- United States

- /

- Insurance

- /

- NasdaqGS:ACGL

Arch Capital Group (NasdaqGS:ACGL) Integrates Wilqo Into Charlie Platform For Enhanced Rate Quotes

Reviewed by Simply Wall St

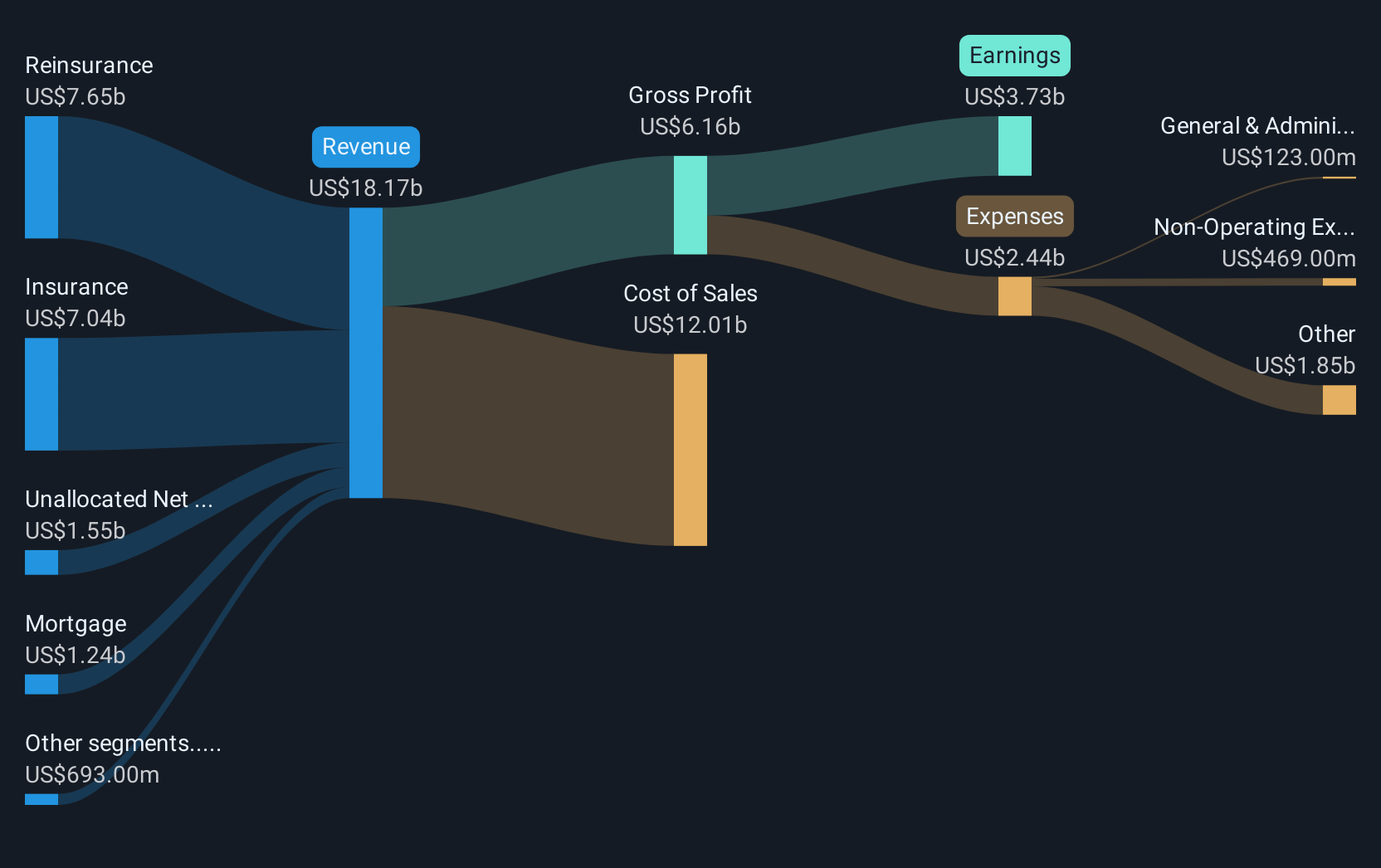

Arch Capital Group (NasdaqGS:ACGL) recently announced the integration of Arch Mortgage Insurance's rate quote capabilities with Wilqo into their Charlie platform, potentially enhancing the mortgage lending process. This development was part of the factors contributing to the company's stock price increase of 3% over the last quarter. The period also saw the declaration of preferred dividends and a share buyback update, while their Q1 earnings reported a drop in net income despite a rise in revenue. Amid fluctuating market conditions marked by both trade tensions and record gains, these developments likely provided support for the broader direction of the company's price movement.

We've spotted 2 weaknesses for Arch Capital Group you should be aware of.

The integration of Arch Mortgage Insurance's rate quote capabilities into the Charlie platform could enhance Arch Capital Group's operational efficiency, potentially leading to improved revenue streams and earnings consistency over time. This initiative aligns with Arch's focus on data-driven risk selection, which may refine underwriting profitability and bolster long-term profit margins. Such developments seem poised to strengthen the company's strategic cycle management, addressing uncertainties and enabling potentially favorable capital allocation across its offerings.

Looking at Arch Capital Group's longer-term performance, shares have exhibited a remarkable total return of 180.36% over the past five years. However, on an annual basis, the company underperformed both the US Insurance industry, which saw an 18.5% return, and the broader US market, which returned 11.5%. Despite this, the five-year total return reflects a robust performance, signaling resilience in more extended time frames despite short-term challenges.

In terms of market positioning, Arch Capital's current share price of US$93.00 is approximately 16.9% below the consensus price target of US$111.86, suggesting potential room for appreciation should the company's earnings and revenue align with forecasts. Analysts expect Arch's earnings to grow moderately to US$3.9 billion by 2028, with a slight decline in profit margins to 20.4%. Revenue forecasts indicate a modest growth trajectory, supported by demand in casualty lines and reinsurance markets. The recent integration initiative can be seen as a stepping stone toward achieving these financial targets and aligning the stock closer to its price target, provided market conditions progress as anticipated.

Review our historical performance report to gain insights into Arch Capital Group's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACGL

Arch Capital Group

Provides insurance, reinsurance, and mortgage insurance products in the United States, Canada, Bermuda, the United Kingdom, Europe, and Australia.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives