- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

Alibaba Health Information Technology And 2 Other Asian Penny Stocks To Watch

Reviewed by Simply Wall St

As global markets navigate a landscape marked by steady interest rates and mixed economic signals, investors are increasingly turning their attention to emerging opportunities in Asia. Penny stocks, though often overlooked, continue to offer intriguing prospects for those seeking growth potential in smaller or newer companies. With the right financial backing, these stocks can present unique opportunities for value and growth that larger firms might miss.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.101 | SGD42.92M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.25 | HK$788.69M | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.10 | HK$1.84B | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.34 | THB2.6B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.174 | SGD34.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.10 | SGD850.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.62 | HK$52.93B | ✅ 4 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,015 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, pharmaceutical e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of approximately HK$73.64 billion.

Operations: The company generated CN¥30.60 billion in revenue from its distribution and development of pharmaceutical and healthcare segment.

Market Cap: HK$73.64B

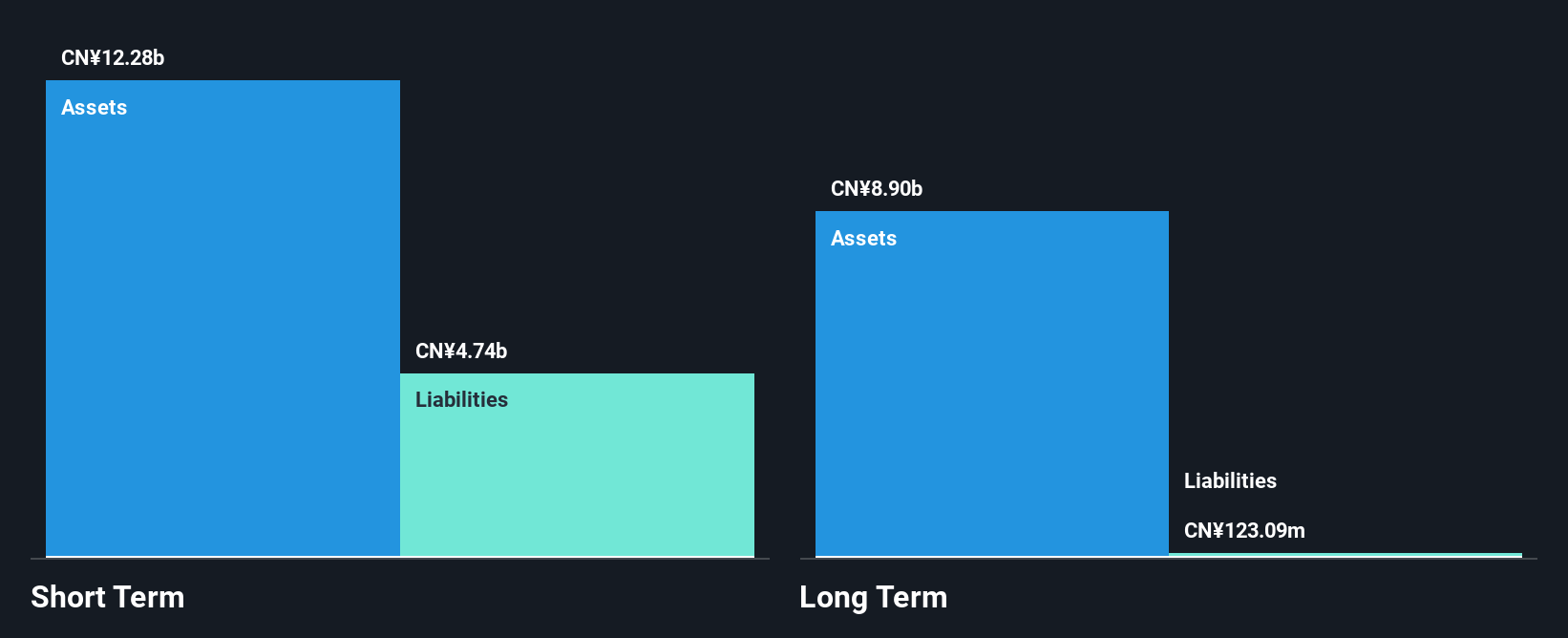

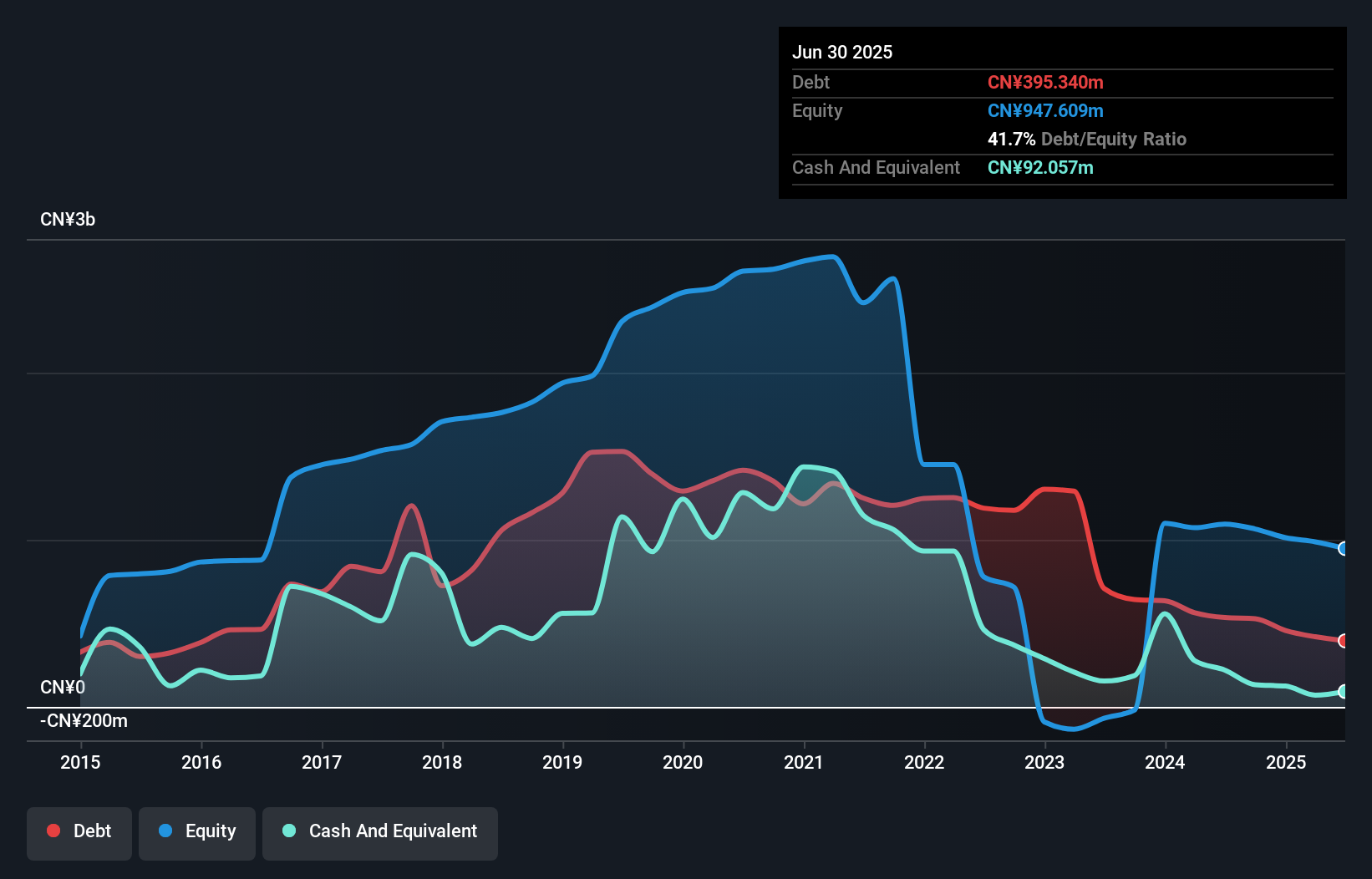

Alibaba Health Information Technology Limited has demonstrated strong financial performance with revenues reaching CN¥30.60 billion and net income of CN¥1.43 billion for the year ending March 31, 2025. The company shows robust earnings growth, outpacing the industry average and achieving a significant increase in profit margins from last year. Despite its low return on equity at 8.8%, Alibaba Health is debt-free, reducing financial risk, and its short-term assets comfortably cover both short-term and long-term liabilities. However, recent results were impacted by a large one-off loss of CN¥398.8 million affecting past earnings quality.

- Get an in-depth perspective on Alibaba Health Information Technology's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Alibaba Health Information Technology's future.

Shanghai Trendzone Holdings GroupLtd (SHSE:603030)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shanghai Trendzone Holdings Group Co., Ltd, with a market cap of CN¥3.63 billion, offers integrated solutions in design, construction, production, and services both in China and internationally.

Operations: Shanghai Trendzone Holdings Group Co., Ltd has not reported specific revenue segments.

Market Cap: CN¥3.63B

Shanghai Trendzone Holdings Group Co., Ltd has shown a decline in revenue from CN¥1.04 billion to CN¥781.93 million over the past year, with a net loss of CN¥110.14 million, indicating financial challenges despite its market cap of CN¥3.63 billion. The company's short-term assets exceed both its short and long-term liabilities, suggesting liquidity strength, yet it struggles with profitability and has less than a year of cash runway based on current free cash flow trends. While debt levels have improved, volatility remains high and earnings growth is elusive due to ongoing losses and negative return on equity at -9.78%.

- Jump into the full analysis health report here for a deeper understanding of Shanghai Trendzone Holdings GroupLtd.

- Understand Shanghai Trendzone Holdings GroupLtd's track record by examining our performance history report.

Leo Group (SZSE:002131)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Leo Group Co., Ltd., with a market cap of CN¥22.01 billion, operates in China through its subsidiaries by researching, developing, manufacturing, and selling pumps and garden machinery products.

Operations: Leo Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥22.01B

Leo Group Co., Ltd. has faced financial challenges, with earnings declining by 33.2% annually over the past five years and a significant one-off loss of CN¥388.7 million affecting recent results. Despite this, its short-term assets of CN¥14.3 billion comfortably cover both short and long-term liabilities, indicating strong liquidity. The company reported a net income of CN¥108.03 million for Q1 2025, recovering from a previous net loss, yet profit margins remain low at 0.4%. While debt levels have increased to a debt-to-equity ratio of 25.6%, cash reserves exceed total debt, providing some financial stability amidst high volatility and low return on equity at 0.3%.

- Navigate through the intricacies of Leo Group with our comprehensive balance sheet health report here.

- Explore historical data to track Leo Group's performance over time in our past results report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1,015 Asian Penny Stocks by using our screener here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives