- United States

- /

- Software

- /

- NasdaqGS:SNPS

AI Innovation in RF Design Migration: Synopsys (NasdaqGS:SNPS) Partners with Keysight Technologies

Reviewed by Simply Wall St

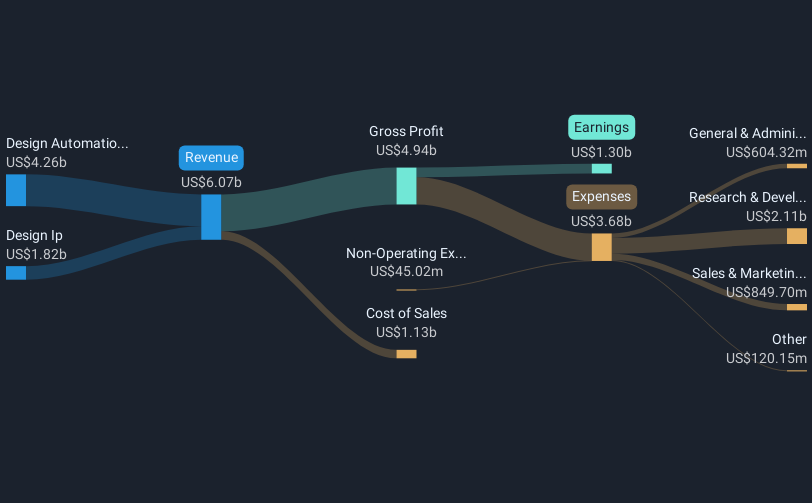

Synopsys (NasdaqGS:SNPS) and Keysight Technologies announced a collaboration to enhance the RF design migration process, which may have supported Synopsys's 6% stock price increase last quarter. The AI-driven integration aligns with the latest technology trends and advances in semiconductor processes, which is crucial in keeping pace with market demand. Meanwhile, the overall market showed moderate growth, and Synopsys's positive financial performance, including increased revenues and net income in Q2, helped maintain investor confidence. These developments collectively provided underlying support to the broader tech sector's gains alongside general market trends.

Buy, Hold or Sell Synopsys? View our complete analysis and fair value estimate and you decide.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent collaboration between Synopsys and Keysight Technologies to enhance RF design processes aligns well with Synopsys's broader strategic initiatives in AI-driven design solutions and leadership in Electronic Design Automation (EDA). This development supports the company's narrative of leveraging AI and advanced node activities to drive revenue growth and market positioning. On a larger scale, over the last five years, Synopsys's total return, including share price and dividends, was 149.81%, showcasing significant appreciation. This long-term performance contrasts with the company's underperformance when compared to the US market and US Software industry over the past year.

The partnership with Keysight is expected to further bolster Synopsys's revenue and earnings forecasts, particularly as analysts project an annual revenue growth of 11.4% over the next three years. Increased demand in AI and EDA tools provides a favorable backdrop for these forecasts, holding potential for future market share expansion. Moreover, with a price target consensus of US$595.21 versus a current share price of US$473.55, the shares show a discount to expected future values, suggesting room for upward movement as Synopsys continues its strategic execution and technological advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides electronic design automation software products used to design and test integrated circuits.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives