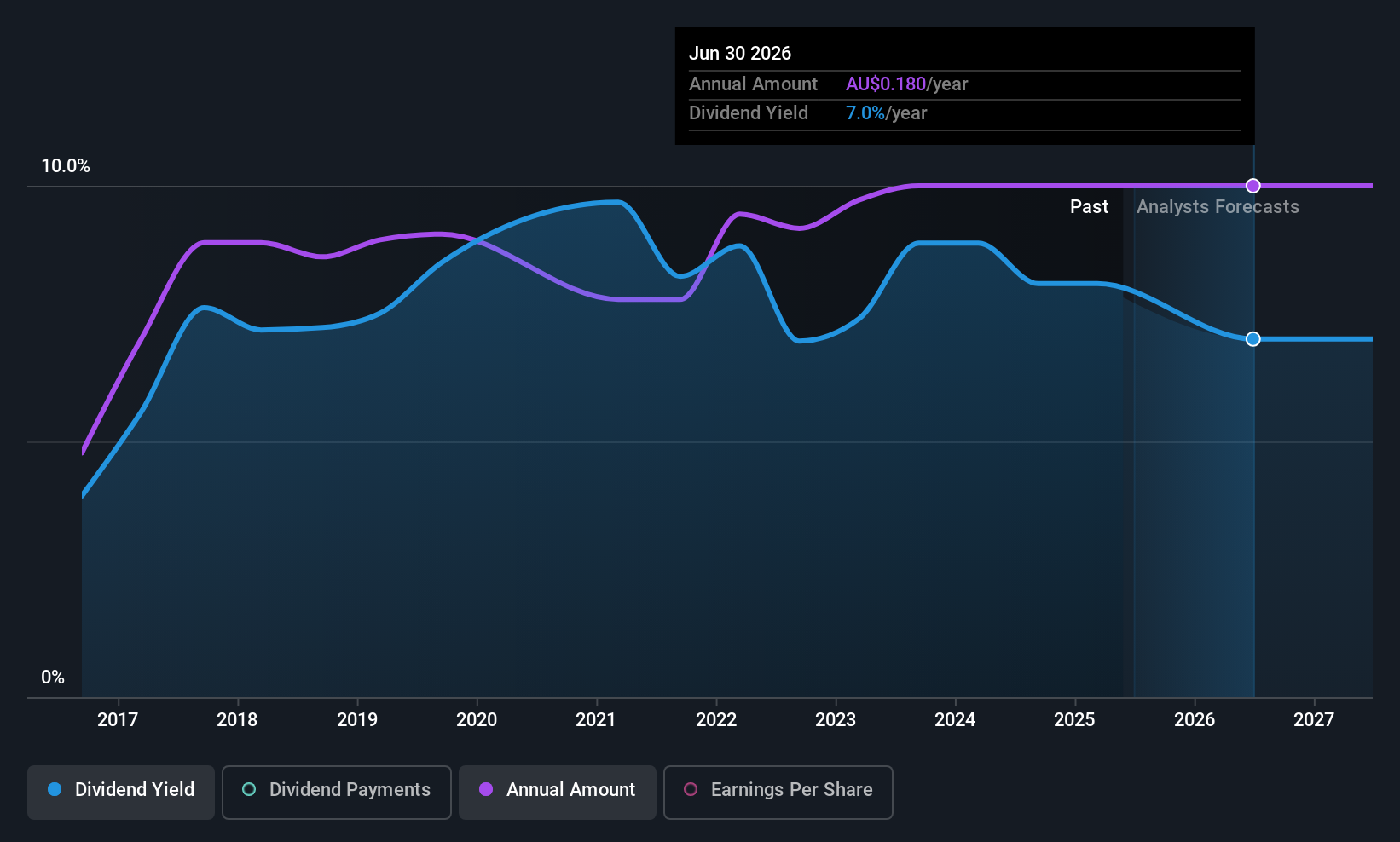

Steadfast Group (ASX:SDF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Steadfast Group Limited operates as a general insurance brokerage firm across Australasia, Asia, and Europe with a market cap of A$6.50 billion.

Operations: Steadfast Group Limited generates revenue primarily from its Insurance Intermediary segment, which accounts for A$1.63 billion, and its Premium Funding segment, contributing A$120.20 million.

Dividend Yield: 3.1%

Steadfast Group's dividend yield of 3.08% is below the top quartile of Australian dividend payers. Although its dividends are covered by earnings and cash flows, they have been volatile over the past decade. The company faces challenges with a high debt level, but it trades at a discount to estimated fair value. Earnings have grown significantly in recent years and are forecasted to continue growing, suggesting potential for future stability in dividends despite past volatility.

- Get an in-depth perspective on Steadfast Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Steadfast Group shares in the market.

Ricegrowers (ASX:SGLLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ricegrowers Limited is a rice food company with operations across Australia, New Zealand, the Pacific Islands, Europe, the Middle East, Africa, Asia, and North America and has a market cap of A$786.64 million.

Operations: Ricegrowers Limited generates revenue through its segments: Riviana (A$231.14 million), Cop Rice (A$250.64 million), Rice Food (A$132.53 million), Rice Pool (A$481.87 million), Corporate Segment (A$26.93 million), and International Rice (A$860.96 million).

Dividend Yield: 5.5%

Ricegrowers' recent dividend increase to A$0.50 per share reflects its commitment to shareholder returns, though its dividends have been volatile over the past decade. The payout ratio of 63.2% indicates dividends are well-covered by earnings, while a cash payout ratio of 59.1% suggests sustainability from cash flows. Despite trading at a discount to estimated fair value and having grown earnings by 8.4%, Ricegrowers’ dividend yield of 5.53% remains slightly below top-tier Australian payers.

- Navigate through the intricacies of Ricegrowers with our comprehensive dividend report here.

- Our valuation report unveils the possibility Ricegrowers' shares may be trading at a discount.

Summing It All Up

- Embark on your investment journey to our 30 Top ASX Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SDF

Steadfast Group

Provides general insurance brokerage services Australasia, Asia, and Europe.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives