- China

- /

- Real Estate

- /

- SHSE:600067

Asian Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As global markets closely watch central bank policies and economic indicators, Asian markets have been experiencing their own shifts, with China's stock market buoyed by retail investor enthusiasm and Japan's economy showing signs of stronger growth. In such a landscape, penny stocks—often representing smaller or emerging companies—continue to capture the interest of investors seeking unique opportunities. Despite being an older term, penny stocks remain relevant as they can offer significant potential for returns when backed by solid financials.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.96 | THB3.91B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.05 | HK$2.48B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.63 | HK$1.01B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.925 | SGD374.89M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.88 | THB2.93B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.15 | SGD12.4B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB5.00 | THB10.1B | ✅ 3 ⚠️ 3 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.425 | SGD159.22M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 977 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Xinjiang Xinxin Mining Industry (SEHK:3833)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinjiang Xinxin Mining Industry Co., Ltd. operates in the mining, ore processing, smelting, refining, and sale of nickel, copper, and other nonferrous metals with a market cap of HK$3.93 billion.

Operations: Xinjiang Xinxin Mining Industry Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$3.93B

Xinjiang Xinxin Mining Industry recently reported half-year earnings with revenue of CNY 1.12 billion, a slight increase from the previous year, but net income halved to CNY 71.65 million due to lower nickel prices and higher production costs. The company's debt is satisfactorily managed with a net debt to equity ratio of 16%, though operating cash flow coverage is weak at 14.4%. Despite stable weekly volatility and an experienced board, earnings have declined over the past five years by 10.5% annually, compounded by recent negative growth of -17.8%, highlighting challenges in sustaining profitability amidst industry fluctuations.

- Take a closer look at Xinjiang Xinxin Mining Industry's potential here in our financial health report.

- Explore historical data to track Xinjiang Xinxin Mining Industry's performance over time in our past results report.

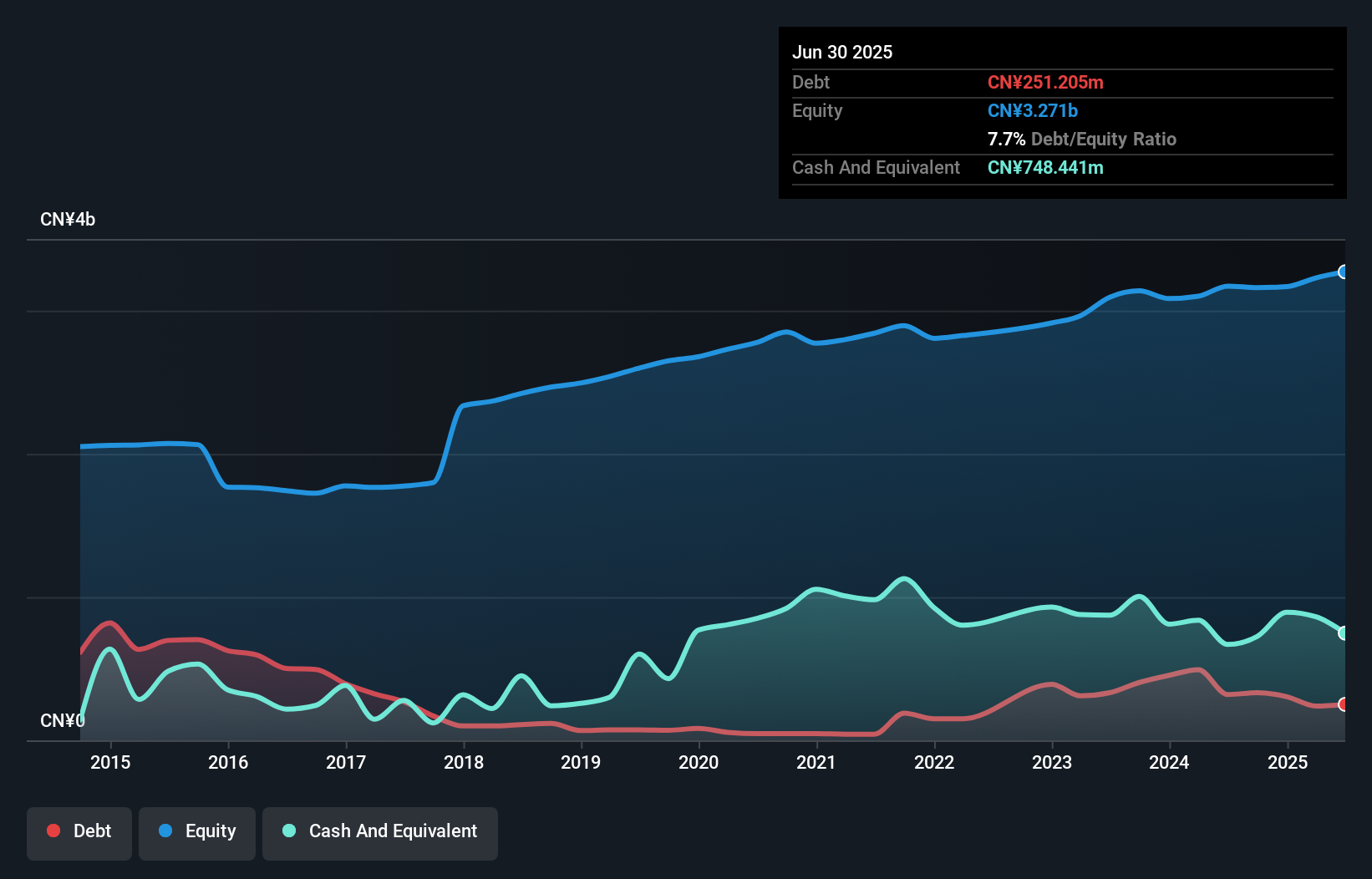

Citychamp Dartong Advanced Materials (SHSE:600067)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Citychamp Dartong Advanced Materials Co., Ltd. operates in the advanced materials sector and has a market capitalization of CN¥4.43 billion.

Operations: Citychamp Dartong Advanced Materials Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.43B

Citychamp Dartong Advanced Materials has shown improvement in its financial health, reducing its debt to equity ratio from 89.7% to 48.1% over five years, and maintaining a satisfactory net debt to equity ratio of 37.5%. The company reported revenue growth for the first half of 2025 with sales reaching CN¥4.54 billion, up from CN¥4.32 billion the previous year, and turned a profit with net income of CN¥19.57 million compared to a loss previously. Despite this progress, it remains unprofitable overall with negative return on equity at -8.79%, and dividends are not well covered by earnings at present levels.

- Get an in-depth perspective on Citychamp Dartong Advanced Materials' performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Citychamp Dartong Advanced Materials' track record.

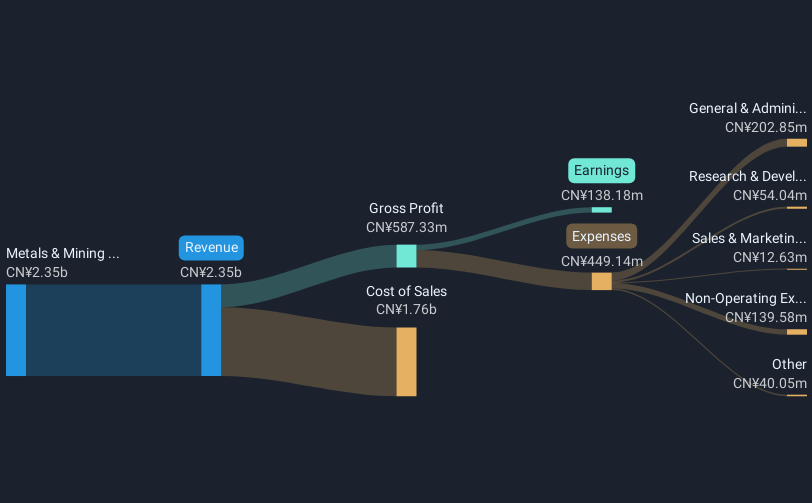

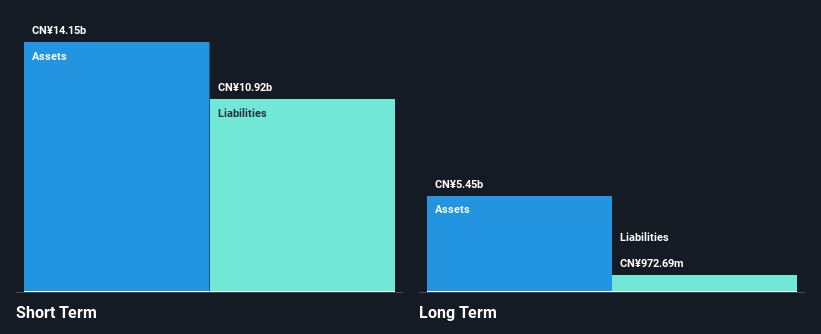

Shandong Mining Machinery Group (SZSE:002526)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Shandong Mining Machinery Group Co., Ltd. operates in the manufacturing and sale of mining machinery and equipment, with a market cap of CN¥7.60 billion.

Operations: The company generates its revenue primarily from Coal Machinery and Equipment (CN¥1.66 billion), followed by Intelligent Bulk Material Conveying Equipment (CN¥289.72 million), Printing Equipment (CN¥206.65 million), and Building Materials Machinery and Equipment (CN¥13.40 million).

Market Cap: CN¥7.6B

Shandong Mining Machinery Group's recent financial performance highlights a mixed picture. The company reported half-year revenue of CN¥1.05 billion, down from CN¥1.17 billion the previous year, yet net income improved to CN¥98.46 million from CN¥89.42 million, aided by a significant one-off gain of CN¥65.7 million. Earnings growth over the past year outpaced industry averages significantly, though return on equity remains low at 4.1%. The company's debt is well-managed with more cash than total debt and short-term assets exceeding liabilities, but its increased debt-to-equity ratio warrants attention for potential investors in penny stocks.

- Click to explore a detailed breakdown of our findings in Shandong Mining Machinery Group's financial health report.

- Understand Shandong Mining Machinery Group's track record by examining our performance history report.

Where To Now?

- Investigate our full lineup of 977 Asian Penny Stocks right here.

- Ready For A Different Approach? This technology could replace computers: discover the 25 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600067

Citychamp Dartong Advanced Materials

Citychamp Dartong Advanced Materials Co., Ltd.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives