- Singapore

- /

- Specialty Stores

- /

- SGX:C41

Asian Penny Stocks To Watch In July 2025

Reviewed by Simply Wall St

The Asian markets have been navigating a complex landscape, with recent U.S. tariffs on countries like Japan and South Korea capturing significant attention, yet the overall market response has remained relatively muted. Amidst these developments, investors are increasingly looking towards smaller companies for potential opportunities, where penny stocks—though an older term—still hold relevance as a niche investment area. These stocks often represent newer or smaller companies that can offer growth prospects at lower price points when supported by robust financial health and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.39 | HK$877.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.11 | HK$3.65B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.18 | HK$1.82B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.445 | SGD180.35M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.17 | HK$1.95B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.58 | THB2.75B | ✅ 3 ⚠️ 3 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.635 | SGD605.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.35 | SGD9.25B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.93 | THB1.37B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.23 | SGD46.51M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 976 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Golden Solar New Energy Technology Holdings (SEHK:1121)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Golden Solar New Energy Technology Holdings Limited is an investment holding company that manufactures and sells footwear products across various international markets, with a market cap of HK$2.85 billion.

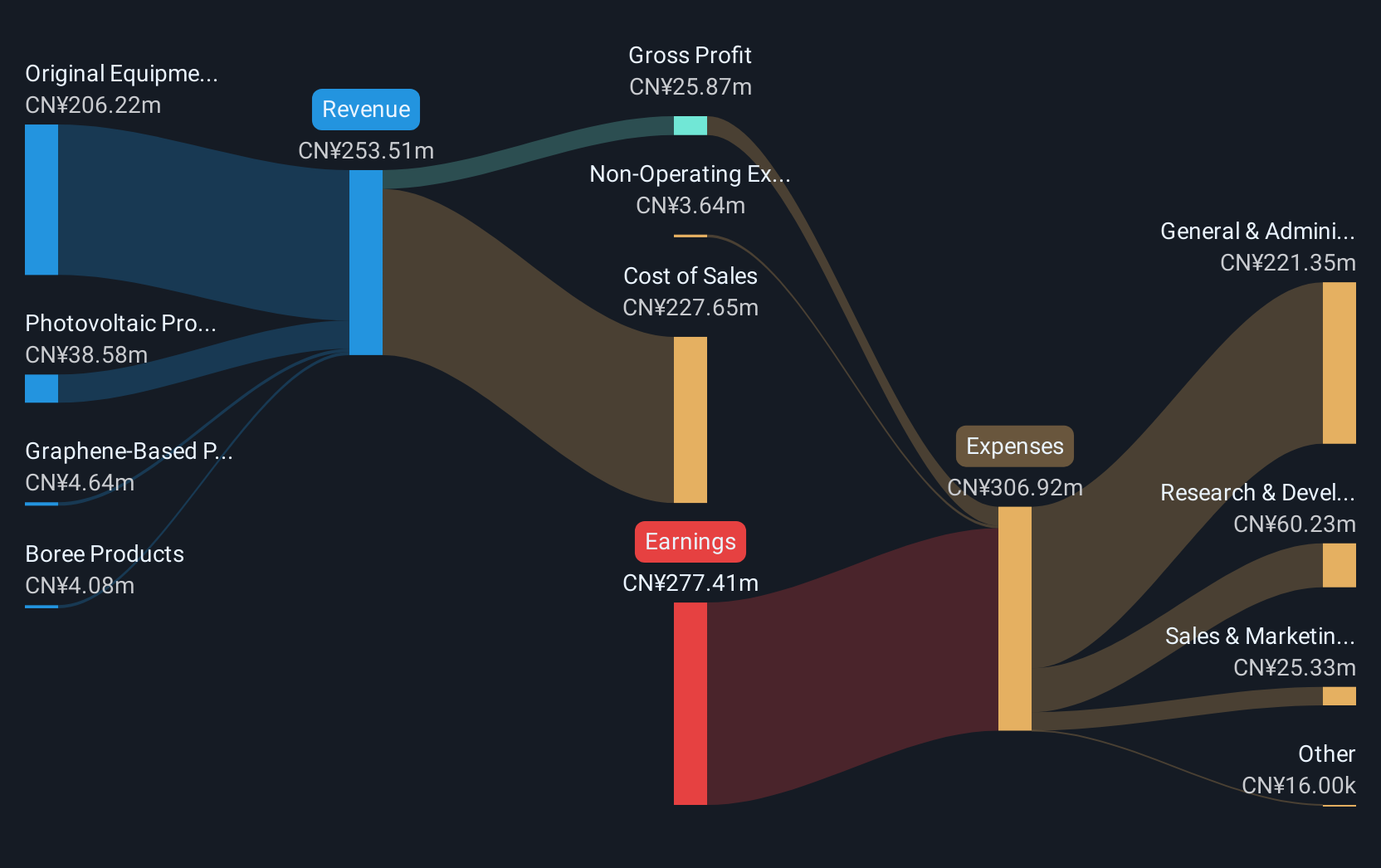

Operations: Golden Solar New Energy Technology Holdings generates revenue from several segments, including CN¥4.08 million from Boree Products, CN¥38.58 million from Photovoltaic Products, CN¥4.64 million from Graphene-Based Products, and CN¥206.22 million through Original Equipment Manufacturer (OEM) services.

Market Cap: HK$2.85B

Golden Solar New Energy Technology Holdings, with a market cap of HK$2.85 billion, faces challenges typical for penny stocks in Asia. Despite being unprofitable and having less than a year of cash runway, the company has improved its debt position significantly over five years. Recent strategic moves include a joint venture agreement to license its patented HBC solar cell technology to produce 4GW solar cells, potentially enhancing revenue streams through royalties. However, the company's negative return on equity and declining earnings highlight ongoing financial difficulties amidst these strategic efforts.

- Click here to discover the nuances of Golden Solar New Energy Technology Holdings with our detailed analytical financial health report.

- Gain insights into Golden Solar New Energy Technology Holdings' past trends and performance with our report on the company's historical track record.

Brii Biosciences (SEHK:2137)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brii Biosciences Limited is engaged in developing therapies for infectious and central nervous system diseases in China and the United States, with a market cap of approximately HK$1.51 billion.

Operations: The company's revenue is primarily generated from its Biotechnology segment, specifically focused on startups, amounting to CN¥54.99 million.

Market Cap: HK$1.51B

Brii Biosciences, with a market cap of HK$1.51 billion, is currently pre-revenue and unprofitable but has shown progress by reducing losses over the past five years. The company benefits from strong short-term asset coverage over liabilities and a cash runway exceeding three years. Recent developments include a licensing agreement with Joincare Pharmaceutical for BRII-693, potentially generating future milestone payments and royalties. Despite an inexperienced board, Brii's management team is seasoned, which may aid in navigating strategic partnerships like the one involving BRII-693 to bolster its financial position in the biotech sector.

- Get an in-depth perspective on Brii Biosciences' performance by reading our balance sheet health report here.

- Examine Brii Biosciences' earnings growth report to understand how analysts expect it to perform.

Cortina Holdings (SGX:C41)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cortina Holdings Limited is an investment holding company involved in the distribution and retailing of timepieces and accessories across Singapore, Malaysia, Thailand, Indonesia, Hong Kong, Taiwan, and internationally with a market cap of SGD581.18 million.

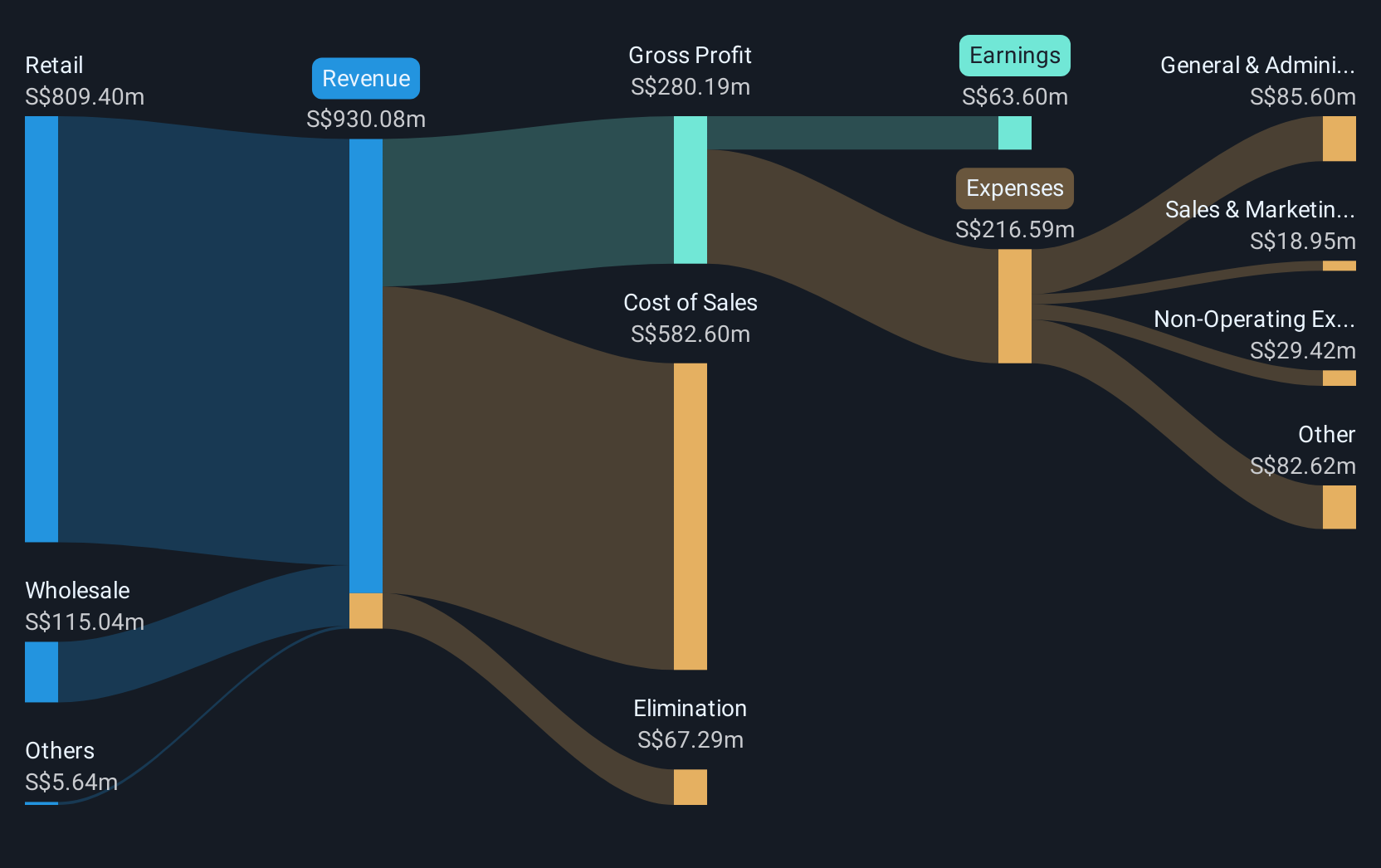

Operations: The company's revenue is primarily derived from its Retail segment, which accounts for SGD809.40 million, followed by the Wholesale segment contributing SGD115.04 million.

Market Cap: SGD581.18M

Cortina Holdings, with a market cap of SGD581.18 million, demonstrates solid financial health as its short-term assets cover both short and long-term liabilities. Despite not outperforming the Specialty Retail industry in recent earnings growth, it maintains high-quality earnings and a low price-to-earnings ratio of 9.1x compared to the SG market average. The company has increased its debt-to-equity ratio over five years but remains well-covered by operating cash flow and interest payments. Recent announcements include stable net income growth to SGD63.6 million and proposed dividends totaling 16 cents per share for the year ended March 31, 2025.

- Click to explore a detailed breakdown of our findings in Cortina Holdings' financial health report.

- Explore historical data to track Cortina Holdings' performance over time in our past results report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 973 Asian Penny Stocks now.

- Looking For Alternative Opportunities? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C41

Cortina Holdings

An investment holding company, engages in the distribution and retailing of timepieces and accessories in Singapore, Malaysia, Thailand, Indonesia, Hong Kong, Taiwan, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives