- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8046

Asian Value Stocks: Chongqing Qianli Technology And 2 More Trading Below Estimated Fair Value

Reviewed by Simply Wall St

As global markets respond to recent economic developments, including the Federal Reserve's interest rate cuts and ongoing trade negotiations between the U.S. and China, investors are closely watching Asia for opportunities amid signs of economic slowdown in China. In this context, identifying undervalued stocks becomes crucial as they may offer potential value when trading below their estimated fair value, such as Chongqing Qianli Technology and two other Asian companies featured in this article.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥83.66 | CN¥165.09 | 49.3% |

| Takara Bio (TSE:4974) | ¥938.00 | ¥1829.46 | 48.7% |

| Pansoft (SZSE:300996) | CN¥17.23 | CN¥33.78 | 49% |

| Meitu (SEHK:1357) | HK$9.06 | HK$18.02 | 49.7% |

| Kolmar Korea (KOSE:A161890) | ₩78300.00 | ₩155815.46 | 49.7% |

| Hugel (KOSDAQ:A145020) | ₩295500.00 | ₩580178.41 | 49.1% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.81 | CN¥78.15 | 49.1% |

| FP Partner (TSE:7388) | ¥2244.00 | ¥4425.25 | 49.3% |

| Bloomberry Resorts (PSE:BLOOM) | ₱3.91 | ₱7.66 | 49% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.86 | CN¥97.19 | 48.7% |

Here we highlight a subset of our preferred stocks from the screener.

Chongqing Qianli Technology (SHSE:601777)

Overview: Chongqing Qianli Technology Co., Ltd. focuses on the research and development, production, and sale of automobiles, motorcycles, engines, and general machinery both in China and internationally, with a market cap of CN¥58.73 billion.

Operations: The company generates revenue through its activities in the research, development, production, and sales of automobiles, motorcycles, engines, and general machinery across domestic and international markets.

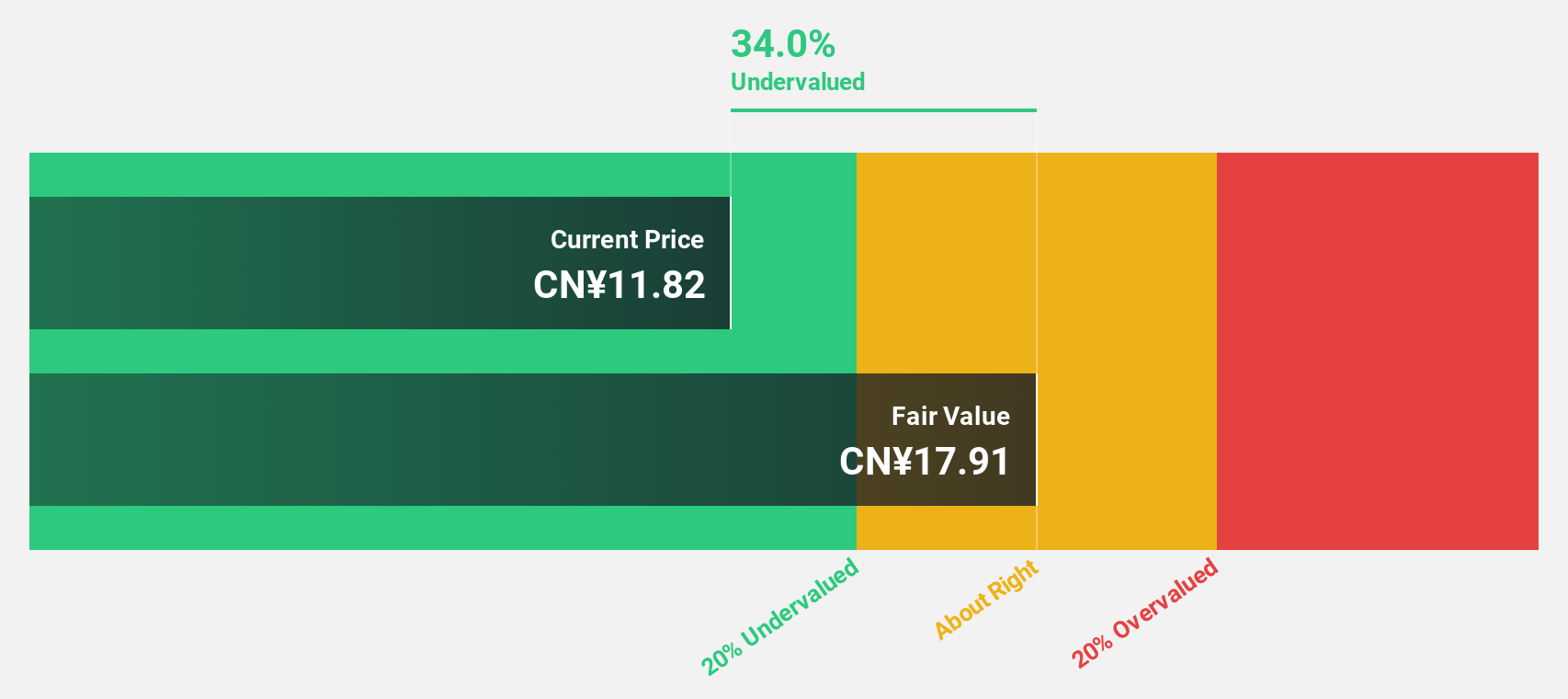

Estimated Discount To Fair Value: 33.7%

Chongqing Qianli Technology is trading 33.7% below its estimated fair value of CNY 19.59, suggesting it is undervalued based on cash flows. Recent earnings showed significant growth, with net income rising to CNY 31.17 million from the previous year’s CNY 26.19 million, despite large one-off items affecting results. Revenue growth is projected at 17.7% annually, surpassing the Chinese market average of 14.1%, while earnings are expected to grow significantly at over 60% per year.

- The analysis detailed in our Chongqing Qianli Technology growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Chongqing Qianli Technology.

Shanghai V-Test Semiconductor Tech (SHSE:688372)

Overview: Shanghai V-Test Semiconductor Tech Co., Ltd. operates in the semiconductor industry and has a market cap of CN¥13.04 billion.

Operations: Shanghai V-Test Semiconductor Tech Co., Ltd. operates in the semiconductor industry with a market cap of CN¥13.04 billion, but specific revenue segments are not provided in the available data.

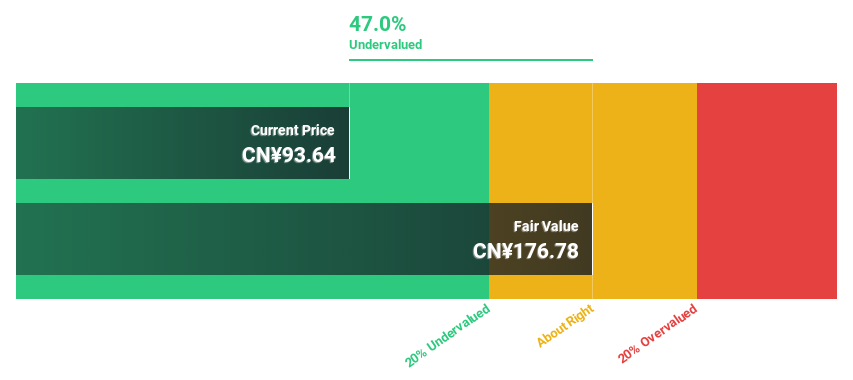

Estimated Discount To Fair Value: 48.2%

Shanghai V-Test Semiconductor Tech. is trading 48.2% below its estimated fair value of CN¥169.04, highlighting its undervaluation based on cash flows. Recent earnings reveal substantial growth, with net income reaching CN¥101.08 million compared to last year's CN¥10.86 million, driven by a significant increase in revenue to CN¥634.25 million from CN¥429.92 million a year ago. Despite high debt levels and low future return on equity forecasts, earnings are expected to grow significantly at 28.4% annually, outpacing the Chinese market average.

- According our earnings growth report, there's an indication that Shanghai V-Test Semiconductor Tech might be ready to expand.

- Unlock comprehensive insights into our analysis of Shanghai V-Test Semiconductor Tech stock in this financial health report.

Nan Ya Printed Circuit Board (TWSE:8046)

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) across Taiwan, the United States, Mainland China, Korea, and internationally with a market cap of NT$147.97 billion.

Operations: The company's revenue segments are comprised of NT$14.24 billion from Asia, NT$30.74 million from America, and NT$25.05 billion domestically.

Estimated Discount To Fair Value: 45.2%

Nan Ya Printed Circuit Board is trading 45.2% below its estimated fair value of NT$417.93, reflecting significant undervaluation based on cash flows. Despite recent volatility and a net loss of NT$187.43 million in Q2 2025, the company's earnings are projected to grow at a substantial rate of 78.1% annually, surpassing the Taiwan market average growth rate. However, profit margins have decreased from last year, and return on equity forecasts remain modest at 10.7%.

- Our comprehensive growth report raises the possibility that Nan Ya Printed Circuit Board is poised for substantial financial growth.

- Take a closer look at Nan Ya Printed Circuit Board's balance sheet health here in our report.

Taking Advantage

- Unlock our comprehensive list of 284 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nan Ya Printed Circuit Board might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8046

Nan Ya Printed Circuit Board

Manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives