- United States

- /

- Hospitality

- /

- NasdaqGM:ARKR

Ark Restaurants Corp. (NASDAQ:ARKR) Is Yielding 4.9% - But Is It A Buy?

Dividend paying stocks like Ark Restaurants Corp. (NASDAQ:ARKR) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

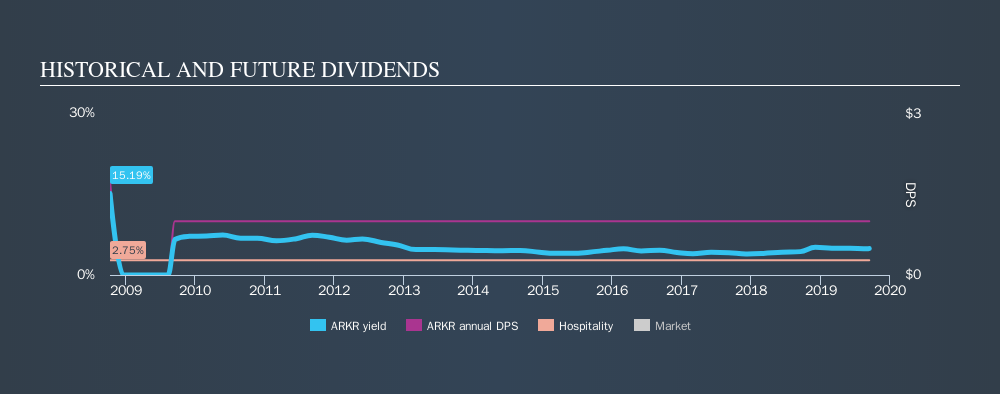

With Ark Restaurants yielding 4.9% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. We'd guess that plenty of investors have purchased it for the income. Some simple research can reduce the risk of buying Ark Restaurants for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Ark Restaurants!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Ark Restaurants paid out 82% of its profit as dividends. It's paying out most of its earnings, which limits the amount that can be reinvested in the business. This may indicate limited need for further capital within the business, or highlight a commitment to paying a dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Ark Restaurants paid out 59% of its cash flow as dividends last year, which is within a reasonable range for the average corporation. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Ark Restaurants has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut by more than 20% on at least one occasion historically. During the past ten-year period, the first annual payment was US$1.76 in 2009, compared to US$1.00 last year. This works out to be a decline of approximately 5.5% per year over that time. Ark Restaurants's dividend has been cut sharply at least once, so it hasn't fallen by 5.5% every year, but this is a decent approximation of the long term change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Ark Restaurants's EPS are effectively flat over the past five years. Flat earnings per share are acceptable for a time, but over the long term, the purchasing power of the company's dividends could be eroded by inflation. Ark Restaurants's earnings per share have barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. When the rate of return on reinvestment opportunities falls below a certain minimum level, companies often elect to pay a larger dividend instead. This is why many mature companies often have larger dividend yields.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Ark Restaurants's is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. Unfortunately, the company has not been able to generate earnings growth, and cut its dividend at least once in the past. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Ark Restaurants out there.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in Ark Restaurants stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:ARKR

Ark Restaurants

Through its subsidiaries, owns and operates restaurants and bars in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives