- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:3393

Asian Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As global markets respond to potential rate cuts by the Federal Reserve, Asian indices are experiencing a mix of optimism and caution, with Chinese stocks seeing notable gains amid improved U.S.-China trade ties. In this dynamic environment, dividend stocks in Asia present an attractive option for investors seeking stable income streams, particularly as market volatility highlights the value of consistent returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.01% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.76% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.87% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.90% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.39% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.11% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Daicel (TSE:4202) | 4.39% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

Click here to see the full list of 1047 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

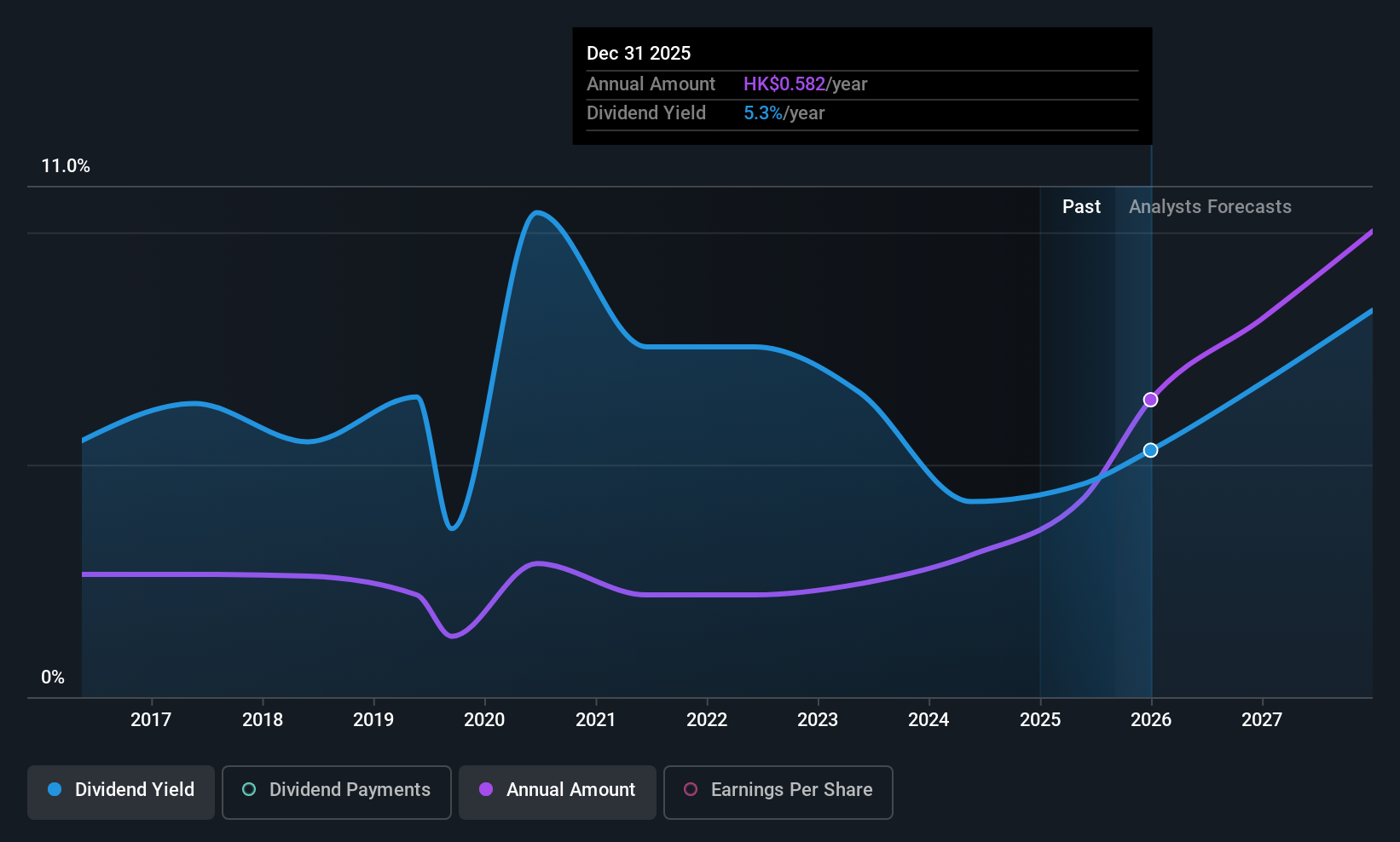

Wasion Holdings (SEHK:3393)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wasion Holdings Limited is an investment holding company involved in the research, development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries, with a market cap of HK$10.26 billion.

Operations: Wasion Holdings Limited generates revenue from energy metering and energy efficiency management solutions tailored for the energy supply sector.

Dividend Yield: 3.7%

Wasion Holdings' recent earnings report highlights a solid financial performance with sales reaching CNY 4.39 billion, up from CNY 3.74 billion a year ago, and net income at CNY 439.65 million compared to CNY 331.03 million previously. Despite trading below fair value and offering good relative value compared to peers, its dividend yield of 3.73% is lower than top-tier payers in Hong Kong, and dividends have been volatile over the past decade despite being covered by earnings (46% payout ratio) and cash flows (87.2% cash payout ratio).

- Unlock comprehensive insights into our analysis of Wasion Holdings stock in this dividend report.

- Our valuation report unveils the possibility Wasion Holdings' shares may be trading at a discount.

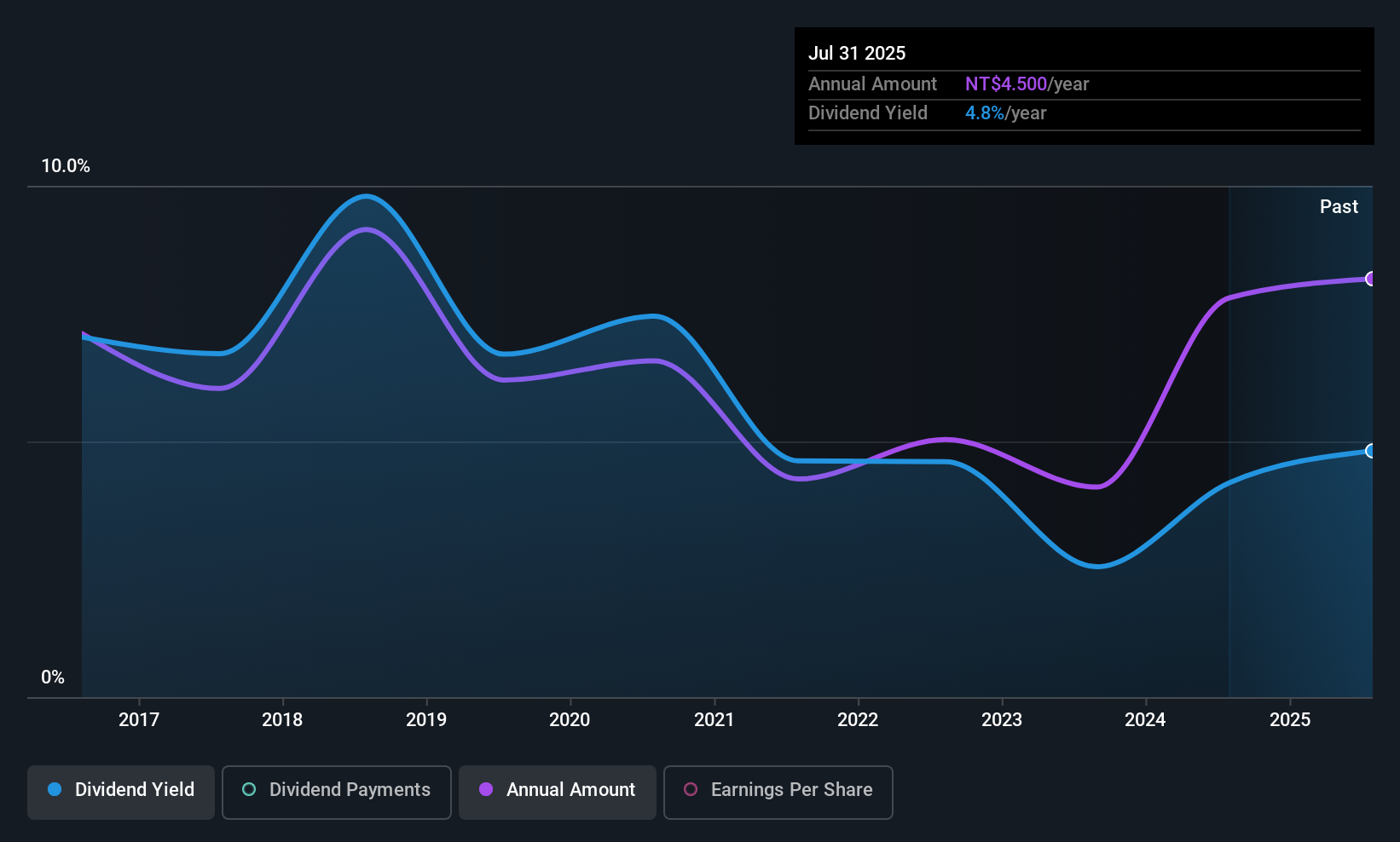

Axiomtek (TPEX:3088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Axiomtek Co., Ltd. designs, manufactures, and sells industrial computers and embedded platforms worldwide, with a market cap of NT$9.55 billion.

Operations: Axiomtek Co., Ltd. generates revenue through its operations in Europe (NT$763.23 million), Taiwan (NT$3.04 billion), and America (NT$2.97 billion).

Dividend Yield: 5.1%

Axiomtek's recent earnings report shows a challenging period with a net loss of TWD 30.69 million for Q2 2025, compared to a net income of TWD 166.35 million the previous year. Despite this, its price-to-earnings ratio suggests good value relative to the TW market. The dividend yield is slightly below top-tier payers, and while dividends are covered by both earnings (84.6% payout ratio) and cash flows (57.7% cash payout ratio), they have been volatile over the past decade.

- Dive into the specifics of Axiomtek here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Axiomtek shares in the market.

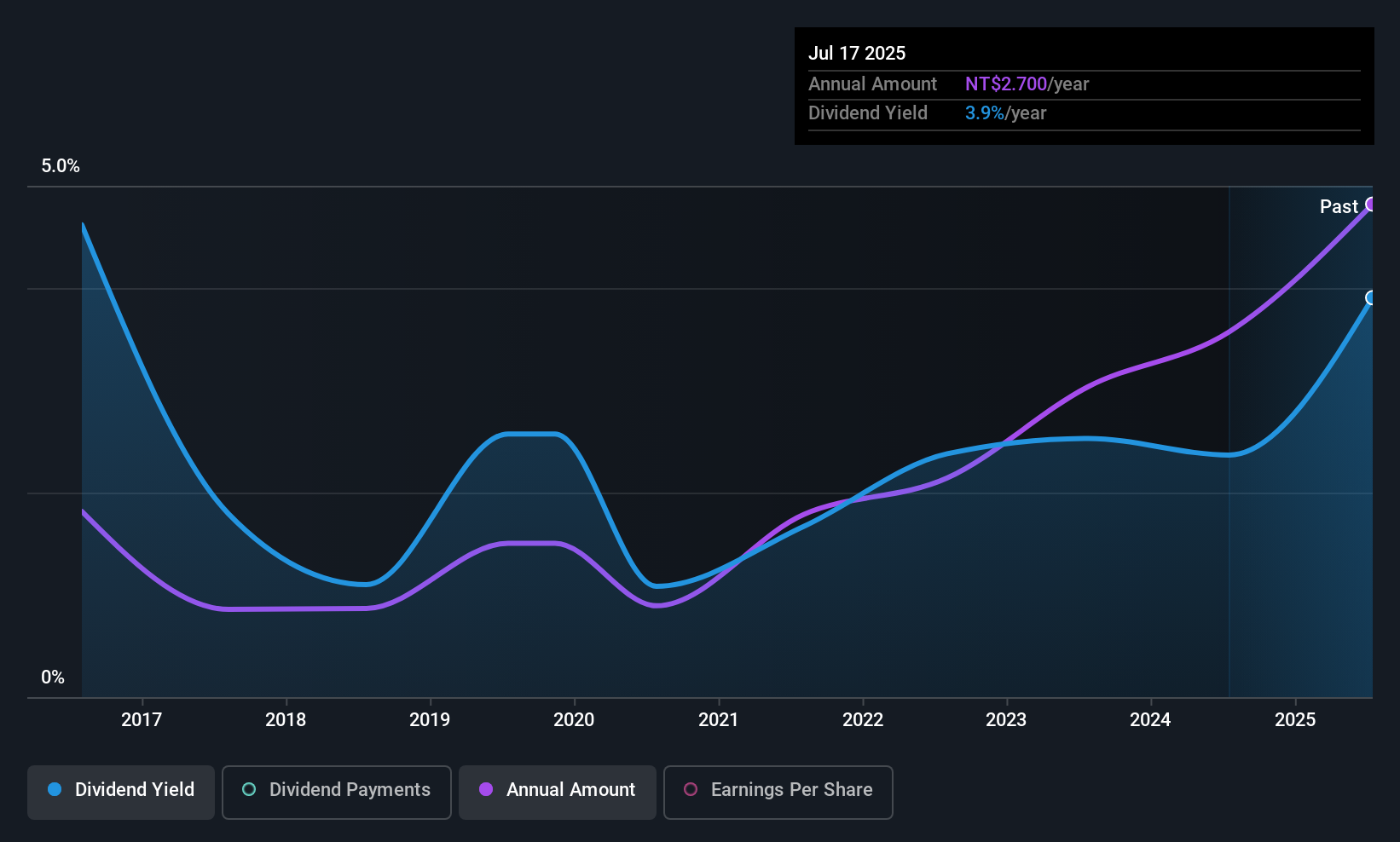

INPAQ Technology (TPEX:6284)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: INPAQ Technology Co., Ltd. specializes in circuit protection components and antenna products for sectors such as computing, communication, consumer electronics, and automotive electronics across Taiwan, China, Hong Kong, and globally with a market cap of NT$9.96 billion.

Operations: INPAQ Technology Co., Ltd. generates revenue through its offerings in circuit protection components and antenna products, serving the computing, communication, consumer electronics, and automotive electronics sectors across various regions including Taiwan, China, Hong Kong, and international markets.

Dividend Yield: 4%

INPAQ Technology's dividend payments, while covered by earnings (60.5% payout ratio) and cash flows (37.8% cash payout ratio), have been volatile over the past decade, with recent increases approved for TWD 2.7 per share. Despite a net loss of TWD 49.75 million in Q2 2025, sales grew to TWD 2 billion from TWD 1.81 billion a year ago. The dividend yield of 4.01% is lower than top-tier payers in Taiwan's market, amid leadership changes and bylaw amendments this year.

- Navigate through the intricacies of INPAQ Technology with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, INPAQ Technology's share price might be too pessimistic.

Where To Now?

- Embark on your investment journey to our 1047 Top Asian Dividend Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wasion Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3393

Wasion Holdings

An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives