As global markets grapple with volatility and economic uncertainties, the Asian market has shown resilience, with investors closely watching developments in China and Japan. In this environment, dividend stocks can offer a stable income stream and potential for growth, making them an attractive option for those looking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| en-japan (TSE:4849) | 4.32% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.02% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.23% | ★★★★★★ |

| Daicel (TSE:4202) | 4.94% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.38% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.72% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.99% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

Click here to see the full list of 1251 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

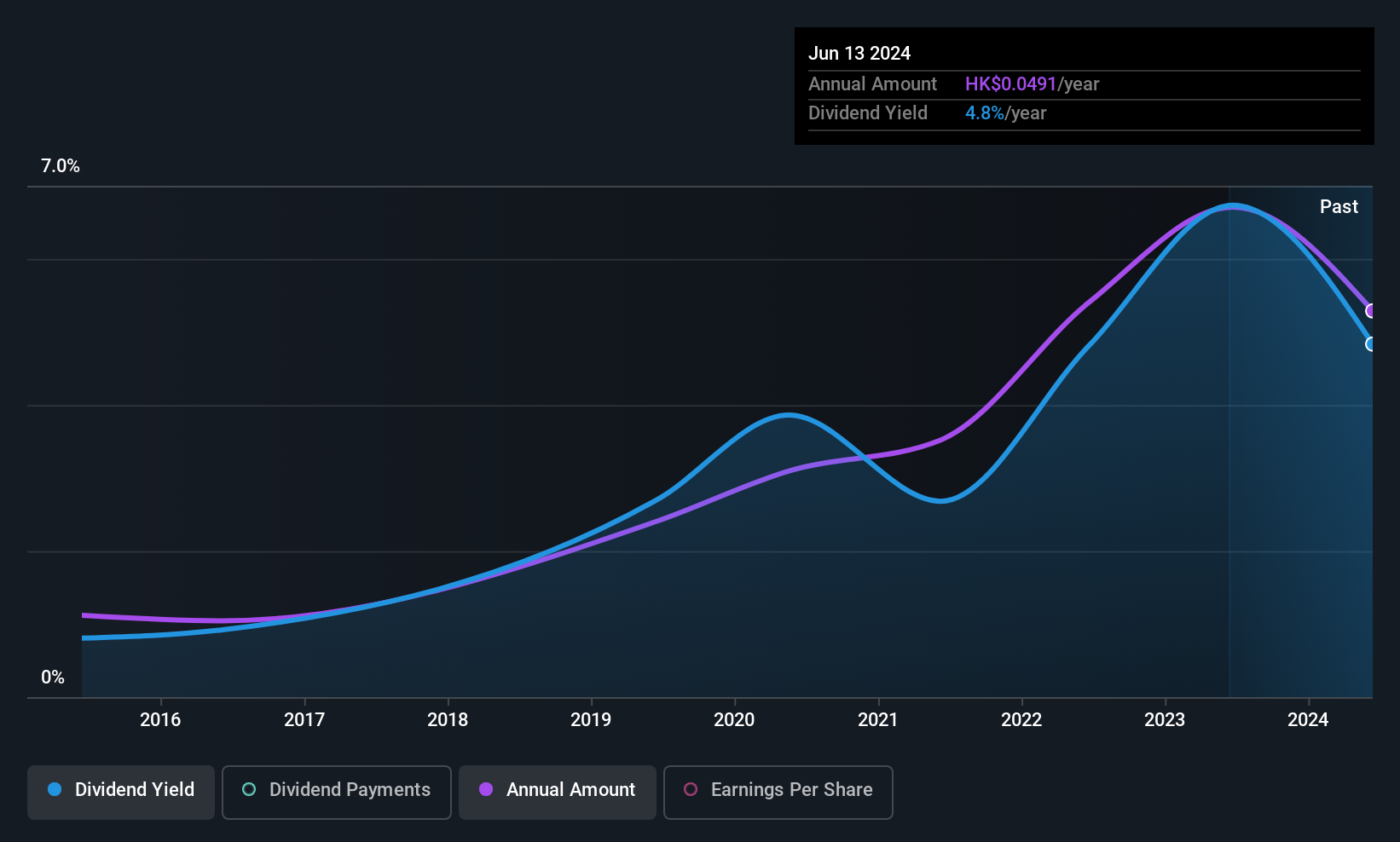

Sinofert Holdings (SEHK:297)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sinofert Holdings Limited is an investment holding company involved in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products both in Mainland China and internationally, with a market cap of HK$9.41 billion.

Operations: Sinofert Holdings Limited's revenue is derived from three main segments: Production (CN¥5.29 billion), Basic Business (CN¥14.05 billion), and Growth Business (CN¥10.85 billion).

Dividend Yield: 4.3%

Sinofert Holdings' dividend payments have been volatile over the past decade, with a current yield of 4.3%, which is low compared to the top 25% of Hong Kong dividend payers. However, dividends are well-covered by earnings and cash flows, with payout ratios of 35% and 47.4%, respectively. The company recently announced an increased final cash dividend for 2024, supported by strong earnings growth from CNY 625.55 million to CNY 1,061.48 million year-over-year.

- Unlock comprehensive insights into our analysis of Sinofert Holdings stock in this dividend report.

- According our valuation report, there's an indication that Sinofert Holdings' share price might be on the cheaper side.

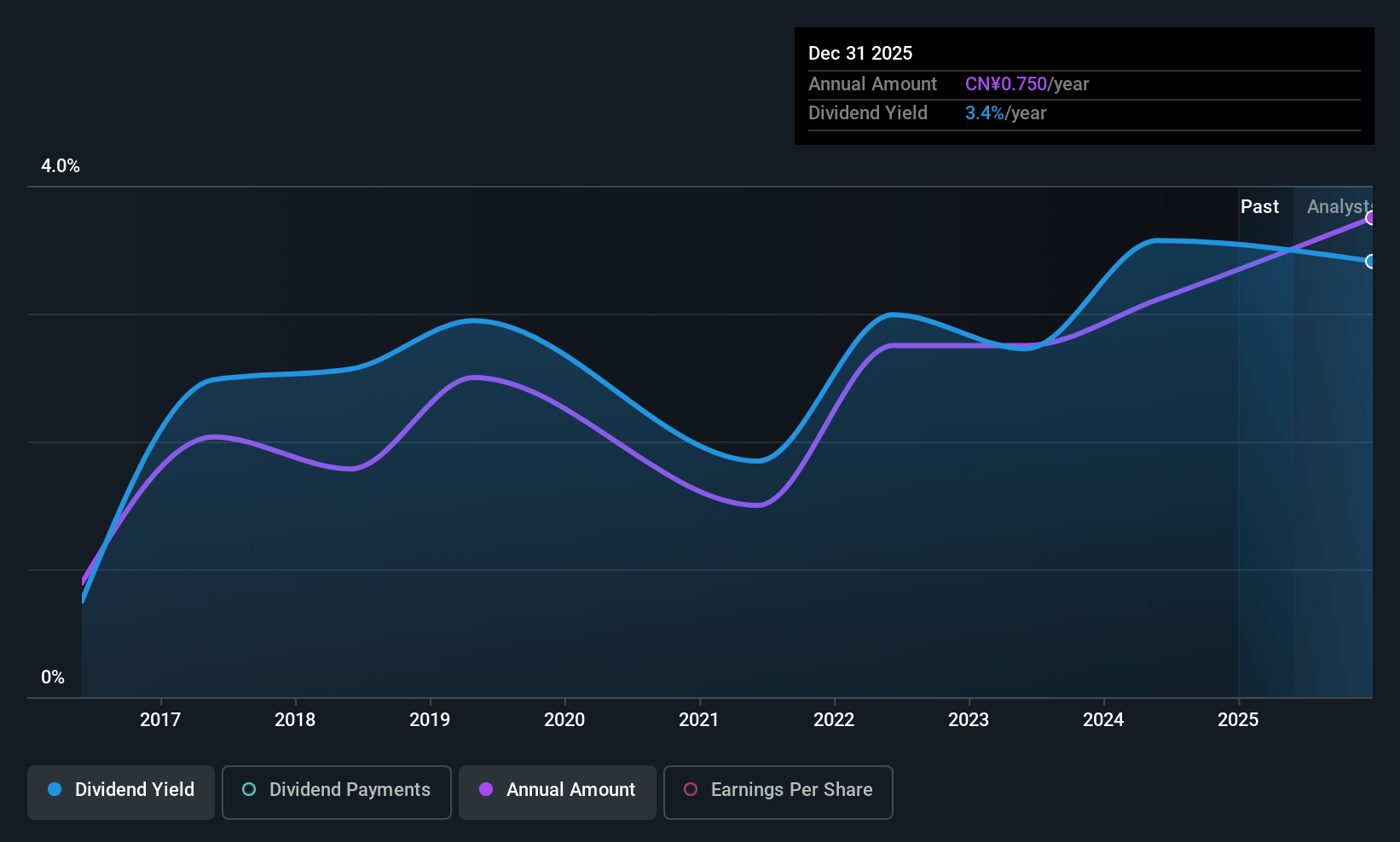

Noblelift Intelligent EquipmentLtd (SHSE:603611)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Noblelift Intelligent Equipment Co., Ltd. operates in the intelligent manufacturing equipment and smart logistics system sectors both in China and globally, with a market capitalization of approximately CN¥5.47 billion.

Operations: Noblelift Intelligent Equipment Co., Ltd. generates revenue through its operations in intelligent manufacturing equipment and smart logistics systems, serving both domestic and international markets.

Dividend Yield: 4.2%

Noblelift Intelligent Equipment's dividend yield ranks in the top 25% of Chinese market payers, although its payments have been volatile over the past decade. Despite this, dividends are covered by earnings and cash flows with payout ratios of 49.3% and 66.2%, respectively. Recent earnings show a net income increase to CNY 122.71 million for Q1 2025, suggesting potential support for future dividends amidst a backdrop of fluctuating revenue figures.

- Navigate through the intricacies of Noblelift Intelligent EquipmentLtd with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Noblelift Intelligent EquipmentLtd's share price might be too pessimistic.

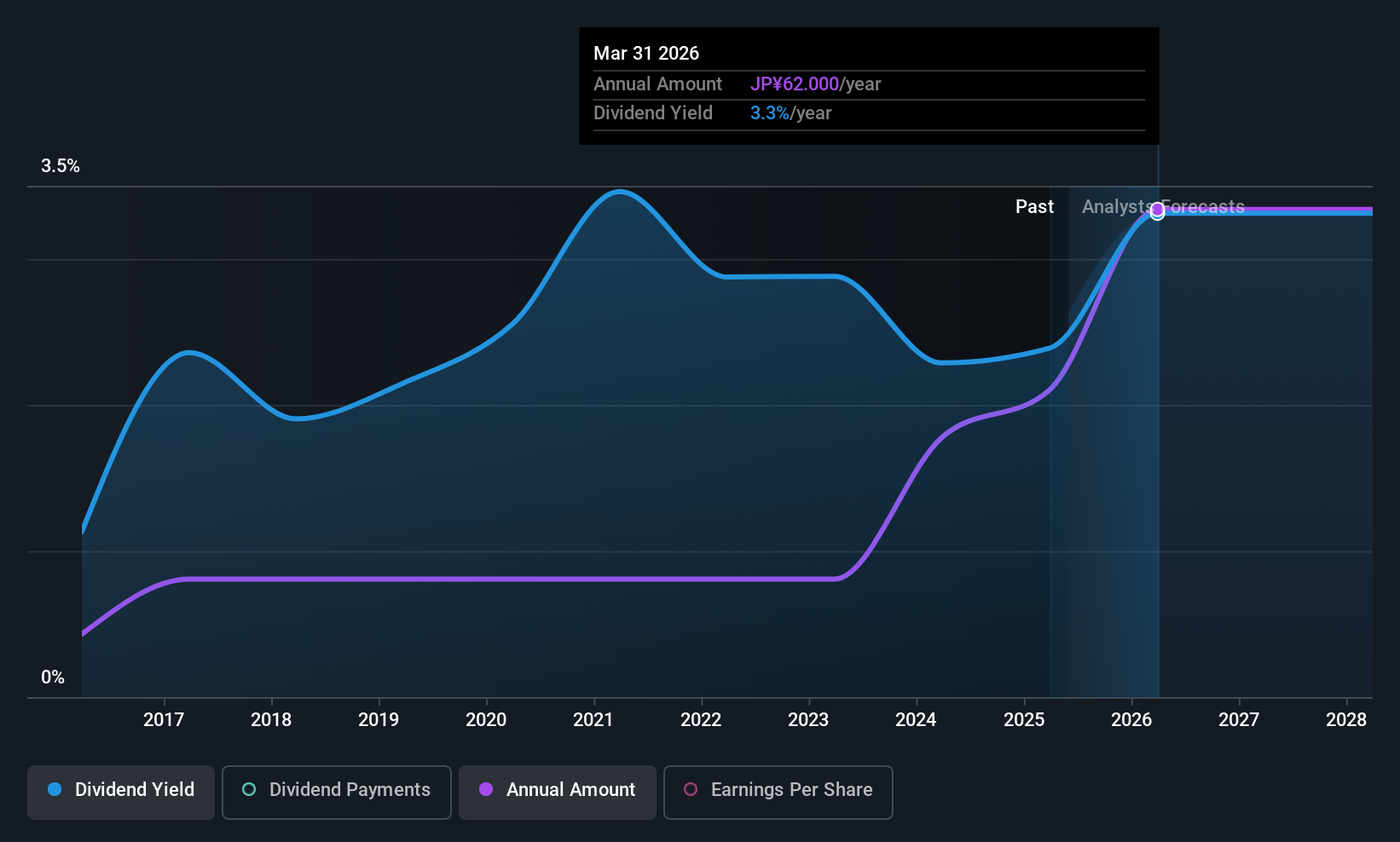

Daihatsu Infinearth Mfg.Co.Ltd (TSE:6023)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daihatsu Infinearth Mfg. Co., Ltd, with a market cap of ¥47.55 billion, manufactures and sells marine engines, land engines, and industrial instruments both in Japan and internationally.

Operations: Daihatsu Infinearth Mfg. Co., Ltd generates revenue from its Marine Engine segment, which contributes ¥72.95 billion, and its Land Engine Related segment, contributing ¥11.54 billion.

Dividend Yield: 3.3%

Daihatsu Diesel Mfg. Co., Ltd. offers a stable dividend with recent increases from ¥49.00 to ¥62.00 per share, supported by a sustainable payout ratio of 34.3%. Despite trading at a significant discount to its estimated fair value and experiencing share price volatility, its dividends have been reliable over the past decade, covered by both earnings and cash flows (55.8%). Recent strategic moves include completing a buyback and an acquisition by Imabari Shipbuilding Co., Ltd., enhancing shareholder value prospects.

- Click here to discover the nuances of Daihatsu Infinearth Mfg.Co.Ltd with our detailed analytical dividend report.

- Our valuation report here indicates Daihatsu Infinearth Mfg.Co.Ltd may be undervalued.

Turning Ideas Into Actions

- Discover the full array of 1251 Top Asian Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:297

Sinofert Holdings

An investment holding company, engages in the production, import and export, distribution, and retail of fertilizer raw materials and crop nutrition products in Mainland China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives