- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1184

Asian Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As global markets react to inflation data and interest rate speculations, Asian stock markets are experiencing notable shifts, driven by easing trade tensions and strong economic indicators in countries like Japan and China. In this dynamic environment, dividend stocks can offer a stable income stream for investors seeking to navigate market fluctuations while potentially benefiting from the region's economic resilience.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.09% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.61% | ★★★★★★ |

| NCD (TSE:4783) | 4.62% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 3.94% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

Click here to see the full list of 1068 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

S.A.S. Dragon Holdings (SEHK:1184)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S.A.S. Dragon Holdings Limited is an investment holding company that offers electronic supply chain services across various regions, including Hong Kong, Mainland China, Taiwan, the United States, Vietnam, Singapore, and Macao; it has a market cap of approximately HK$3.19 billion.

Operations: S.A.S. Dragon Holdings Limited generates revenue primarily from the distribution of electronic components and semiconductor products, amounting to HK$27.76 billion.

Dividend Yield: 7.9%

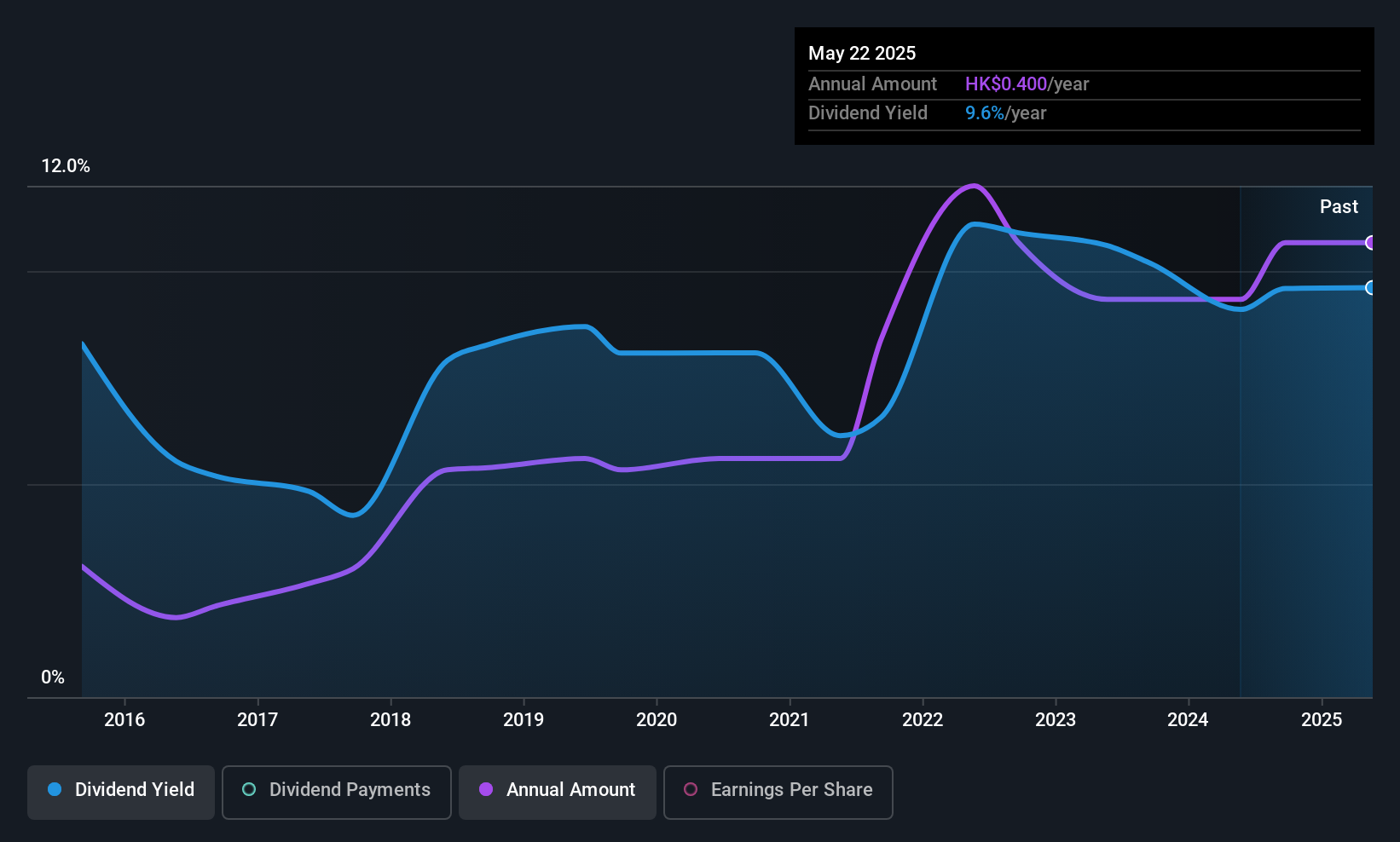

S.A.S. Dragon Holdings offers a high dividend yield of 7.86%, placing it in the top 25% of Hong Kong dividend payers, though its dividends have been volatile over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows with payout ratios below 50%. Recent board changes and a final dividend approval of HK$25 per share highlight ongoing shareholder focus, yet investors should weigh the historical volatility against current yield benefits.

- Get an in-depth perspective on S.A.S. Dragon Holdings' performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that S.A.S. Dragon Holdings is trading behind its estimated value.

SITC International Holdings (SEHK:1308)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SITC International Holdings Company Limited is a shipping logistics company that provides integrated transportation and logistics solutions across Mainland China, Hong Kong, Taiwan, Japan, Southeast Asia, and internationally with a market cap of approximately HK$78.84 billion.

Operations: SITC International Holdings generates revenue from its Transportation - Shipping segment, which amounts to $3.42 billion.

Dividend Yield: 7.3%

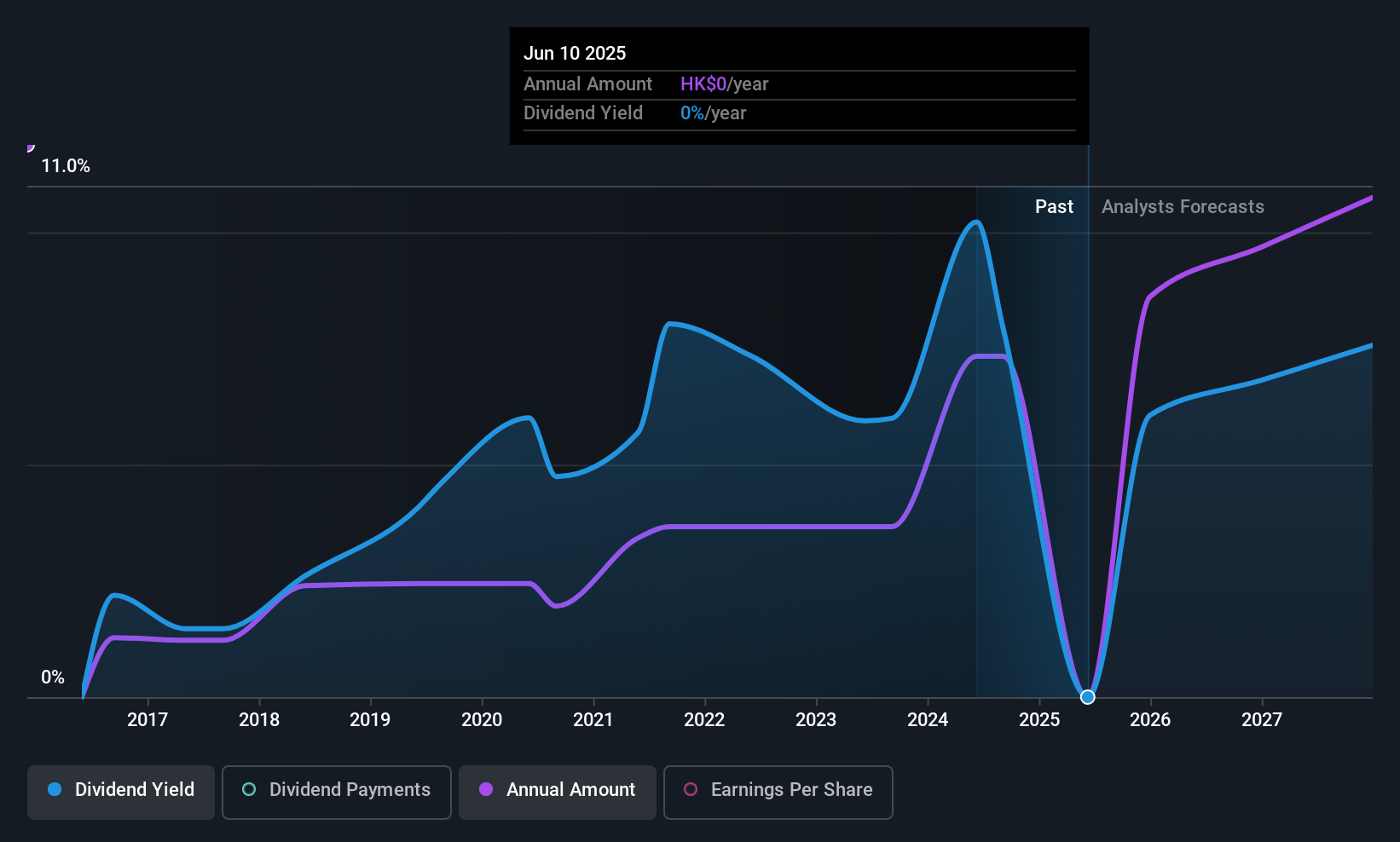

SITC International Holdings declared an interim dividend of HK$1.3 per share, with a history of volatile dividends over the past decade. Despite this, the current payout ratio of 71.3% ensures dividends are covered by earnings and cash flows at an 81.9% cash payout ratio. Recent earnings growth to US$630 million for H1 2025 supports dividend sustainability, though future earnings are projected to decline. The dividend yield remains attractive within Hong Kong's top quartile payers.

- Dive into the specifics of SITC International Holdings here with our thorough dividend report.

- Our expertly prepared valuation report SITC International Holdings implies its share price may be lower than expected.

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consun Pharmaceutical Group Limited focuses on the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China, with a market cap of HK$12.33 billion.

Operations: Consun Pharmaceutical Group's revenue is derived from its Consun Pharmaceutical Segment, generating CN¥2.53 billion, and the Yulin Pharmaceutical Segment, contributing CN¥442.84 million.

Dividend Yield: 4%

Consun Pharmaceutical Group announced an interim dividend of HKD 0.33 per share, reflecting a stable payout ratio with dividends covered by earnings at 50.8% and cash flows at 46.3%. Despite a history of volatile dividends, recent earnings growth to CNY 498.3 million for H1 2025 enhances sustainability prospects. Trading below estimated fair value offers potential upside, though the dividend yield remains modest compared to top payers in Hong Kong's market.

- Navigate through the intricacies of Consun Pharmaceutical Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Consun Pharmaceutical Group's current price could be quite moderate.

Seize The Opportunity

- Explore the 1068 names from our Top Asian Dividend Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1184

S.A.S. Dragon Holdings

An investment holding company, provides electronic supply chain services in Hong Kong, Mainland China, Taiwan, the United States, Vietnam, Singapore, Macao, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives