- India

- /

- Construction

- /

- NSEI:DBL

A Sliding Share Price Has Us Looking At Dilip Buildcon Limited's (NSE:DBL) P/E Ratio

To the annoyance of some shareholders, Dilip Buildcon (NSE:DBL) shares are down a considerable 30% in the last month. That drop has capped off a tough year for shareholders, with the share price down 53% in that time.

All else being equal, a share price drop should make a stock more attractive to potential investors. In the long term, share prices tend to follow earnings per share, but in the short term prices bounce around in response to short term factors (which are not always obvious). The implication here is that long term investors have an opportunity when expectations of a company are too low. Perhaps the simplest way to get a read on investors' expectations of a business is to look at its Price to Earnings Ratio (PE Ratio). Investors have optimistic expectations of companies with higher P/E ratios, compared to companies with lower P/E ratios.

View our latest analysis for Dilip Buildcon

How Does Dilip Buildcon's P/E Ratio Compare To Its Peers?

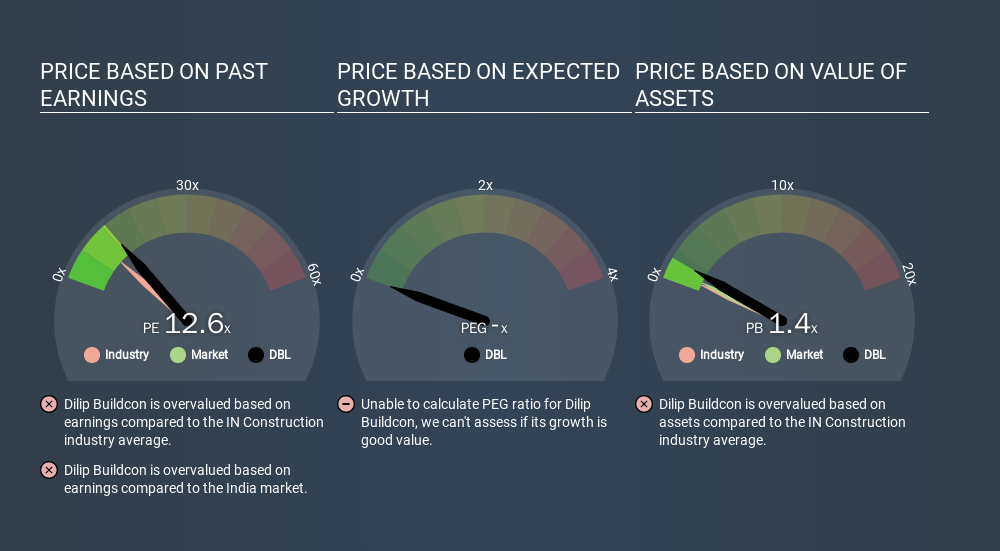

Dilip Buildcon's P/E of 12.64 indicates some degree of optimism towards the stock. You can see in the image below that the average P/E (9.3) for companies in the construction industry is lower than Dilip Buildcon's P/E.

Dilip Buildcon's P/E tells us that market participants think the company will perform better than its industry peers, going forward. The market is optimistic about the future, but that doesn't guarantee future growth. So investors should always consider the P/E ratio alongside other factors, such as whether company directors have been buying shares.

How Growth Rates Impact P/E Ratios

Companies that shrink earnings per share quickly will rapidly decrease the 'E' in the equation. That means unless the share price falls, the P/E will increase in a few years. So while a stock may look cheap based on past earnings, it could be expensive based on future earnings.

Dilip Buildcon shrunk earnings per share by 46% over the last year. But it has grown its earnings per share by 24% per year over the last five years. And EPS is down 7.4% a year, over the last 3 years. This growth rate might warrant a low P/E ratio.

Remember: P/E Ratios Don't Consider The Balance Sheet

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

So What Does Dilip Buildcon's Balance Sheet Tell Us?

Dilip Buildcon's net debt is considerable, at 172% of its market cap. If you want to compare its P/E ratio to other companies, you must keep in mind that these debt levels would usually warrant a relatively low P/E.

The Bottom Line On Dilip Buildcon's P/E Ratio

Dilip Buildcon's P/E is 12.6 which is about average (12.2) in the IN market. With significant debt and no EPS growth last year, the P/E suggests shareholders are expecting higher profit in the future. Given Dilip Buildcon's P/E ratio has declined from 18.1 to 12.6 in the last month, we know for sure that the market is significantly less confident about the business today, than it was back then. For those who prefer to invest with the flow of momentum, that might be a bad sign, but for a contrarian, it may signal opportunity.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with modest (or no) debt, trading on a P/E below 20.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:DBL

Dilip Buildcon

Together its subsidiaries, engages in the development of infrastructure facilities on engineering, procurement, and construction (EPC) basis in India.

Proven track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion