- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (NasdaqGS:ALAB) Reports Turnaround To Profit In Q1 2025

Reviewed by Simply Wall St

Astera Labs (NasdaqGS:ALAB) has experienced a significant share price increase of 53% over the past month. This surge coincides with the company's impressive Q1 2025 financial results, showcasing a substantial rise in sales and a shift from net loss to profitability. Moreover, the introduction of its new PCIe 6 connectivity portfolio tailored for AI platforms further strengthens its market position. This positive trajectory aligns with the broader market trends, as indices such as the Dow Jones and the Nasdaq Composite have been on an upward streak, reflecting a broader investor appetite for innovative tech stocks.

Astera Labs has 2 possible red flags we think you should know about.

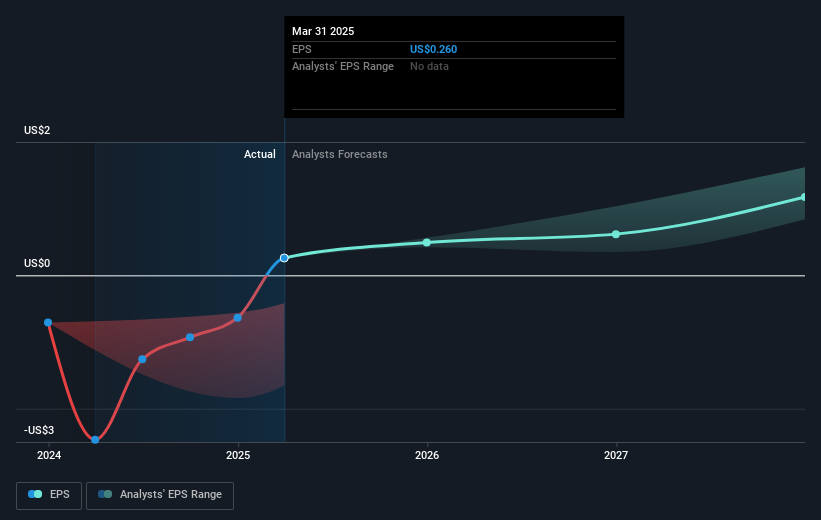

The recent upswing in Astera Labs' share price aligns with its better-than-expected Q1 2025 financial results and innovative product introductions, such as the new PCIe 6 connectivity portfolio aimed at AI platforms. This momentum is likely to bolster forecasts for both revenue and earnings, as the company capitalizes on expanding AI infrastructure and next-generation connectivity solutions. Analysts project revenue growth at 44.3% annually over the next three years, while earnings are expected to reach US$231.8 million by 2028, driven by strategic R&D investments and market share gains in the semiconductor space.

In terms of overall performance, Astera Labs has delivered a total shareholder return of 17.1% over the past year. However, when compared to the broader market, the company's one-year return was above the US market's 10.6% but fell short of the US Semiconductor industry's performance at 21%. Long-term investors have seen stable gains, though the firm's high valuation metrics, such as its Price-to-Sales Ratio of 30.5x, may raise concerns about future growth sustainability.

The recent price surge sets the current share price at US$65.65, which is 40.9% below the consensus analyst price target of US$111.16. This gap might indicate upside potential, contingent upon Astera Labs achieving projected earnings and revenue milestones, including the successful volume ramp-up of its LEO product family and continued development of AI cluster connectivity solutions. Investors may also need to consider Astera Labs' reliance on key hyperscale customers and evolving technological trends, which could introduce risk factors affecting revenue growth and market positioning.

Understand Astera Labs' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives