Asian Stocks Estimated To Be Trading At Discounts Of Up To 44.3%

Reviewed by Simply Wall St

As global markets navigate a complex landscape of cautious central bank commentary and economic indicators, Asian stock markets have shown resilience, with some indices recording gains despite broader uncertainties. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities that may not yet be fully appreciated by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Takara Bio (TSE:4974) | ¥942.00 | ¥1829.46 | 48.5% |

| SRE Holdings (TSE:2980) | ¥3325.00 | ¥6495.81 | 48.8% |

| Pansoft (SZSE:300996) | CN¥17.19 | CN¥33.87 | 49.2% |

| Kolmar Korea (KOSE:A161890) | ₩77800.00 | ₩154695.49 | 49.7% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.29 | CN¥77.70 | 49.4% |

| Fositek (TWSE:6805) | NT$967.00 | NT$1863.14 | 48.1% |

| Everest Medicines (SEHK:1952) | HK$54.95 | HK$107.13 | 48.7% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥70.42 | CN¥135.70 | 48.1% |

| COVER (TSE:5253) | ¥1900.00 | ¥3657.59 | 48.1% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.81 | CN¥59.50 | 48.2% |

Let's uncover some gems from our specialized screener.

AVIC Shenyang Aircraft (SHSE:600760)

Overview: AVIC Shenyang Aircraft Company Limited is involved in the manufacture and sale of aviation products in China, with a market cap of CN¥182.81 billion.

Operations: AVIC Shenyang Aircraft's revenue is derived from the manufacture and sale of aviation products in China.

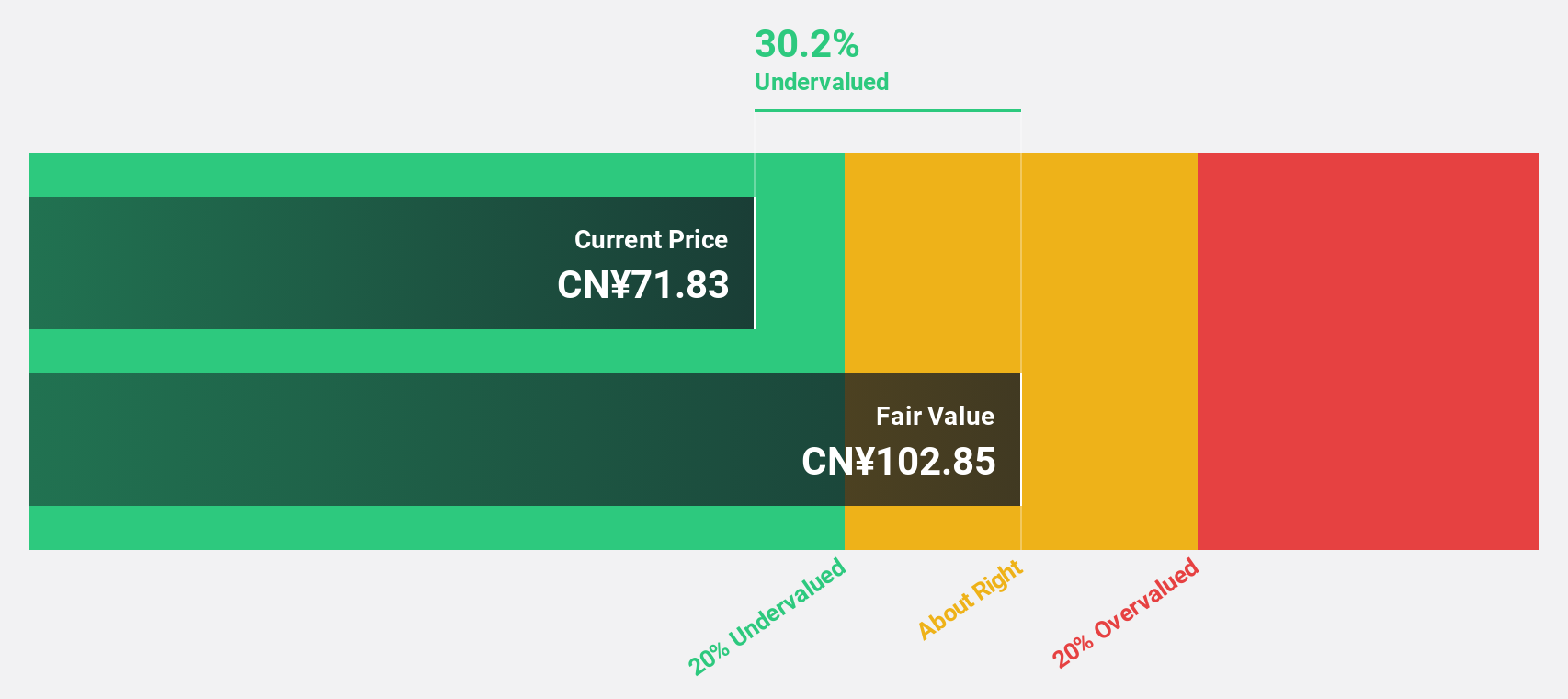

Estimated Discount To Fair Value: 37.3%

AVIC Shenyang Aircraft is trading at CN¥64.48, significantly below its estimated fair value of CN¥102.86, indicating potential undervaluation based on cash flows. Despite recent declines in revenue and net income, the company is expected to achieve substantial annual profit growth of 22.43% over the next three years, with revenue projected to grow at 22.8% annually—outpacing market averages. However, it faces challenges with a low forecasted return on equity and an unstable dividend record.

- Our growth report here indicates AVIC Shenyang Aircraft may be poised for an improving outlook.

- Click here to discover the nuances of AVIC Shenyang Aircraft with our detailed financial health report.

Zhejiang Sanmei Chemical IndustryLtd (SHSE:603379)

Overview: Zhejiang Sanmei Chemical Industry Co., Ltd. operates in the chemical manufacturing sector and has a market capitalization of approximately CN¥34.49 billion.

Operations: The company generates revenue from its chemical industry segment, amounting to approximately CN¥4.83 billion.

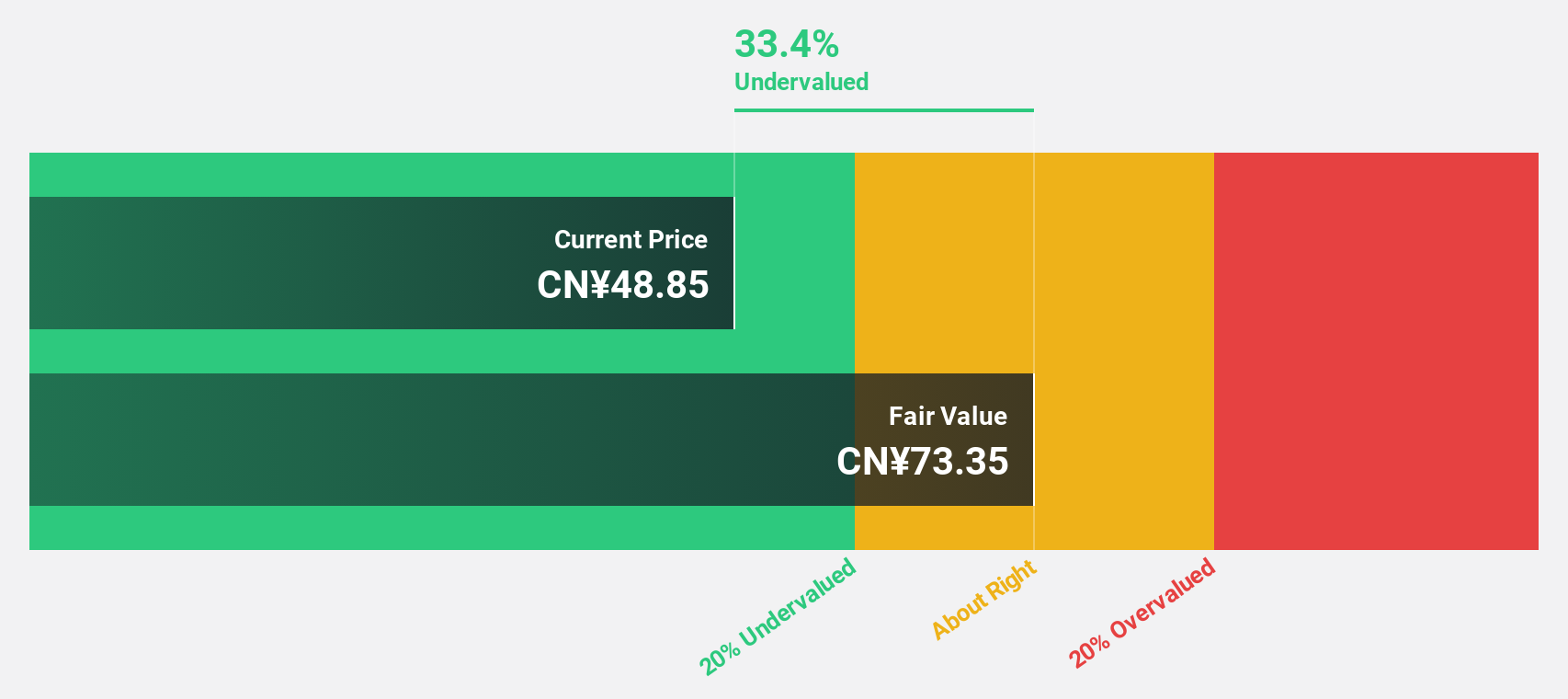

Estimated Discount To Fair Value: 44.3%

Zhejiang Sanmei Chemical Industry Ltd. is trading at CN¥56.84, significantly below its estimated fair value of CN¥102.12, highlighting potential undervaluation based on cash flows. Recent earnings show robust growth, with net income rising to CNY 994.63 million from CNY 383.7 million year-on-year, despite an unstable dividend history and high non-cash earnings levels. Forecasts suggest strong annual profit growth of 25.1%, although slightly below the broader market's pace in China.

- Our comprehensive growth report raises the possibility that Zhejiang Sanmei Chemical IndustryLtd is poised for substantial financial growth.

- Get an in-depth perspective on Zhejiang Sanmei Chemical IndustryLtd's balance sheet by reading our health report here.

Hangzhou Zhongtai Cryogenic Technology (SZSE:300435)

Overview: Hangzhou Zhongtai Cryogenic Technology Corporation develops, designs, manufactures, and sells cryogenic equipment in China with a market cap of CN¥8.10 billion.

Operations: Revenue Segments (in millions of CN¥):

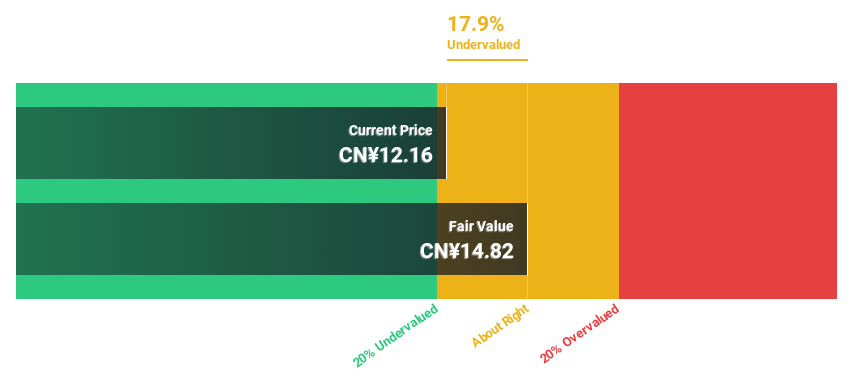

Estimated Discount To Fair Value: 38.9%

Hangzhou Zhongtai Cryogenic Technology is trading at CN¥21, well below its estimated fair value of CN¥34.38, indicating potential undervaluation based on cash flows. Despite a slight decline in sales and revenue for the first half of 2025 compared to last year, net income increased to CNY 134.7 million from CNY 123.42 million. The company’s earnings are projected to grow significantly at 58.4% annually, although its dividend yield remains low and not well-covered by earnings.

- In light of our recent growth report, it seems possible that Hangzhou Zhongtai Cryogenic Technology's financial performance will exceed current levels.

- Take a closer look at Hangzhou Zhongtai Cryogenic Technology's balance sheet health here in our report.

Turning Ideas Into Actions

- Reveal the 279 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sanmei Chemical IndustryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603379

Zhejiang Sanmei Chemical IndustryLtd

Zhejiang Sanmei Chemical Industry Co., Ltd.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives