- Taiwan

- /

- Semiconductors

- /

- TWSE:2330

Asian Market Insights: 3 Stocks Including Suzhou Dongshan Precision Manufacturing That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets react to easing trade tensions and positive economic developments, Asian indices have shown resilience, with notable gains in key markets like China and Japan. In such an environment, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer growth potential when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| T'Way Air (KOSE:A091810) | ₩2025.00 | ₩4024.62 | 49.7% |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥111.64 | CN¥222.46 | 49.8% |

| SIGMAXYZ Holdings (TSE:6088) | ¥1221.00 | ¥2440.83 | 50% |

| Shanghai OPM Biosciences (SHSE:688293) | CN¥43.21 | CN¥85.97 | 49.7% |

| Prospect Logistics and Industrial Freehold and Leasehold Real Estate Investment Trust (SET:PROSPECT) | THB7.20 | THB14.35 | 49.8% |

| Maxscend Microelectronics (SZSE:300782) | CN¥69.87 | CN¥139.59 | 49.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥3375.00 | ¥6748.76 | 50% |

| Good Will Instrument (TWSE:2423) | NT$43.40 | NT$86.69 | 49.9% |

| Forum Engineering (TSE:7088) | ¥1195.00 | ¥2373.59 | 49.7% |

| Duk San NeoluxLtd (KOSDAQ:A213420) | ₩33600.00 | ₩66906.69 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

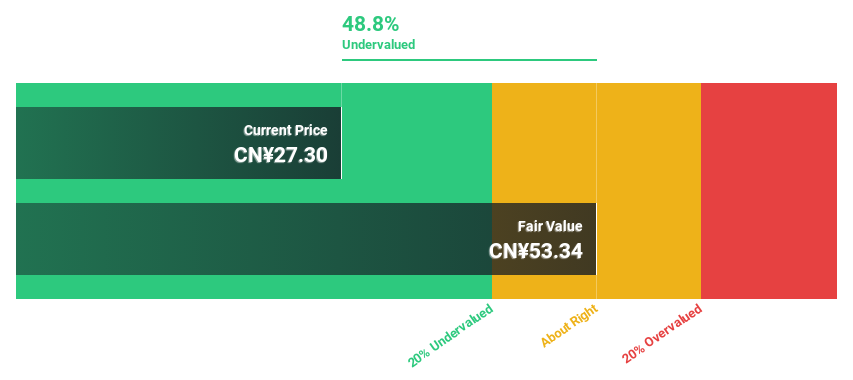

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. (SZSE:002384) operates in the precision manufacturing industry, with a market cap of CN¥72.18 billion.

Operations: The company generates revenue from its precision manufacturing operations, with a market cap of CN¥72.18 billion.

Estimated Discount To Fair Value: 23.4%

Suzhou Dongshan Precision Manufacturing is trading at CN¥39.6, significantly below its fair value estimate of CN¥51.72, indicating potential undervaluation based on cash flows. Despite a volatile share price recently, the company shows strong earnings growth prospects at 36.9% annually over the next three years, outpacing the Chinese market average of 23.5%. Recent events include a completed share buyback worth CNY 100 million and a dividend decrease approved in May 2025.

- In light of our recent growth report, it seems possible that Suzhou Dongshan Precision Manufacturing's financial performance will exceed current levels.

- Dive into the specifics of Suzhou Dongshan Precision Manufacturing here with our thorough financial health report.

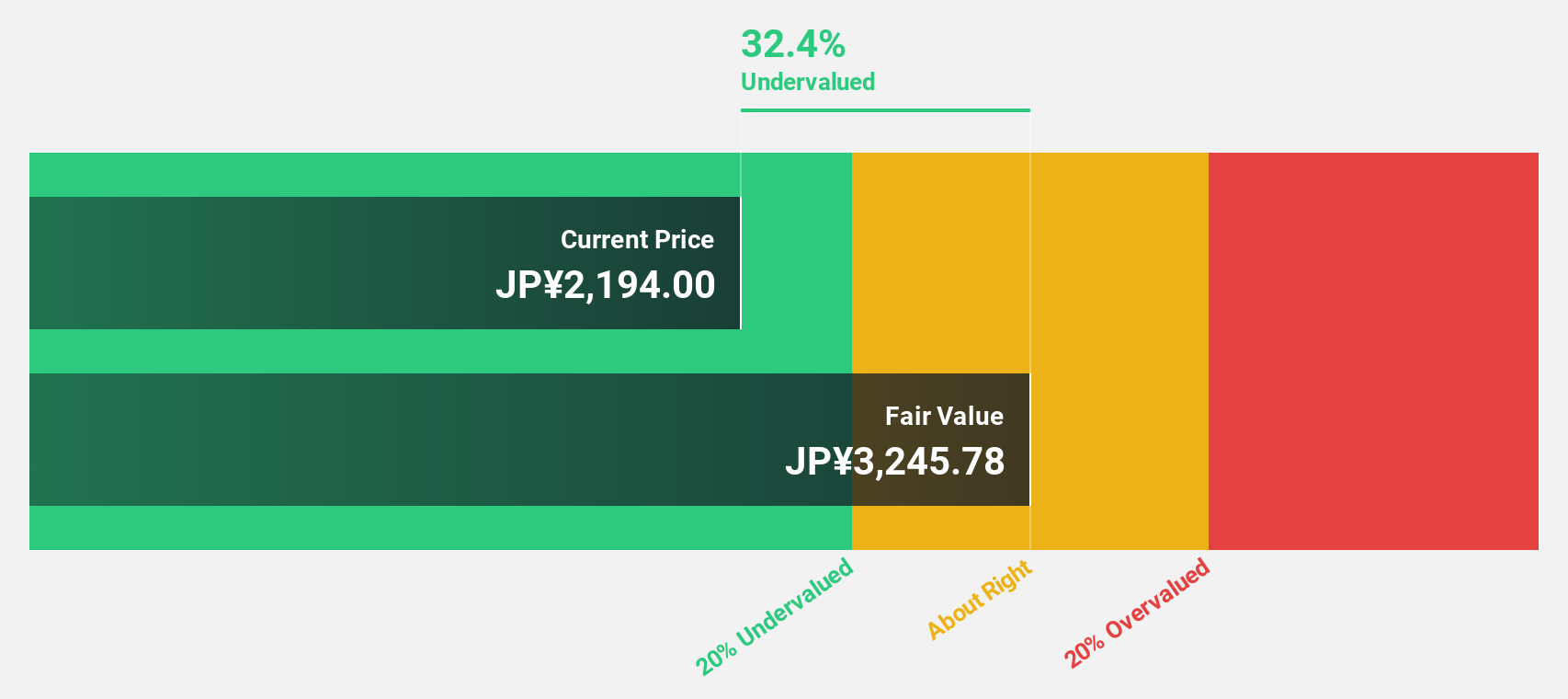

Future (TSE:4722)

Overview: Future Corporation offers IT consulting and services mainly in Japan, with a market cap of ¥204.73 billion.

Operations: The company's revenue is primarily derived from IT Consulting & Services, including package software and services, amounting to ¥63.38 billion, complemented by Business Innovation which contributes ¥8.85 billion.

Estimated Discount To Fair Value: 21.1%

Future Corporation is trading at ¥2310, below its estimated fair value of ¥2928.94, highlighting potential undervaluation based on cash flows. Earnings are projected to grow at 13.95% annually, surpassing the JP market's 7.5%. The company forecasts net sales of ¥76 billion and operating profit of ¥16.05 billion for 2025, with a dividend increase to ¥23 per share from last year's ¥21, reflecting solid financial health despite moderate revenue growth expectations.

- The analysis detailed in our Future growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Future stock in this financial health report.

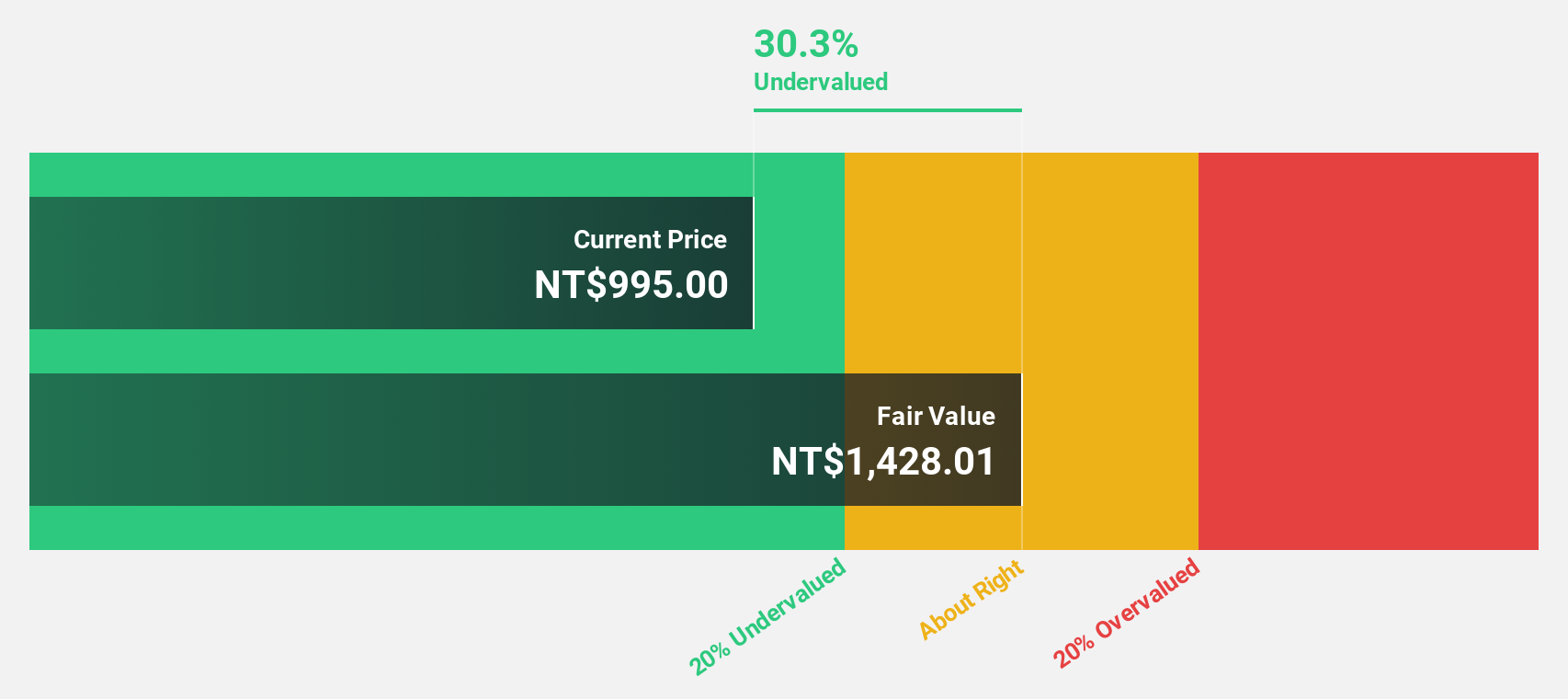

Taiwan Semiconductor Manufacturing (TWSE:2330)

Overview: Taiwan Semiconductor Manufacturing Company Limited, along with its subsidiaries, is engaged in the manufacturing, packaging, testing, and sale of integrated circuits and semiconductor devices globally with a market capitalization of NT$28.14 trillion.

Operations: The company's revenue primarily comes from its Foundry segment, which generated NT$3.14 billion.

Estimated Discount To Fair Value: 30.9%

Taiwan Semiconductor Manufacturing is trading at NT$1085, significantly below its estimated fair value of NT$1571.16, suggesting undervaluation based on cash flows. Recent revenue figures show substantial growth year-on-year, with May 2025 net revenue reaching TWD 320.52 billion compared to TWD 229.62 billion a year ago. Earnings are projected to grow at 14.09% annually, outpacing the Taiwan market's forecasted growth and demonstrating robust financial performance despite moderate revenue growth expectations.

- The growth report we've compiled suggests that Taiwan Semiconductor Manufacturing's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Taiwan Semiconductor Manufacturing.

Next Steps

- Discover the full array of 268 Undervalued Asian Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2330

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives